XBRL GL - Working Group Note - Elaborating

on Enumerations: a Supplement to the Documentation in the XBRL GL Label

Linkbases

Working Group Note dated 2008-01-30

Copyright

© XBRL International, Inc. – 2008. All Rights Reserved.

XBRL-GL-WGN-Elaborating_on_Enumerations-2008-01-30.rtf

is non-normative.

|

PricewaterhouseCoopers

LLP |

||

|

Gianluca

Garbellotto |

Iphix LLC |

Abstract

This document discusses the use of enumerated fields, entry fields where values are limited to a predefined set of choices, within the XBRL Global Ledger Framework.

Status

Circulation of this Working Group Note is unrestricted. Recipients are invited to submit comments to the author or to the XBRL GL Working Group xbrlgl@xbrl.org, and to submit notification of any relevant patent rights of which they are aware and to provide supporting documentation.

Working Group Note dated

2008-01-30

Copyright © XBRL

International, Inc. – 2008. All Rights Reserved.

3. Other

challenges in understanding

accountantContactPhoneNumberDescription

identifierContactPhoneNumberDescription

identifierPhoneNumberDescription

organizationAccountingMethodPurpose

organizationAccountingMethodPurposeDefault

originatingDocumentIdentifierType

reportingCalendarOpenClosedStatus

A. Intellectual

Property Status (non-normative)

B. Document

History (non-normative)

1. Introduction

An important tool used by the XBRL Global Ledger Framework (XBRL GL) to facilitate data exchange is the use of enumerated fields – entry fields where the choices are limited to a predefined and fixed set of possible entries. For example, the only required field in XBRL GL is such an enumerated field – the [entriesType] field is the main key to understanding the content of the [accountingEntries] batch of information. However, enumerated fields challenge the student of XBRL GL as enumerated fields are not common in XBRL FR, and many of today’s XBRL tools don’t make the lists of enumerations, or choices, transparent to a reviewer. They do not appear on standard reports from taxonomy tools; it is not until someone tries to validate an instance document that the errors are reported in some cases.

In addition to the enumerations themselves not being easily available, XML Schema does not provide a standard tool for documenting the meaning of enumerations; XBRL’s labels don’t routinely describe enumerations, as they describe the field and not the options for the content of the field. The Dimensional taxonomies, which act like enumeration tools for segments and scenarios in FR contexts, are XBRL’s first recognition of this limitation, and use XBRL taxonomies instead of XML Schema enumerations to solve the problem.

In this document, formerly known as 10E - Eric’s Educational, Exhaustive and Expansive Explanation of Each and Every Enumeration: Early Edition, we wish to provide more exposure to the enumerated fields in XBRL GL, provide a central document for communicating the meanings, and facilitate the discussion of the expansion and precision of the enumerated fields.

2. Enumerations in XBRL GL

Why XBRL GL uses enumerations

As we often note, XBRL GL attempts to serve two masters. First, it attempts to serve as an audit file, capturing exactly what was in the originating system. Second, it attempts to serve as a data interchange file, providing keys for the consuming application to better understand what the producing application has provided. For the most important fields where a shared understanding is necessary to be able to import, analyze and reuse the data, the XBRL GL philosophy has led to field “pairs” – concepts that have both an enumerated version and a free-form version.

For example, an auditor may want to analyze information from an accounting system’s cash disbursement journal to look for entries that normally wouldn’t flow through cash, such as depreciation. There is no global standard in place today to identify entries from a source journal associated with cash disbursements. XBRL GL has an enumerated field, [sourceJournalID], where an enumerated value of {cd} represents the Cash Disbursements journal. XBRL GL also provides a [sourceJournalDescription] field for a free-form entry, so the publishing application can indicate its own code or phrase for the source journal they use for “Cash Disbursements” – perhaps they call it “Cash Disbursement Journal”, similar but not identical and therefore not easy to integrate.

As previously noted, [entriesType] is the only required content field in XBRL GL today, so XBRL GL does not force publishers to use any other enumerated fields. However, regulators, information partners and software may require the use of certain fields for optimal data exchange.

Principals used in creating enumerations

We have tried to be consistent in the development of the taxonomy and to use certain principles in the creation of enumerations.

· If there is a reasonable set of fixed entries that provide value in data interchange, a set of enumerations is provided.

· The words used to represent the enumerations could have been simple randomized strings (GUID); English language phrases (recommended UK English for future development) or common abbreviations expressed in lower case have been used since most of the development has been by (US) English-speaking participants. However, the enumerations chosen are just meant to be a code used to provide consistent entries in key fields.

· They should not need to be translated for regional/different language use, but are meant to be the global underlying code for system-to-system exchange. English language terms were used, but applications can isolate the user and provide localized terms in the user interface instead of the enumerated terms.

· An “other” option is generally provided, except in the narrowest cases.

XBRL GL’s enumerations – not always clearly defined in the taxonomies

During the development of the XBRL GL taxonomies, and due to the lack of enumeration-friendly tooling, the meanings for the individual enumerations were sometimes lost.

· The explanations for some are left in the XBRL GL mailing lists and never made it into the taxonomy proper.

· Some explanations are embedded in other XBRL GL related documents, such as the Conceptual Guide[1], PowerPoint presentations used at XBRL GL meetings and trainings, and other documents provided by the XBRL GL group.

· Some are explained in the taxonomy documentation (up through 2.0a, in the Schema; in 2.1, in the documentation label) but over the years of development, the documentation and the enumerations were not always kept in synch.

· Some were considered “obvious” to anyone with experience in accounting systems; this proved to be a difficulty when translation teams did not have accounting system backgrounds but were called upon to rephrase information for their region’s business environments.

· Others were left to implementers to use as they saw fit.

3. Other challenges in understanding

Tooling Challenges

As noted in the introduction, enumerations have not played a major role in the Financial Reporting taxonomies, so most XBRL tooling does not facilitate the development of or exposure to enumerated fields. In Figure 1, you can see the enumerations for [entriesType] in the “Content Model” tab of the Fujitsu Taxonomy Creator.

Figure 1: Viewing enumerations in the Fujitsu Taxonomy Editor

A careful scan of the screen shot will expose another challenge to those not very familiar with XBRL GL: the enumerations are not stored in the same schema (.xsd) file as the elements. The schema for [entriesType] is the CORE schema (gl-cor); the schema in which the [entriesType] enumerations reside is the GEN (gl-gen). You can see how the current alpha release of the Fujitsu GL Taxonomy Editor has the user choose which files they are working on with the screen shown in Figure 2.

In order to facilitate the extensibility and customization of the taxonomies that make up the XBRL GL framework, the enumerations are stored in separate files from the original definitions of the related elements. In that fashion, the enumerations can be modified without affecting the original schemas.

While the approach uses XML Schema standard tooling, few XML Schema tools fully incorporate all of the XML Schema functionality, and so the connection may not be obvious in off-the-shelf tooling and parsers.

Figure 2: Many files make up the XBRL GL Framework

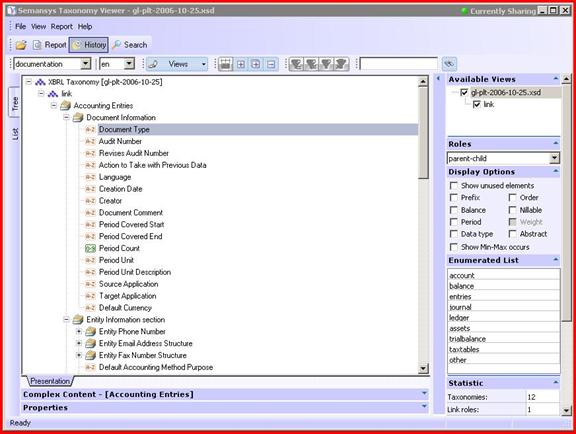

Another tool that can expose enumerations is the Semansys Taxonomy Viewer, as illustrated in Figure 3

Figure 3: The Semansys Taxonomy Viewer

4.

Enumerations

The different fields with enumerations are provided below. The explanations are currently non-normative, but provide additional helpful guidance in understanding the meaning of each choice.

We believe that the list of enumerations in the Table of Content is complete. However, if you find an item that we have missed, if the descriptions are not complete and useful or you have other suggestions please drop us a note at xbrlgl@xbrl.org.

accountantContactPhoneNumberDescription

Documentation:

Accountant Contact

Phone Number Description such as Main, Investor relations, etc.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”bookkeeper”/> |

See note above. |

|

<enumeration

value=”controller”/> |

See note above. |

|

<enumeration

value=”direct”/> |

See note above. |

|

<enumeration

value=”fax”/> |

See note above. |

|

<enumeration

value=”investor-relations”/> |

See note above. |

|

<enumeration

value=”main”/> |

See note above. |

|

<enumeration

value=”switchboard”/> |

See note above. |

|

<enumeration value=”other”/> |

See note above. |

accountantEngagementType

Documentation:

Type of engagement

being performed by external accountant

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”audit”/> |

See note above |

|

<enumeration

value=”review”/> |

See note above. |

|

<enumeration

value=”compilation”/> |

See note above. |

|

<enumeration

value=”tax”/> |

See note above. |

|

<enumeration

value=”other”/> |

See note above. |

accountPurposeCode

Documentation:

.Code

related to usage for account aggregate - Consolidating, European, IFRS,

Offsetting, Primary, Tax, USGAAP, Japanese, Other. Japanese companies will use

this for the tax required offsetting entry. If left blank, assumes default

accounting method for company.

|

<enumeration

value=”consolidating”/> |

Account used at

the consolidating level rather than the local/primary level. |

|

<enumeration

value=”european”/> |

Account primarily

used for jurisdictional reporting. The word “european” seems overly specific,

of course; but it is only a code to mean regional/jurisdictional/local and

not US GAAP/IFRS or a more global standard. |

|

<enumeration

value=”ifrs”/> |

Account primarily

used for IFRS reporting. |

|

<enumeration

value=”offsetting”/> |

For Japanese

purposes, the offsetting account in the necessary “quadruple entry” system. |

|

<enumeration

value=”primary”/> |

The local set of

books, May overlap with book (iasb, usgaap, etc.) or tax. |

|

<enumeration

value=”tax”/> |

Accounts primarily

used for tax reporting. The jurisdiction is specified in the accounting

method structure and related tools. |

|

<enumeration

value=”usgaap”/> |

Accounts used for |

|

<enumeration

value=”japanese”/> |

Accounts used for

Japanese reporting |

|

<enumeration

value=”other”/> |

For other types of

accounts. |

accountType

Documentation:

Type

of account

|

<enumeration

value=”account”/> |

When an account is

a typical “financial” account, one of the accounts of the trial balance. |

|

<enumeration

value=”bank”/> |

When account is

used to identify a bank/bank account. |

|

<enumeration

value=”employee”/> |

When account is

used to identify an employee. Can be used in conjunction with

[identifierReference] structure. |

|

<enumeration

value=”customer”/> |

When account is

used to identify a customer (common in Continental systems). Can be used in

conjunction with [identifierReference] structure. |

|

<enumeration

value=”job”/> |

When account is

used to identify a job for job costing. Can be used in conjunction with

[jobInfo] structure. |

|

<enumeration

value=”vendor”/> |

When account is

used to identify a vendor (common in Continental systems). Can be used in

conjunction with [identifierReference] structure. |

|

enumeration

value=”measurable”/> |

When account is

used to identify a job for fixed assets or in general as an

alternative/complementary way to represent data related to measurables. Can

be used in conjunction with [measurable] structure. |

|

<enumeration

value=”statistical”/> |

When an account is

a statistical (non-financial) account. Useful for performance measurement. |

|

<enumeration

value=”other”/> |

For accounts used

to represent other types of information. |

bookTaxDifference

Documentation:

Enumerated

field with possible values of permanent, temporary or none indicating the type

of difference between book and tax accounting methods. Omission of this field

is equivalent to “none”

|

<enumeration

value=”permanent”/> |

The book-tax

difference is not a timing difference; the difference is not capable of being

reversed in future periods (or is not a reversal from a prior period). |

|

<enumeration

value=”temporary”/> |

The book-tax

difference is a timing difference, capable of being reversed in a future

period or representing a reversal from a prior period, |

|

<enumeration

value=”none”/> |

Provided to

specifically state there is no book/tax difference. The field could otherwise

be left out to implicitly say there is no book/tax difference. |

budgetAllocationCode

Documentation:

Code

associated with the calculation formula: e.g. (D)ivide by number of periods,

(T)otal for period given

|

<enumeration

value=”D”/> |

(D)ivide by a number

of periods |

|

<enumeration

value=”T”/> |

(T)otal for period

given |

contactPhoneNumberDescription

Documentation:

Contact Phone Number

Description such as Main, Investor relations, etc.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”bookkeeper”/> |

See note above |

|

<enumeration

value=”controller”/> |

See note above |

|

<enumeration

value=”direct”/> |

See note above |

|

<enumeration

value=”fax”/> |

See note above |

|

<enumeration

value=”investor-relations”/> |

See note above |

|

<enumeration

value=”main”/> |

See note above |

|

<enumeration

value=”switchboard”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

debitCreditCode

Documentation:

Optional

identifier of whether the amount is a (D)ebit, a (C)redit or Undefined

|

<enumeration

value=”D”/> |

Debit |

|

<enumeration

value=”C”/> |

Credit |

|

<enumeration

value=”debit”/> |

Debit |

|

<enumeration

value=”credit”/> |

Credit |

|

<enumeration

value=”undefined”/> |

Undefined |

dmJurisdiction

Documentation:

Jurisdiction

(e.g. federal, state, local): e.g.

|

<enumeration

value=”F”/> |

Federal |

|

<enumeration

value=”federal”/> |

Federal |

|

<enumeration

value=”S”/> |

State |

|

<enumeration

value=”state”/> |

State |

|

<enumeration

value=”L”/> |

Local |

|

<enumeration

value=”local”/> |

Local |

|

<enumeration

value=”other”/> |

Other |

documentType

Documentation:

An

enumerated field describing the original source document, with invoice,

voucher, check and other enumerated entries

|

<enumeration

value=”check”/> |

Check/cheque or

similar document sent or received. See also [paymentMethod]. |

|

<enumeration

value=”debit-memo”/> |

Debit memo sent or

received |

|

<enumeration

value=”credit-memo”/> |

Credit memo sent

or received |

|

<enumeration

value=”finance-charge”/> |

Finance charge

sent or received |

|

<enumeration

value=”invoice”/> |

Invoice or similar

originating document for charges sent to a customer. |

|

<enumeration

value=”order-customer”/> |

An order from a

customer |

|

<enumeration

value=”order-vendor”/> |

An order sent to a

vendor (purchase order) |

|

<enumeration

value=”payment-other”/> |

A payment in a

form other than a check/cheque |

|

<enumeration

value=”reminder”/> |

A reminder

document – normally would not have accounting significance |

|

<enumeration

value=”tegata”/> |

An official

Japanese document – if you have to ask, you, like I, won’t understand. |

|

<enumeration

value=”voucher”/> |

Invoice received

from a vendor. |

|

<enumeration

value=”shipment”/> |

Notification of a

shipment, probably against an order, preceding an invoice. |

|

<enumeration

value=”receipt”/> |

Notification or

documentation of receipt of goods. |

|

<enumeration

value=”manual-adjustment”/> |

A manual

adjustment against an account, other than one of the above. |

|

<enumeration

value=”other”/> |

A document not in

one of the above categories. Its meaning will have to be determined from

other factors. |

entriesType

Documentation:

account:

information to fill in a chart of accounts file.

balance:

the results of accumulation of a complete and validated list of entries for an

account (or a list of account) in a specific period - sometimes called general

ledger

entries: a list of individual accounting entries,

which might be posted/validated or nonposted/validated

journal:

a self-balancing (Dr = Cr) list of entries for a specific period including

beginning balance for that period.

ledger:

a complete list of entries for a specific account (or list of accounts) for a

specific period; note - debits do not have to equal credits.

assets:

a listing of open receivables, payables, inventory, fixed assets or other information

that can be extracted from but are not necessarily included as part of a

journal entry

trialbalance:

the self-balancing (Dr = Cr) result of accumulation of a complete and validated

list of entries for the entity in a complete list of accounts in a specific

period.

taxtables: aids automated interpretation of instances

that represent tax tables; Tax table are defined by using multiple [taxes]

structures to gather the population of codes, authorities and rates; through

[taxTableCode] cross-references in the [taxes] structure, these "master

file" tax tables can be referenced.

Often

sorted by date or by account, these terms have specific, and sometimes

different, meanings in different areas. Common practice will drive accounting

method/term matches.

taxtables: aids automated interpretation of

|

<enumeration

value=”account”/> |

Concentration is

on the [account] structure and its content. This may related to customers,

vendors, and other master files that are globally included in the term

“account”. See the [accountType] enumeration description for more

information. |

|

<enumeration

value=”balance”/> |

See description

provided in documentation. |

|

<enumeration

value=”entries”/> |

See description

provided in documentation. |

|

<enumeration

value=”journal”/> |

See description

provided in documentation. |

|

<enumeration

value=”ledger”/> |

See description

provided in documentation. |

|

<enumeration

value=”assets”/> |

Represents not

just “assets” but also liabilities – anything that ties to a balance sheet. |

|

<enumeration

value=”trialbalance”/> |

See description

provided in documentation. |

|

<enumeration

value=”taxtables”/> |

Concentration on

the [taxes] structure. |

|

<enumeration

value=”other”/> |

For all other

types of representations. |

entryAccountingMethod

Documentation:

For this entry, the

method of accounting represented - from: accrual, cash, modified cash, modified

accrual, encumbrance, special methods, hybrid methods, other

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”accrual”/> |

See note above |

|

<enumeration

value=”cash”/> |

See note above |

|

<enumeration

value=”modified cash”/> |

See note above |

|

<enumeration

value=”modified accrual”/> |

See note above |

|

<enumeration

value=”encumbrance”/> |

See note above |

|

<enumeration

value=”special methods”/> |

See note above |

|

<enumeration

value=”hybrid methods”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

entryAccountingMethodPurpose

Documentation:

For this entry, the

reporting purpose represented - from book, tax, management, statutory, other

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”book”/> |

See note above |

|

<enumeration

value=”tax”/> |

See note above |

|

<enumeration

value=”management”/> |

See note above |

|

<enumeration

value=”statutory”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

entryType

Documentation:

One

of the following enumerated list: adjusting, budget, comparative,

external-accountant, standard, passed-adjusting, eliminating, proposed,

recurring, reclassifying, simulated, tax, other

|

<enumeration

value=”adjusting”/> |

***Formalization

needed to firmly agree on the use of adjusting and standard. Some use

“standard” to mean entries that come in from subledgers, and “adjusting” to

show entries from the GL. Others use “adjusting” to mean normal entries

whether from subledgers or the ledger, and “standard” to mean standard

entries from a library used period after period. |

|

<enumeration

value=”budget”/> |

Entries related to

amounts used to represent the budget figures. |

|

<enumeration

value=”comparative”/> |

Entries related to

amounts used to represent comparative figures. Comparatives can be explicitly

identified as figures for comparison with this tool, or be derived from

actual prior period results. |

|

<enumeration

value=”external-accountant”/> |

Entries

recommended by the external accountant or auditor. |

|

<enumeration

value=”standard”/> |

***Formalization

needed to firmly agree on the use of adjusting and standard. Some use

“standard” to mean entries that come in from subledgers, and “adjusting” to

show entries from the GL. Others use “adjusting” to mean normal entries

whether from subledgers or the ledger, and “standard” to mean standard

entries from a library used period after period. |

|

<enumeration

value=”passed-adjusting”/> |

Adjusting entries

that are “passed”, not accepted, not posted, for being immaterial or

otherwise unacceptable. |

|

<enumeration

value=”eliminating”/> |

Entries used as

part of the elimination process. |

|

<enumeration

value=”proposed”/> |

Proposed entries,

waiting for approval. |

|

<enumeration

value=”recurring”/> |

Entries from a

“library” of entries that are reused period by period, such as depreciation

or payroll accruals |

|

<enumeration

value=”reclassifying”/> |

An entry for

reclassification purposes. Produces a substitution result. |

|

<enumeration

value=”simulated”/> |

An entry that is

not “real” but is provided to see the results of certain actions or

treatments. |

|

<enumeration

value=”tax”/> |

An entry for tax

purposes only. |

|

<enumeration

value=”other”/> |

Entries of other

kinds which must be determined from other information. |

identifierContactPhoneNumberDescription

Documentation:

Identifier Contact

Phone Number Usage (

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”bookkeeper”/> |

See note above |

|

<enumeration

value=”controller”/> |

See note above |

|

<enumeration

value=”direct”/> |

See note above |

|

<enumeration

value=”fax”/> |

See note above |

|

<enumeration

value=”investor-relations”/> |

See note above |

|

<enumeration

value=”main”/> |

See note above |

|

<enumeration

value=”switchboard”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

identifierOrganizationType

Documentation:

Identifier

Organization Type

|

<enumeration

value=”individual”/> |

Most often used to

signify that the information being given describes a person. |

|

<enumeration

value=”organization”/> |

Used to signify

that the information being provided is an organization – a sole proprietorship,

a partnership, a corporation, or another entity, which may be associated with

zero or more individuals. |

|

<enumeration

value=”other”/> |

Provided by the

XBRL GL philosophy; for cases where legal or practical requirements need to

identify an organization as other than an “individual” or “organization”. |

identifierPhoneNumberDescription

Documentation:

Identifier Contact

Phone Number Usage (

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”bookkeeper”/> |

See note above |

|

<enumeration

value=”controller”/> |

See note above |

|

<enumeration

value=”direct”/> |

See note above |

|

<enumeration

value=”fax”/> |

See note above |

|

<enumeration

value=”investor-relations”/> |

See note above |

|

<enumeration

value=”main”/> |

See note above |

|

<enumeration

value=”switchboard”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

identifierType

Documentation:

Entity type

(enumerated): e.g., customer, vendor, employee.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”C”/> |

See note above |

|

<enumeration

value=”customer”/> |

See note above |

|

<enumeration

value=”E”/> |

See note above |

|

<enumeration

value=”employee”/> |

See note above |

|

<enumeration

value=”V”/> |

See note above |

|

<enumeration

value=”vendor”/> |

See note above |

|

<enumeration

value=”O”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

|

<enumeration

value=”I”/> |

See note above |

|

<enumeration

value=”salesperson-internal”/> |

See note above |

|

<enumeration

value=”X”/> |

See note above |

|

<enumeration

value=”salesperson-external”/> |

See note above |

|

<enumeration

value=”N”/> |

See note above |

|

<enumeration

value=”contractor”/> |

See note above |

invoiceType

Documentation:

Invoice

Type (self-billed, ePos enumerated values)

Note: These phrases have specific meaning in a VAT environment.

|

<enumeration

value=”ePos”/> |

Invoice comes from

electronic point of sale system. |

|

<enumeration

value=”self-billed”/> |

Invoice is

self-billed. |

mainAccountType

Documentation:

Account

type - FASB Concepts 6 and similar international designs. When xbrlInfo is used

to associated other XBRL reporting items, this field is more suited to

representing existing systems (audit) than data interchange.

Note:

this list of items is taken directly from the Statement of Financial Accounting

Concepts No. 6, a copy of which is available at http://www.fasb.org/pdf/con6.pdf

|

<enumeration

value=”asset”/> |

See http://www.fasb.org/pdf/con6.pdf |

|

<enumeration

value=”liability”/> |

“ “ “ “ |

|

<enumeration

value=”equity”/> |

“ “ “ “ |

|

<enumeration

value=”income”/> |

“ “ “ “ |

|

<enumeration

value=”gain”/> |

“ “ “ “ |

|

<enumeration

value=”expense”/> |

“ “ “ “ |

|

<enumeration

value=”loss”/> |

“ “ “ “ |

|

<enumeration

value=”contr-to-equity”/> |

“ “ “ “ |

|

<enumeration

value=”distr-from-equity”/> |

“ “ “ “ |

|

<enumeration

value=”comprehensive-income”/> |

“ “ “ “ |

|

<enumeration

value=”other”/> |

Other |

measurableCode

Documentation:

Code

for measurable item including BP - Business process, FA - Fixed

asset/Capitalized item, IN - Inventory, KPI - Metric, NT - Intangible, SP -

Supplies, SV-P - Service by employee, vendor or contractor, SV-M - Service by

equipment/machinery, OT – Other

|

<enumeration

value=”BP”/> |

See documentation |

|

<enumeration

value=”FA”/> |

See documentation |

|

<enumeration

value=”IN”/> |

See documentation |

|

<enumeration

value=”KPI”/> |

See documentation |

|

<enumeration

value=”NT”/> |

See documentation |

|

<enumeration

value=”SP”/> |

See documentation |

|

<enumeration

value=”SV-P”/> |

See documentation |

|

<enumeration

value=”SV-M”/> |

See documentation |

|

<enumeration

value=”OT”/> |

See documentation |

organizationAccountingMethod

Documentation:

For this entity, the

method of accounting represented - from: accrual, cash, modified cash, modified

accrual, encumbrance, special methods, hybrid methods, other

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”accrual”/> |

See note above |

|

<enumeration

value=”cash”/> |

See note above |

|

<enumeration

value=”modified cash”/> |

See note above |

|

<enumeration

value=”modified accrual”/> |

See note above |

|

<enumeration

value=”encumbrance”/> |

See note above |

|

<enumeration

value=”special methods”/> |

See note above |

|

<enumeration value=”hybrid

methods”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

organizationAccountingMethodPurpose

Documentation:

For this entity, the

reporting purpose represented - from book, tax, management, statutory, other

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”book”/> |

See note above |

|

<enumeration

value=”tax”/> |

See note above |

|

<enumeration

value=”management”/> |

See note above |

|

<enumeration

value=”statutory”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

organizationAccountingMethodPurposeDefault

Documentation:

If not stated

explicitly at the line level, the default reporting purpose - from book, tax,

management, statutory, other

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”book”/> |

See note above |

|

<enumeration

value=”tax”/> |

See note above |

|

<enumeration

value=”management”/> |

See note above |

|

<enumeration

value=”statutory”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

originatingDocumentIdentifierType

Documentation:

Originating

document identifier type: e.g. Customer, Vendor, Employee, Other

|

<enumeration

value=”C”/> |

Customer |

|

<enumeration

value=”customer”/> |

Customer |

|

<enumeration

value=”E”/> |

Employee |

|

<enumeration

value=”employee”/> |

Employee |

|

<enumeration

value=”V”/> |

Vendor |

|

<enumeration

value=”vendor”/> |

Vendor |

|

<enumeration

value=”O”/> |

Other than the

values provided here |

|

<enumeration

value=”other”/> |

Other than the

values provided here |

|

<enumeration

value=”I”/> |

Internal

salesperson, normally an employee, but to note their specific role as a

salesperson. |

|

<enumeration

value=”salesperson-internal”/> |

Internal

salesperson, normally an employee, but to note their specific role as a

salesperson. |

|

<enumeration

value=”X”/> |

External

salesperson, normally not an employee. |

|

<enumeration

value=”salesperson-external”/> |

External

salesperson, normally not an employee. |

|

<enumeration

value=”N”/> |

Independent

contractor; a specialization of vendor who acts more like an employee. |

|

<enumeration

value=”contractor”/> |

Independent

contractor; a specialization of vendor who acts more like an employee. |

periodUnit

Documentation:

Type of periods

covered by periodCount

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”daily”/> |

See note above |

|

<enumeration

value=” weekly”/> |

See note above |

|

<enumeration

value=” bi-weekly”/> |

See note above |

|

<enumeration

value=” semi-monthly”/> |

See note above |

|

<enumeration

value=” monthly”/> |

See note above |

|

<enumeration

value=” quarterly”/> |

See note above |

|

<enumeration

value=” thirdly”/> |

See note above |

|

<enumeration

value=” semiannual”/> |

See note above |

|

<enumeration

value=” annual”/> |

See note above |

|

<enumeration

value=” ad-hoc”/> |

See note above |

|

<enumeration

value=” current-period-only”/> |

See note above |

|

<enumeration

value=” other”/> |

See note above |

phoneNumberDescription

Documentation:

Entity Phone Number

Description such as Main, Investor relations.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”bookkeeper”/> |

See note above |

|

<enumeration

value=”controller”/> |

See note above |

|

<enumeration

value=”direct”/> |

See note above |

|

<enumeration

value=”fax”/> |

See note above |

|

<enumeration

value=”investor-relations”/> |

See note above |

|

<enumeration

value=”main”/> |

See note above |

|

<enumeration

value=”switchboard”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

postingStatus

Documentation:

Deferred:

although entered, it cannot be posted until a later time posted: already posted

proposed: a proposed item that must be approved simulated: a simulated item,

for what-if tax: a tax-specific entry unposted:entered but not yet posted or

validated cancelled:entered and later cancelled other:other status - should be

described in postingStatusDescription

|

<enumeration

value=”deferred”/> |

Entry will not be

posted, but will not be removed from the system; it is deferred and may

become active at a later time. |

|

<enumeration

value=”posted”/> |

Entries have been

posted locally. |

|

<enumeration

value=”proposed”/> |

Entry has been

suggested but not approved for posting. |

|

<enumeration

value=”simulated”/> |

Entry is for

simulation purposes, to see the effect of certain entries on end reporting. |

|

<enumeration

value=”tax”/> |

Entries have been

posted for tax purposes only. |

|

Entries have not

yet been posted locally. |

|

|

<enumeration

value=”cancelled”/> |

Entries have been

entered and then cancelled |

|

<enumeration

value=”other”/> |

Other

classification of status that would need to be determined by other means. |

qualifierEntry

Documentation:

Entry

Qualifier - An enumerated field that qualifies the type of entry, specifically

useful for general ledger and trial balance environments when it is important

to state the values represented are summarized as of the reporting date -

opening or closing balances. In accounting systems, this is often known as BBF

(balance brought forward.) Permitted values are: standard,

balance-brought-forward and other.

|

<enumeration

value=”standard”/> |

Represents

information during the reporting period and not the balances/accumulations

during the reporting period. |

|

<enumeration

value=”balance-brought-forward”/> |

The information

provided represents the balances or accumulations as of a particular date in

time. |

|

<enumeration

value=”other”/> |

The meaning of

this information needs to be interpreted based on other information in the

batch. |

reportingCalendarOpenClosedStatus

Documentation:

An identifier on

whether the reporting calendar is still open for activity. enumerated,

"open", "closed", "pending"

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”open”/> |

See note above |

|

<enumeration

value=”closed”/> |

See note above |

|

<enumeration

value=”pending”/> |

See note above |

reportingCalendarPeriodType

Documentation:

A code for the type of

period involved. Enumerated as: monthly, quarterly, semi-annually, 4-5-4,

ad-hoc, other.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”monthly”/> |

See note above |

|

<enumeration value=” quarterly”/> |

See note above |

|

<enumeration value=” semi-annually”/> |

See note above |

|

<enumeration value=”4-5-4”/> |

See note above |

|

<enumeration value=” ad-hoc”/> |

See note above |

|

<enumeration value=” other”/> |

See note above |

reportingPurpose

Documentation:

A description of the

accounting set of books involved. Uses enumeration from accounting method

purpose.

Note: These items are

relatively self-explanatory, and at this time no additional commentary is

provided.

|

<enumeration

value=”book”/> |

See note above |

|

<enumeration

value=”tax”/> |

See note above |

|

<enumeration value=”management”/> |

See note above |

|

<enumeration

value=”statutory”/> |

See note above |

|

<enumeration

value=”other”/> |

See note above |

revisesUniqueIDAction

Documentation:

Provides guidance on action to take with

previous set of data: supersedes - old data should be considered as

obsolete/overwritten; supplements - belongs with that data as if it was

included with it.

|

<enumeration

value=”supplement”/> |

Information in

this batch of information should be added to the original batch; this is new

and additional information. |

|

<enumeration

value=”supersede”/> |

Information in

this batch of information should be used instead of the information in the

original batch; this is replacement information. |

signOfAmount

Documentation:

Sign

of amount; provides 4 possible fields only when used in conjunction with

debitCreditCode; primarily used for correcting entries so total debits and

credits after an entry error are not inflated. D + increase DebitsD - decrease

debitsC + decreases creditC - increases credit

|

<enumeration

value=”+”/> |

Plus, positive |

|

<enumeration

value=”-“/> |

Minus, negative |

|

<enumeration

value=”plus”/> |

Plus, positive |

|

<enumeration

value=”minus”/> |

Minus, negative |

sourceJournalID

Documentation:

Source

journal. The code of the journal in which the entry is processed. The code must

be a unique indication for a journal and is selected from the following

enumerated list:

cd cash disbursements (sending cheques to

vendors)

cr cash receipts (receiving cheques from

others)

fa fixed assets

gi giro/other bank adjustments

gj general journal

im inventory management

jc job cost

pj purchase journal (liabilities from

purchases)

pl payroll journal

sj sales journal

se standard entries

ud user defined

ot other sources of entries

|

<enumeration

value=”cd”/> |

See documentation |

|

<enumeration

value=”cr”/> |

See documentation |

|

<enumeration

value=”fa”/> |

See documentation |

|

<enumeration

value=”gi”/> |

See documentation |

|

<enumeration

value=”gj”/> |

See documentation |

|

<enumeration

value=”im”/> |

See documentation |

|

<enumeration

value=”jc”/> |

See documentation |

|

<enumeration

value=”pj”/> |

See documentation |

|

<enumeration

value=”pl”/> |

See documentation |

|

<enumeration

value=”sj”/> |

See documentation |

|

<enumeration

value=”se”/> |

See documentation |

|

<enumeration

value=”ud”/> |

See documentation |

|

<enumeration

value=”ot”/> |

See documentation |

xbrlInclude

Documentation:

Indicates

that the information being given is beginning_balance, ending_balance,

period_change or other.

|

<enumeration

value=”beginning_balance”/> |

Balances provided

represent a beginning balance, useful in associating with appropriate label

from a taxonomy and checking that the associated taxonomy element is a point

in time element, rather than a duration element. |

|

<enumeration

value=”ending_balance”/> |

Balances provided

represent an ending balance, useful in associating with appropriate label

from a taxonomy and checking that the associated taxonomy element is a point

in time element, rather than a duration element. |

|

<enumeration

value=”period_change”/> |

Balances provided

represent a period change, useful in associating with appropriate label from

a taxonomy and checking that the associated taxonomy element is a duration element rather than a point

in time element. |

5. Additional Resources

The reader is encouraged, as always, to contact the chair of the XBRL GL Working Group at

Members of XBRL International can post questions to the INT-GL mailing list by joining the Working Group.

Others can take part in the public XBRL GL mailing list - go to

http://groups.yahoo.com/group/xbrl-gl-public

to find out more.

The XBRL GL portion of the XBRL International web site begins at

http://www.xbrl.org/GLTaxonomy

Our annotated best practice instance documents, webcasts of the XBRL GL Working Group monthly outreach calls and other useful resources are found in our GaLaPaGoS tool at

A. Intellectual Property Status (non-normative)

This document and translations of it may be copied and furnished to others, and derivative works that comment on or otherwise explain it or assist in its implementation may be prepared, copied, published and distributed, in whole or in part, without restriction of any kind, provided that the above copyright notice and this paragraph are included on all such copies and derivative works. However, this document itself may not be modified in any way, such as by removing the copyright notice or references to XBRL International or XBRL organizations, except as required to translate it into languages other than English. Members of XBRL International agree to grant certain licenses under the XBRL International Intellectual Property Policy (www.xbrl.org/legal).

This document and the information contained herein is provided on an “AS IS” basis and XBRL INTERNATIONAL DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO ANY WARRANTY THAT THE USE OF THE INFORMATION HEREIN WILL NOT INFRINGE ANY RIGHTS OR ANY IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE.

The attention of users of this document is directed to the possibility that compliance with or adoption of XBRL International specifications may require use of an invention covered by patent rights. XBRL International shall not be responsible for identifying patents for which a license may be required by any XBRL International specification, or for conducting legal inquiries into the legal validity or scope of those patents that are brought to its attention. XBRL International specifications are prospective and advisory only. Prospective users are responsible for protecting themselves against liability for infringement of patents. XBRL International takes no position regarding the validity or scope of any intellectual property or other rights that might be claimed to pertain to the implementation or use of the technology described in this document or the extent to which any license under such rights might or might not be available; neither does it represent that it has made any effort to identify any such rights. Members of XBRL International agree to grant certain licenses under the XBRL International Intellectual Property Policy (www.xbrl.org/legal).

B. Document History (non-normative)

|

Date |

Editor |

Summary |

|

|

2006-03-10 |

Eric E. Cohen |

Original Document. |

|

|

2007-10-30 |

Gianluca Garbellotto |

Various edits and adaptation to

the XBRL GL RECOMMENDATION |

|

|

2008-01-29 |

Gianluca Garbellotto |

Edits for publication |

|