1.

Public Working Draft - Review Period and Comments

The US Financial Reporting Taxonomy Framework (USFRTF) has been released as a Public Working Draft effective September 20, 2004. The public review period will run for 60 days ending November 19, 2004.

Comments and feedback on either accounting concepts within

the taxonomy or technical aspects of the US Financial Reporting Taxonomy

Framework are welcome, particularly ideas to improve this taxonomy. If you have

a comment or wish to report an error, email them on or before November 19, 2004

to Brad Homer (bhomer@aicpa.org).

To assist in the feedback process, a review template has been

provided for each taxonomy, these can be found on each individual taxonomy

summary page. Other feedback outside of this template will be accepted, however

it should be as specific as possible in identifying the taxonomy, elements,

links or other details that are being commented on. Feedback received will be

summarized and be made available to the XBRL-US Domain Working Group and also

publicly.

Detailed responses will not be provided for every comment

submitted, however a summary of which feedback has been incorporated will be

provided.

2. Overview

2.1. Purpose

The XBRL-US Domain Working Group is leading the development

of this XBRL

This US-GAAP-BASI Taxonomy is designed to facilitate the creation of XBRL instance documents that reflect business and financial reporting for Banking and Savings Institutions companies according to the Financial Accounting Standards Board and other generally accepted accounting principles. The purpose of the US-GAAP-BASI Taxonomy is to provide a framework for the consistent creation of XBRL documents for financial reporting purposes by private and public sector entities. The purpose of this and other taxonomies produced using XBRL is to supply a framework that will facilitate data exchange among software applications used by companies and individuals as well as other financial information stakeholders, such as lenders, investors, auditors, attorneys, and regulators.

The authority for this US-GAAP-BASI Taxonomy is based upon US Generally Accepted Accounting Principles (GAAP). The development of the taxonomy is based upon input from accounting firms, technology companies and other domain experts in the field of financial reporting. In addition, the specific content of the taxonomy is based upon standards identified by the Financial Accounting Standards Board (FASB) and other related standards organizations.

The particular disclosures in this US-GAAP-BASI Taxonomy model are:

1. Required by particular Banking and Savings Institutions Companies

2. Typically represented in AICPA model financial statements, checklists and guidance materials as provided from each of the major international accounting firms.

3. Found in common reporting practice, or

4. Flow logically from items 1-3, for example, sub-totals and totals.

2.2. Taxonomy Status

The US-GAAP-BASI Taxonomy is an Acknowledged Public Working Draft. Its

content and structure have been reviewed by both accounting and technical teams

that comprise XBRL-US and XBRL International. It is intended that the US-GAAP-BASI

Taxonomy will comply with the Financial Reporting Taxonomy Architecture 1.0 (FRTA)

and XBRL Specification Version 2.1.

The XBRL-US Domain Working Group intends to have this taxonomy reach the

status of a approved taxonomy under the XBRL Taxonomy Approval Process (TAP)

2004. XBRL Taxonomies can exist in two states insofar as XBRL International TAP

is concerned:

- Acknowledged – A royalty-free taxonomy that

the creators have asked XBRL International to list at XBRL.org; XBRL

International confirms only that the taxonomy is compliant with the XBRL

specification and is available free of royalties. This classification

indicates to the business user the degree of endorsement by XBRL

International.

- Approved – A taxonomy which is technically

compliant with XBRL, is available on royalty free terms, follows best

practices prescribed by XBRL International (e.g. FRTA) and either has been

developed by XBRL International itself or that has followed a public

review process similar to XBRL International's own.

2.3.

Scope of Taxonomy

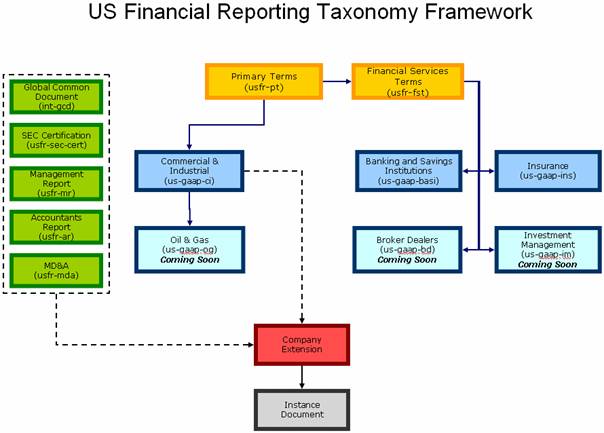

This US-GAAP-BASI Taxonomy is released in conjunction with the Accountants Report (USFR-AR), Management’s Discussion & Analysis (USFR-MDA), Primary Terms (USFR-PT), Financial Services Terms (USFR-FST), Management Report (USFR-MR), and SEC Officers Certification (USFR-SEC-CERT). Together, these taxonomies deliver the ability to report core financial statements, Notes to the Financial Statements, Accountants Report and other related content that certain private and public sector entities report, typically in annual, semi-annual or quarterly financial disclosures. These taxonomies are all part of the US Financial Reporting Taxonomy Framework, an XBRL taxonomy framework that enables reusability of components and provides the foundation for creating new industry taxonomies (such as Insurance, Banks and Savings Institutions, etc.) going forward.

Taken together, these taxonomies will meet

the reporting needs of companies that meet three criteria, viz (i) they report

under FASB standards, (ii) are in the broad category of “banking and savings

institutions” industries and (iii) have relatively common reporting elements in

their financial statements. In practice, these three criteria are less likely to

hold for all companies. Additional taxonomies

are likely to be required. These

taxonomies are likely to identify the particular needs of:

- National

jurisdictions for those companies that require

a non-US GAAP standard as the core financial standards setting foundation

and may include supplementary reporting requirements or prevent use of

available options by local accounting standards setters as well as stock

exchanges etc.

- National

industry or

common practice, for example, tax or credit reporting.

- An individual company

These

extension taxonomies will either extend the US-GAAP-BASI Taxonomy to meet

the particular reporting requirements of that industry, country or company and/or restrict by limiting the use of

particular US-GAAP-BASI Taxonomy elements.

The

inter-relationships of the various taxonomies are show in Figure 1:

Figure 1: Interrelationship of Taxonomies and Instance Document

3.

Overview of Taxonomy

3.1.

Taxonomy Structure

The US-GAAP-BASI Taxonomy contains over 1,600 unique, individually identified pieces of information related to financial reporting. Most of these 1,600 elements are contained in the up-stream taxonomies and are “imported” or “included” in the US-GAAP-BASI taxonomy. The XML Schema files at the heart of the US-GAAP-BASI taxonomy provides a straightforward listing of the elements in the taxonomy. The US-GAAP-BASI linkbases provide the other information necessary to interpret (e.g. Label and reference linkbases) taxonomy elements or place a given taxonomy element in context of other taxonomy elements (e.g. Calculation and Presentation linkbases).

The application of a metaphor assists in understanding taxonomies. The US-GAAP-BASI Taxonomy is organized using a financial statement metaphor. This organization is used because it is understood by most accountants who use it to organize their audit working papers; to put the notes to the financial statements in order and in a variety of other uses. This metaphor is also familiar to the users of financial statements.

However, this metaphor and organization somewhat limits an understanding of the power behind an XBRL taxonomy. A taxonomy has multiple “dimensions”. Relationships can be expressed in terms of definitions, calculations, links to labels in one or more languages, links to one or more references, etc. The metaphor used expresses only one such relationship.

The US-GAAP-BASI

Taxonomy is divided logically into sections that correspond to typical US GAAP financial

statement components. While there is no true concept of “sections” in the

Taxonomy, their purpose is to group similar concepts together and facilitate

navigation within the Taxonomy.

3.2.

Label Languages

Currently, labels for taxonomy elements are provided in English. In the future, taxonomy labels could be expressed in additional languages as required.

3.3.

References

This Taxonomy provides references to FASB and other relevant standards. Figure 3 shows an example of the reference elements are used in this taxonomy, using “FASB 142, sub paragraph 23” to illustrate how a reference is matched to these elements:

Figure 3: Reference Naming Structure

|

Name: |

FASB |

|

Number: |

142 |

|

Paragraph: |

|

|

Subparagraph: |

23 |

|

Clause: |

|

Authoritative reference

information used throughout the taxonomy relies on a series of acronyms. The following list provides an overview of

the acronyms used commonly throughout the authoritative references:

- Accounting Research Bulletin (ARB)

- AICPA Opinion and Interpretation

- Industry Audit and Accounting Guide (AAG)

- Statement of Position (SOP)

- Practice Bulletin (PB)

- AICPA Accounting Interpretation (AIN)

- AICPA Accounting Principles Board Statement

- AICPA Issues Papers

- AICPA Technical Practice Aids (TPA)

FASB

- Accounting Principles Board Opinion (APB)

- Statement of Financial Accounting Standard (FAS)

- FASB Interpretation (FIN)

- FASB Technical Bulletin (FTB)

- Emerging Issues Taskforce (EITF)

- Implementation Guide (Q&A)

- FASB Staff Position (FSP)

- Current Text (CT)

- Accounting Principles Board Statements (APS)

- FASB Financial Accounting Concepts (CON)

SEC

- Regulation S-X (SX)

- Article 9 (ART 9)

- Article 4 (ART 4)

- Regulation S-K (SK)

- Regulation S-B (SB)

- Regulation S-T (ST)

- Staff Accounting Bulletins (SAB)

- Regulation T (Reg T)

- Staff Position (SP)

- Financial Reporting Release (FRR)

- Staff Legal Bulletin (SLB)

- SEC Industry Guide

OTS

- Federal Regulation (FR)

4. Reviewing This Taxonomy

There are a number of approaches to reviewing the taxonomy both from an accounting and technical XBRL perspective. For more information on reviewing taxonomies, reviewers should read the Reviewer’s Guide to Financial Reporting Taxonomies 1.0 as published by XBRL-US.

5. Sample Instance Documents

Sample instance documents have been provided for each industry taxonomy, which may be useful in helping you understand how the taxonomy works and is intended to be used. If you are confused by something in the taxonomy, look for that information in the sample instance documents to see if the context helps explain the taxonomy content.

6. Updates and Changes

6.1.

Updates to this Taxonomy

This taxonomy will be updated with revisions for errors and new features within the following guidelines:

· Since financial statements created using a taxonomy must be available indefinitely, the taxonomy must be available indefinitely. All updates will take the form of new versions of the taxonomy with a different date. For example, the taxonomy http://www.xbrl.org/us/fr/gaap/basi/2004-08-15/us-gaap-basi-2004-08-15.xsd will never change. New versions will be issued under a different name, such as http://www.xbrl.org/us/fr/gaap/basi/2004-12-31/us-gaap-basi-2004-12-31.xsd. This will ensure that any taxonomy created will be available indefinitely.

- It is anticipated that this taxonomy will be updated as required to incorporate changes in generally accepted accounting principles and business reporting norms.