1. Overview

1.1. Purpose

The International Accounting Standards Committee Foundation (IASC Foundation, http://www.iascf.com) and XBRL International (http://www.xbrl.org) have developed a comprehensive eXtensible Business Reporting Language (XBRL) taxonomy that models the primary financial statements that a commercial and industrial entity may use to report under International Accounting Standards (IAS) (http://www.iasb.org.uk).

This Explanatory Disclosures and Accounting Policies (EDAP) Taxonomy is designed to facilitate the creation of XBRL instance documents that reflect business and financial reporting for Commercial and Industrial companies according to the International Accounting Standards Board’s (http://www.iasb.org.uk) IAS Generally Accepted Accounting Principles. The purpose of the EDAP Taxonomy, along with the Primary Financial Statements (PFS) Taxonomy is to provide a framework for the consistent creation of XBRL documents for financial reporting purposes by private sector and certain public sector entities. The purpose of this and other taxonomies produced using XBRL is to supply a framework that will facilitate data exchange among software applications used by companies and individuals as well as other financial information stakeholders, such as lenders, investors, auditors, attorneys, and regulators.

The EDAP Taxonomy design will facilitate the creation of XBRL instance documents that capture business and financial reporting information for commercial and industrial entities according to the International Accounting Standards Board’s (http://www.iasb.org.uk) International Accounting Standards. The EDAP Taxonomy provides a framework for consistent identification of elements when entities create XBRL documents under that taxonomy. Typical documents can facilitate the reporting requirements of corporations to make annual, semi-annual or quarterly disclosures to stakeholders and capital markets.

The purpose of this and other taxonomies produced using XBRL is to facilitate data exchange among applications used by companies and individuals as well as other financial information stakeholders, such as lenders, investors, auditors, attorneys, and regulators.

1.2. Authority

The authority for this EDAP Taxonomy is based upon the International Accounting Standards Board’s (http://www.iasb.org.uk) International Accounting Standards (IAS) and Statements of Interpretation (SIC) effective 01 January 2002 (http://www.iasplus.com/standard/standard.htm). The EDAP Taxonomy also includes non-authoritative “common practices,” where the Standards and SICs are silent on common patterns of financial reporting. As this Taxonomy primarily addresses the reporting considerations of commercial and industrial entities, IAS 26 (Accounting and Reporting by Retirement Benefit Plans) and IAS 30 (Disclosures in the Financial Statements of Banks and Similar Financial Institutions) disclosure requirements are not represented in the EDAP Taxonomy’s content.

The particular disclosures this EDAP Taxonomy models are:

1. Required by particular IASs

2. Typically represented in IAS model financial statements, checklists and guidance materials as provided from each of the major international accounting firms.

3. Found in common practice financial reporting, or

4. Flow logically from items 1-3, for example, sub-totals and totals.

This EDAP Taxonomy is in compliance with XBRL Specification Version 2.0, dated 2001-12-14 (http://www.xbrl.org/tr/2001/).

1.3. Taxonomy Status

The Taxonomy is a Public Working Draft. Its content and structure have been reviewed both accounting and technical teams of the IASC Foundation (http://www.iascf.com) and the IAS Taxonomy Development Working Group. The Draft is now open for public comment. The XBRL element names should be considered largely complete and stable within the domain of the Taxonomy. Conversely, the XBRL labels, linkbases and references are subject to change. Changes may occur to any of this XBRL data.

The following is a summary of meanings of the status of taxonomies:

- Internal Working Draft – Internal Working Draft version of a taxonomy exposed to XBRL.ORG members for internal review and testing. An Internal Working Draft is subject to significant changes as initial testing undertaken. Its structure may not be stable and its content may not be complete.

- Public Working Draft – Working Draft version of a taxonomy exposed to public for review and testing. A Working Draft has been tested and its structure is unlikely to change although its contents may still change as the result of broader testing.

- Recommendation – Final version of taxonomy, released for use by the public.

1.4. Scope of Taxonomy

This Explanatory Disclosures and Accounting Policies (EDAP) Taxonomy is released in tandem with the XBRL Global Common Document (GCD) Taxonomy (the most recent Working Draft is at http://www.xbrl.org/Taxonomy/int/br/common/gcd/2002-10-15/) and the IAS Primary Financial Statements (PFS) Taxonomy (the final PFS taxonomy is at http://www.xbrl.org/taxonomy/int/fr/ias/ci/pfs/2002-11-15/).

GCD – Global Common Document Taxonomy

The GCD Taxonomy incorporates elements that are common to the vast majority of XBRL instance documents, regardless of their type. The GCD Taxonomy has elements that describe the XBRL instance document itself and the entity to which the instance document relates. The Taxonomy was co-developed by the IAS Taxonomy Development and XBRL US Domain Working Groups. See http://www.xbrl.org for the latest version of the GCD Taxonomy.

AR – Accountant’s Report Taxonomy

The AR Taxonomy is intended to provide information related to the auditor’s/independent Accountants Report that typically accompanies external financial reports of public companies. The Taxonomy was co-developed by the IAS Taxonomy Development and XBRL US Domain Working Groups. See http://www.xbrl.org for the latest version of the AR Taxonomy.

PFS – Primary Financial Statements Taxonomy

The PFS Taxonomy encompasses the core financial statements that private sector and certain public sector entities typically report in annual, semi-annual or quarterly financial disclosures as required by IAS 1, paragraph 7 (revised 1993) and IAS 34, paragraph 8 (revised 1998).

Those financial statements are the:

- Balance Sheet,

- Income statement,

- Statement of Cash Flows

- Statement of Changes in Equity,

and their condensed equivalents.

Reporting elements from those financial statements may be incorporated into a wide variety of other disclosures from press releases to multi-period summaries.

EDAP – Explanatory Disclosures and Accounting Policies Taxonomy

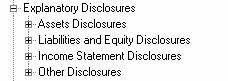

The EDAP Taxonomy has elements that provide additional or enhanced disclosure over and above the disclosures made in the primary financial statements. These disclosures are, in the context of annual financial statements, typically made in the notes to the financial statements or management commentary. The EDAP Taxonomy also provides elements to identify the accounting policies adopted by the reporting entity. Elements in the EDAP Taxonomy include:

- Accounting Policies

- Explanatory Disclosures

- Management Commentary

The Relationship Between PFS and EDAP

The elements captured in PFS and EDAP Taxonomies combine to represent the IAS XBRL elements.

The IAS Taxonomy Working Group gave special consideration to which elements should be captured in the PFS Taxonomy, rather than left for inclusion in the EDAP Taxonomy. Generally, the question relates to how much detail the PFS Taxonomy should contain given that it focuses on the primary financial statements. For example, the elements relating to Property, Plant and Equipment might include just the aggregate carrying amount of Property, Plant and Equipment (which is all that is required on the face of the Balance Sheet under IAS), the carrying amount of common classes, cost (or valuation) and accumulated depreciation or detailed movements between the opening and closing amounts. The primary guide to determining this detail is observed practice.

In many respects the distinction between the PFS and EDAP elements is arbitrary. The working relationship between the PFS and EDAP is such that the user of the taxonomies is indifferent to which of the two taxonomies an element is housed. The more important issue for the Group’s consideration is identification of the correct elements to be contained in the taxonomies and the relationship between those elements.

As the Taxonomies evolve the grouping of elements in PFS and EDAP may disappear. Options include combining the two taxonomies into a single Financial Report Taxonomy, or alternatively, splitting the taxonomies into smaller modules.

IAS Framework

Used together, these taxonomies will meet the reporting needs of entities that meet three criteria, viz (i) report under International Accounting Standards (IAS), (ii) are in the broad category of “commercial and industrial” industries and (iii) have relatively common and consistent set of reporting elements in their financial statements. Whilst many reporting entities meet these three criteria, there are entities that do not. Additional taxonomies that represent extensions to IAS are likely to be required. These taxonomies are likely to identify the particular needs of:

- International industries, for example, airlines, pharmaceuticals or agribusiness.

- National jurisdictions. The accounting standards in many countries are substantially based on IAS. However, timing differences in adoption or additional requirements may exist.

- National industry or common practice, for example, agriculture or credit reporting.

- Individual entities and their specific reporting requirements. These extension taxonomies will either extend the GCD, AR, PFS and EDAP taxonomies to meet the particular reporting requirements of that industry, country or entity and/or restrict the use of particular taxonomies by limiting the use of particular PFS or EDAP Taxonomy elements.

The inter-relationships of the various taxonomies are show in Error! Reference source not found.:

Figure 1: Interrelationship of Taxonomies and Instance Document

At the date of release of this document some of these taxonomies have been created and released and others have not been created or have not been released. However, extension taxonomies are under development for some national jurisdictions and within certain industries.

1.5. Relationship to Other Work

XBRL utilizes the World Wide Web consortium (W3C www.w3.org ) recommendations, specifically:

- XML 1.0 (http://www.w3.org/TR/2000/REC-xml-20001006)

- XML Namespaces (http://www.w3.org/TR/1999/REC-xml-names-19990114/)

- XML Schema 1.0 (http://www.w3.org/TR/xmlschema-1/ and http://www.w3.org/TR/xmlschema-2/), and

- XLink 1.0 (http://www.w3.org/TR/xlink/).

2. Overview of EDAP Taxonomy

The following is an overview of the taxonomy. It is assumed that the reader is familiar with financial and business reporting and has a basic understanding of XBRL.

2.1. Contents of the Taxonomy

This EDAP Taxonomy makes available to users the disclosures of financial and other performance information and accounting policies under the IASB’s IAS Standards.

The EDAP Taxonomy is made up of a “package” of interrelated XML files:

- XML Schema File (.XSD file): An XBRL Version 2.0 Taxonomy XML Schema file.

- XBRL Linkbases (.XML files): “Linkbases” for:

- Labels

- References

- Presentation information

- Calculation relationships between elements, and

- Definitional relationships between elements.

2.2. Taxonomy Structure

Overview

The EDAP Taxonomy contains approximately 2,000 XBRL elements, which are unique, individually identified pieces of information. The XML schema file is the foundation of the taxonomy package and provides a straightforward listing of the elements in the Taxonomy. The associated linkbases provide the information that is necessary to interpret (e.g. Label and Definition linkbases) Taxonomy elements or place a given Taxonomy element in context of other Taxonomy elements (e.g. Calculation and Presentation linkbases).

Viewing a Taxonomy

The actual EDAP Taxonomy comprises an XSD file and five linkbases that express taxonomy element relationships. Viewing the full relationship between the XML Schema and the linkbase files requires a Taxonomy Builder. For review purposes a paper based representation, in Adobe Acrobat (PDF) or Excel, is the most practical solution. The disadvantage is that, in this printed form, many of the characteristics of taxonomies are not obvious. Printed versions are two-dimensional, whereas the information in the taxonomy is multi-dimensional.

Given that information on the Taxonomy is included in XML schema and linkbase files, it is best rendered for human interpretation in a “paper” paradigm. Users are encouraged to review versions of the taxonomy elements in Adobe Acrobat (PDF) (http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-elements.pdf) or Excel http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-elements.xls formats.

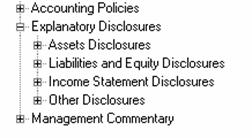

The EDAP Taxonomy has three major components, as shown in Figure 2:

Figure 2: Structure of the EDAP Taxonomy

Financial Statements disclosures typically incorporate qualitative disclosures on accounting policies (see Section 3.2 Accounting Policies) and mixed quantitative and qualitative disclosures on financial statements that expand and explain the disclosures made in the Primary Financial Statements (PFS) Taxonomy (see Section 3.3 Enhanced Disclosures).

The Management Commentary provides the typical disclosures made in the Management Discussion and Analysis (MD&A) as it is named in the USA or its equivalently named section of the financial statements made in other jurisdictions (see Section 3.4 Management Commentary).

2.3. Element Naming Convention

The convention for naming XBRL elements within a taxonomy follows that of XML Schema. Each name within a taxonomy must be unique and must start with an alpha character or the underscore character. Element names are case-sensitive. The PFS Taxonomy naming convention follows these rules; see the XML Specification for more information.

In addition to following XML Schema naming requirements, the PFS Taxonomy places additional constrains on element naming based on an element naming convention developed by the IAS Taxonomy Working Group and the US Taxonomy Working Group. Companies creating extension taxonomies are encouraged to follow this XBRL “best practices” naming convention, but are not required to do so.

The naming convention used encourages camel case names (e.g. the term “Balance Sheet” becomes BalanceSheet) which use descriptive names for readability and are common in other XML languages.

Certain short connector words are dropped when labels are converted to element names, including: an, and, any, are, as, at, be, but, by, can, could, does, for, from, has, have, if, in, is, its, made, may, of, on, or, such, than, that, the, this, to, when, where, which, with, would.

2.4. Label Languages

Currently, labels for taxonomy elements are provided in English. In the future, taxonomy labels will be expressed in additional languages.

2.5. References

Sources for references provided in the PFS Taxonomy include:

- IAS standards, referenced as: IAS x para y(z)

- IAS Standing Interpretations Committee (SIC), referenced as: SIC x para y(z)

- IAS common practice, referenced as: IAS-CP

- Structural completeness (i.e. a sub-total), referenced as: IAS-SC

For this version of the PFS Taxonomy, minimal referencing is provided in order to allow for the release of this Taxonomy in a timely manner.

Future Developments

The editors of this Taxonomy acknowledge that enhanced referencing schemes provide better information with respect to taxonomy elements. Feedback has been received that the inclusion of an IAS reference for a particular element in the EDAP Taxonomy implies that that element must be disclosed in the footnotes. In many cases the detailed elements included in the EDAP Taxonomy are commonly observed in practice, but not necessarily required to be disclosed in the footnotes.

A revised reference scheme is likely to be incorporated in the construction of future versions of this Taxonomy, or provided by third parties, that ensures that the referencing system distinguishes between the absolute minimum disclosures specified under IAS and the commonly observed disclosures. The referencing system is also likely to indicate the IAS reference that defines an item and, in the case of common practice, what influenced the inclusion of an element in the Taxonomy.

2.6. Further Documentation Available

The intent of this document is to explain the Taxonomy. This document assumes a general understanding of accounting and XBRL. If the reader desires additional information relating to XBRL, the XBRL International web site (http://www.xbrl.org) is recommended. Specifically, a reading of the XBRL Specification Version 2.0 is highly recommended (http://www.xbrl.org/tr/2001/). The purpose of this document is to explain how XBRL is being applied in this specific case, for this taxonomy.

The following documentation is available to assist those wishing to understand and use this taxonomy. This documentation is available on the XBRL International web site (http://www.xbrl.org):

Explanatory Notes (this document):

This overview document describing objectives of the IASC Foundation, XBRL International IAS Working Party and the Taxonomy:

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.htm (HTML Format)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.doc (Word Format)

Taxonomy Elements:

This is a summary listing of taxonomy elements in a human readable format for the purpose of obtaining an overview of this taxonomy.

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-elements.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-elements.xls (Excel Format)

The explanatory documents for the Primary Financial Statements (PFS) Taxonomy elaborate a number of concepts that are relevant for this EDAP Taxonomy. The Explanatory documentation for the PFS Taxonomy is at:

http://www.xbrl.org/taxonomy/int/fr/ias/ci/pfs/2002-11-15/ias-ci-pfs-2002-11-15.htm (HTML Format)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/pfs/2002-11-15/ias-ci-pfs-2002-11-15.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/pfs/2002-11-15/ias-ci-pfs-2002-11-15.doc (Word Format)

Taxonomy Package

These following ZIP file contains the taxonomy package, taxonomy documentation, and sample instance documents: http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.zip

These files are located as follows:

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.xsd (Schema)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-references.xml (References linkbase)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-labels.xml (Labels linkbase)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-presentation.xml (Presentation linkbase)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-calculation.xml (Calculation linkbase)

http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-definition.xml (Definition linkbase)

3. Items to Note in Using the Taxonomy

3.1. Introduction

The following explanation of the taxonomy, the taxonomies with which this EDAP Taxonomy is designed to interoperate, and examples of how to interpret the EDAP Taxonomy are provided to make the EDAP Taxonomy easier to use. Please refer to the detailed printout of the EDAP Taxonomy as you go through this explanation (http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15-elements.pdf). This explanatory document is designed to provide an overview of the EDAP Taxonomy to be a brief and concise overview. We expect that the XBRL community will create courses, books and other materials to provide a through explanation of every aspect of using the EDAP Taxonomy and other cognate taxonomies.

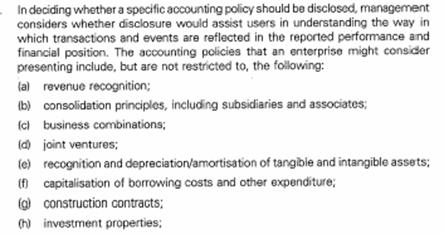

3.2. Accounting Policies

The Accounting Policies section of the EDAP taxonomy is designed to provide pointers to appropriate constituents of accounting policies adopted by entity. This disclosure is typically made in the first note to the financial statements. The elements of the Accounting Policies section of the EDAP taxonomy is shown in Figure 3:

Figure 3: Structure of Accounting Policies

Within each of these major sections are a variety of elements that meet the particular reporting requirements of corporations and the IAS standards. For example, the element “InvestmentPropertyPolicy” is the element that represent firms’ accounting policies of its accounting for Investment Properties. This element is derived from the disclosures suggested in IAS 1 Para 99, as shown in

Figure 4: Accounting Policies - Investment Properties

There are eight other elements that relate to this element, most of which derive their authorithy from IAS 40, as shown in Figure 5.

Figure 5: Investment Property Disclosures

|

ID |

Element Name |

Label |

Authority |

|

111 |

InvestmentPropertyPolicy |

Investment Property Policy |

IAS 1 99 h |

|

112 |

BasisUsedSubsequentMeasurement |

Basis Used for Subsequent Measurement |

IAS 40 66 b |

|

114 |

SubsequentMeasurementUsingCostModel |

Subsequent Measurement Using Cost Model |

IAS 1 99 h |

|

113 |

SubsequentMeasurementUsingCostModel |

Methods and Significant Assumptions for Fair Values |

IAS 40 66 b |

|

115 |

EstimatedUsefulLivesDepreciationRates |

Estimated Useful Lives or Depreciation Rates |

IAS 40 69 b |

|

116 |

MethodUsedDepreciatingInvestmentPropertyLifeRate |

Method Used for Depreciating Investment Property(Life or Rate) |

IAS 40 69 a |

|

117 |

LifeRateInvestmentProperty |

Life or Rate for Investment Property |

IAS 40 69 b |

|

118 |

MinimumLifeRateInvestmentProperty |

Minimum Life or Rate for Investment Property |

IAS 40 69 b |

|

119 |

MaximumLifeRateInvestmentProperty |

Maximum Life or Rate for Investment Property |

IAS 40 69 b |

A total of 300 elements in the EDAP taxonomy are for the accounting policies of

the corporation. Particular corporations will make the judgment as to whether

they will disclose their accounting policies at a higher level, for example at

the level of “InvestmentPropertyPolicy” or at a more detailed level, for

example at the level of “MaximumLifeRateInvestmentProperty”

3.3. Enhanced Disclosures

The elements that relate to the financial disclosures found in Balance Sheet, Income Statement and Cash Flow are included in the PFS taxonomy. This applies whether or not the disclosures are made on the “Face” of the financial statements or in the footnotes to those statements. For example, details of inventories, such as “Raw Materials” or “Inventories” may be included on the Balance Sheet or in an Inventory note to the financial statements. Each reporting elements that could be either in the notes or in the primary financial statements are included in the Primary Financial Statement (PFS) taxonomy.

The “Explanatory Disclosures” elements in this EDAP taxonomy are designed for the reporting of disclosures that enhance the meaning of financial statement. The major elements of the Enhanced Disclosures are shown in Figure 6:

Figure 6: Enhanced Disclosures

Assets and Liability and Equity Disclosures

For each element in the Balance Sheet component of the Financial Statement Enhanced Disclosure (“Asset Disclosures” and “Liability and Equity Disclosures”), there is a relatively consistent structure that determines the closing balance of the asset or liability. This structure is illustrated in Figure 7. Whilst this general pattern holds, there are differences between classes of assets or liabilities that arise from the particular disclosure requirements of the IASs and/or from the essential nature of the item. For example, the disclosures for Investment Properties are necessarily somewhat different from those of Property, Plant and Equipment.

Figure 7: Structure of Changes in Assets or Liabilities

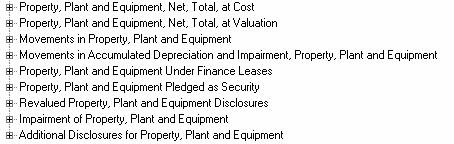

The makeup of Property, Plant and Equipment is shown in Figure 8:

Figure 8: Makeup of Property, Plant and Equipment

In addition, the nature of enhanced disclosures vary with the nature of assets or liabilities. Required disclosures on Deferred Tax are, for example, driven by the particular requirements of IAS 12.

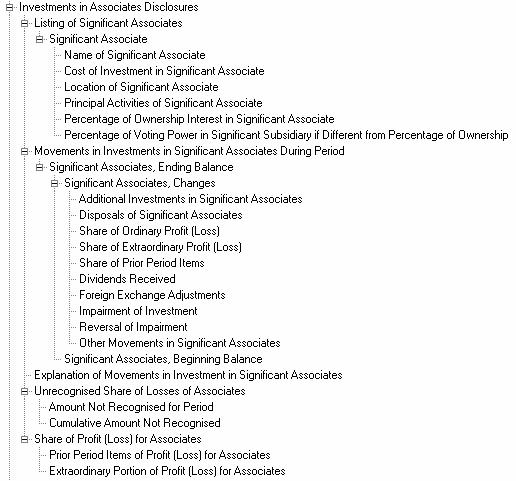

Certain classes of assets require additional disclosures beyond the details of movements. For example, a corporation may have an asset “Investments in Associates.” IAS 28 requires a number of additional disclosures that further explain these investments and particularly the changes in investments over the accounting period. These additional disclosures are covered by the elements shown in Figure 9:

Figure 9: Additional Disclosures on Investments in Associates.

The “Significant Associate” (SignificantAssociate) structure is a tuple that contains required disclosures on each significant associate, including name, cost of acquisition, location, significant, percentage of ownership and “Percentage of Voting Power in Signifiant Subsidiary if Different from Percentage of Ownership.” These elements will be repeated for each associate.

By contrast, the section “Movements in Investments in Significant Associates During the Period” provides the closing balance of all investments in significant associates (“Significant Associates, Ending Balance”). The opening balance of the significant associates (“Significant Associates, Beginning Balance”) and the various changes (e.g. “Share of Ordinary Profit (Loss)”; “Dividends Received” and “Impairment of Investment”).

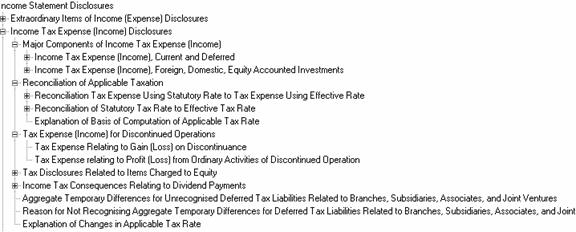

Income Statement Disclosures

The enhanced disclosures on the Income Statement component of the taxonomy provide both descriptive, qualitative disclosures which explain the primary disclosures made in the PFS Taxonomy as well provide additional quantitative disclosures to supplement the disclosures made in that taxonomy.

For example, the disclosures required by IAS 12 on income taxation are primarly additional quantitative disclosures to supplement the disclosure of income taxation in the PFS taxonomy, as shown in Figure 10:

Figure 10: Disclosures on Revenue

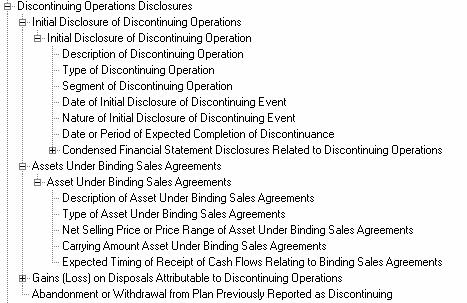

Similarly the disclosures relating to Discontinuing Operations primarily provide enhanced explanatory disclosures which supplement the Primary Financial Statements, as shown in Figure 11:

Figure 11: Discontinuing Operations Disclosures

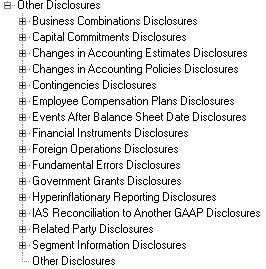

There are a variety of “Other Disclosures,” as shown in Figure 12:

Figure 12: Other Disclosures

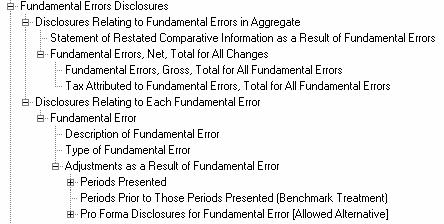

For example, IAS 8 requires a variety of disclosures on fundamental errors in the financial statements. The benchmark treatment of fundamental errors is shown in paragraphs 34 to 37 of IAS 8, reproduced below:

Benchmark Treatment

34. The amount of the correction of a fundamental error that relates to prior periods should be reported by adjusting the opening balance of retained earnings. Comparative information should be restated, unless it is impracticable to do so.

35. The financial statements, including the comparative information for prior periods, are presented as if the fundamental error had been corrected in the period in which it was made. Therefore, the amount of the correction that relates to each period presented is included within the net profit or loss for that period. The amount of the correction relating to periods prior to those included in the comparative information in the financial statements is adjusted against the opening balance of retained earnings in the earliest period presented. Any other information reported with respect to prior periods, such as historical summaries of financial data, is also restated.

36. The restatement of comparative information does not necessarily give rise to the amendment of financial statements which have been approved by shareholders or registered or filed with regulatory authorities. However, national laws may require the amendment of such financial statements.

37. An enterprise should disclose the following:

(a) the nature of the fundamental error;

(b) the amount of the correction for the current period and for each prior period presented;

(c) the amount of the correction relating to periods prior to those included in the comparative information; and

(d) the fact that comparative information has been restated or that it is impracticable to do so.

The standard also allows an alternative treatment, as shown in Paragraphs 38-40:

Allowed Alternative Treatment

38. The amount of the correction of a fundamental error should be included in the determination of net profit or loss for the current period. Comparative information should be presented as reported in the financial statements of the prior period. Additional pro forma information, prepared in accordance with paragraph 34, should be presented unless it is impracticable to do so.

39. The correction of the fundamental error is included in the determination of the net profit or loss for the current period. However, additional information is presented, often as separate columns, to show the net profit or loss of the current period and any prior periods presented as if the fundamental error had been corrected in the period when it was made. It may be necessary to apply this accounting treatment in countries where the financial statements are required to include comparative information which agrees with the financial statements presented in prior periods.

40. An enterprise should disclose the following:

(a) the nature of the fundamental error;

(b) the amount of the correction recognised in net profit or loss for the current period; and

(c) the amount of the correction included in each period for which pro forma information is presented and the amount of the correction relating to periods prior to those included in the pro forma information. If it is impracticable to present pro forma information, this fact should be disclosed.

These disclosure items are reflected in the taxonomy by the elements shown in Figure 13:

Figure 13: Fundamental Errors Disclosures

Important note: Where appropriate, disclosures in this section of the EDAP Taxonomy are linked to the PFS Taxonomy by “same-as” links.

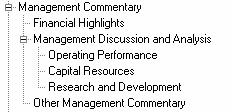

3.4. Management Commentary

The Management Commentary provides a skeleton for tagging the MD&A or similar management performance overview, as shown in Figure 14:

Figure 14: Management Commentary

3.5. Namespaces

Namespaces are an important XML concept. XBRL, using XML Schema 1.0, uses XML namespaces extensively in its schemas and instance documents. The purpose of a namespace, in the context of XBRL, is to identify the Taxonomy to which any particular XML element belongs. Namespaces allow software to resolve any ambiguity that may arise as a result of elements from different taxonomies sharing the same element name.

For example, the EDAP Taxonomy uses the element name “DescriptionHedge” (ID 1829) to represent narrative disclosures on individual Hedging Financial Instruments, as required by IAS 39 (169). If a different XBRL taxonomy from the United Kingdom also uses this element name, there must be a “differentiation” mechanism. This is accomplished by giving each taxonomy a unique namespace. A namespace is a URI (Uniform Resource Identifier) such as http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15 (which is the namespace of this release of the EDAP Taxonomy). A namespace is not a URL. It is a globally unique identifier. Within any XML document, it is not necessary to repeat lengthy identifiers with every taxonomy element. Instead, XML allows one to define an abbreviation for each namespace used. Using “qualified” namespaces in this way, instance documents and taxonomies can define an alias such as iascf-edap for the IAS Taxonomy, and uk-edap for the UK Taxonomy.

Thus the IAS element would be referred to as iascf-edap:DescriptionHedge and the UK element as uk-edap:DescriptionHedge – the namespace alias adds a context-establishing prefix to every XML element.

Note that these particular aliases reflect a usage convention only within the IAS taxonomies themselves as an aid to communication between humans. Software applications must not depend on these particular prefixes being used; they should process namespace identifiers and aliases as specified by the XML specifications.

Important Note: XBRL instance document element names for financial concepts must be qualified names containing a namespace prefix and an element name, for example: iascf-edap:DescriptionHedge.

The namespaces relevant to this EDAP Taxonomy are:

· iascf-edap, Explanatory Disclosure and Accounting Policies

· xbrl-gcd, XBRL Global Common Document

· iascf-pfs, IAS Primary Financial Statements

4. Reviewing this Taxonomy

4.1. Introduction

This section is designed to provide guidance in reviewing this taxonomy. This will assist the user of this documentation and of the taxonomy provide feedback to the IASCF and XBRL International. There are three levels of review

- Global Review: A high level review of completeness.

- Detailed Review: A detailed review of accounting disclosures and completeness

- XBRL Review: A review of appropriate treatment of disclosures within the context of the XBRL specification and good practice in building taxonomies.

4.2. Global Review

This is a high level review, undertaken with the objective of ensuring the taxonomy has not omitted any key sections. This contrasts with the Detailed Review, which is concerned with a line-by line analysis. If a crucial part of the taxonomy is missing, such as a specific Disclosure Note, this should be picked up in the Global Review. Knowledge of GAAP and Financial Reporting is required to undertake this review. It is intended to identify missing sections of the taxonomy rather than a missing element within a section. A question that would be asked in the Global Review might be “are there elements that capture operating leases?” rather than validating each of the individual Lease Standard disclosures.

Other issues include:

Structure – nesting and completeness

Are the elements grouped in a sensible manner? To illustrate, this review would ask whether the elements that are nested under, for example, Finance Costs are appropriate. To answer this requires a determination as to whether Finance Costs should reflect net or gross finance costs and an assessment as to whether the list of sub-elements seems complete.

Do the elements seem to roll up properly?

For example, net elements should have the ending balance as the parent with the components and opening balance being expressed as its children.

Consistency

Are elements aggregated in a consistent manner? There may be cases where some parent elements appear to have a disproportionate number of children, and therefore provide detail that is more appropriately included elsewhere in the PFS or EDAP taxonomies.

4.3. Detailed Review

The objective of the Detailed Review is to ensure the taxonomy correctly captures GAAP. It has two components, the first driven from GAAP and the second driven from XBRL.

GAAP Review

This review has a Financial Reporting focus, and involves validating the elements and disclosures in the taxonomy on a line-by-line basis against GAAP.

The accuracy is checked by reviewing the taxonomy against:

- GAAP standards and reference materials

- GAAP disclosure checklists

- Model financial statements; and against

- Actual financial statements

GAAP to XBRL

Reviewers should be able to identify an element in the taxonomy for every item required to be disclosed under GAAP, in this case the International Accounting Standards. This requires a 100% mapping from GAAP to the Taxonomy. This includes checking all the appropriate Accounting Standard references.

There are many generic requirements to disclose a component for which there may be several classes. Examples include classes of shares, PPE (Property, Plant & Equipment) and expenses. The taxonomy should only capture the most common classes observed in practice, to limit the need to build supplementary enterprise-specific taxonomies. In a similar manner, a standard may require the discourse of all “movements” in a particular item, such as capital.

This review should ensure that the element list is sufficiently complete in relation to all of these matters.

XBRL to GAAP

Not all elements in the Taxonomy will map directly to a GAAP disclosure requirement. Such elements should exist in the taxonomy because it is either 1) common practice for enterprises to disclose the fact or 2) the fact is a sub-total that helps the structural completeness of the taxonomy.

4.4. XBRL Review

This review has an XBRL focus, and involves verifying some of the attributes of the elements. The principal attributes to be verified are weights, labels and data type.

Weights

Is the weight correct, so that the children correctly roll-up to the parent?

Labels

Label names should be consistent. For example, the net carrying amount of an asset might be labeled as “Description – Net”, such as “Goodwill – Net”. There should therefore be no cases of “Net Description” or any other variations. All abbreviations should also be consistent.

Data-Types

Is the element data-type correct?

5. Review and Testing, Updates and Changes

5.1. Change Log

None at this time.

5.2. Updates to this Taxonomy

This taxonomy will be updated with revisions for errors and new features within the following guidelines:

· Since financial statements created using a taxonomy must be available indefinitely, the taxonomy must be available indefinitely. All updates will take the form of new versions of the taxonomy with a different date. For example, the taxonomy http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2002-11-15/ias-ci-edap-2002-11-15.xsd will never change. New versions will be issued under a different name, such as http://www.xbrl.org/taxonomy/int/fr/ias/ci/edap/2003-12-31/ias-ci-edap-2003-12-31.xsd. This will ensure that any taxonomy created will be available indefinitely.

- It is anticipated that this taxonomy will be updated as required to incorporate changes in generally accepted accounting principles and business reporting norms.

5.3. Errors and Clarifications

The following information relating to this taxonomy will be accumulated:

- Errors which are brought to the attention of the preparers of this specification

- Workarounds where appropriate and available

- Clarification of items which come to the attention of the editors via comments and feedback

If you wish to report an error or require a clarification, please provide feedback as indicated in the “Comments and Feedback” section of this document.

5.4. Comments and Feedback

Comments and feedback are welcome, particularly ideas to improve this taxonomy. If you have a comment or feedback or wish to report an error, post comments to:

xbrlfeedback@iasb.org.uk (mailto:xbrlfeedback@iasb.org.uk)

6. Acknowledgements

A tremendous effort has gone into creating this piece of intellectual property that is being placed in the public domain by the IASCF and XBRL International for use and benefit of all. The IASCF and members of XBRL International believe that this cooperative effort will benefit all participants in the financial information supply chain.

The IASCF and XBRL International would like to acknowledge the contributions of the following individuals for their work in the creation of this taxonomy, and to their organizations that provided funds and time for their participation in this effort:

Name |

Organization |

Accounting Jurisdiction |

|

Alastair Boult |

Audit New Zealand |

New Zealand |

|

Roger Debreceny |

Nanyang Technological University |

Singapore |

|

Kersten Droste |

PricewaterhouseCoopers |

Germany |

|

Thomas Egan |

Deloitte and Touche |

Singapore |

|

Dave Garbutt |

FRS |

South Africa |

|

Preetisura Gupta |

PricewaterhouseCoopers |

Singapore |

|

David Hardidige |

Ernst and Young |

Australia |

|

David Huxtable |

KPMG |

Australia |

|

Walter Hamscher |

Standard Advantage |

USA |

|

Charles Hoffman |

UBMatrix |

USA |

|

Josef Macdonald |

Ernst and Young |

New Zealand |

|

Gillian Ong |

Nanyang Technological University |

Singapore |

|

Ong Suat Ling |

Andersen |

Singapore |

|

Paul Phenix |

Australian Stock Exchange |

Australia |

|

Kurt Ramin |

IASC Foundation |

IAS |

|

David Prather |

IASC Foundation |

IAS |

|

Julie Santoro |

KPMG |

IAS |

|

Mark Schnitzer |

Morgan Stanley |

USA |

|

Geoff Shuetrim |

KPMG |

Australia |

|

Bruno Tesniere |

PricewaterhouseCoopers |

Belgium |

|

Stephen Taylor |

Deloitte and Touche |

Hong Kong |

|

Alan Teixeira |

University of Auckland |

New Zealand |

|

Jan Wentzel |

PricewaterhouseCoopers |

South Africa |

|

Charles Yeo |

Ernst and Young |

Singapore |

7. XBRL International Members

A current listing of members of XBRL International is available at www.xbrl.org