1. Overview

1.1. Purpose

The International Accounting Standards Committee Foundation (IASC Foundation) and XBRL International (http://www.xbrl.org) are leading the development of this eXtensible Business Reporting Language (XBRL) Primary Financial Statements (PFS) Taxonomy for the purpose of expressing financial statements according to the International Accounting Standards Board’s International Accounting Standards (IAS) and forthcoming International Financial Reporting Standards (IFRS) (http://www.iasb.org.uk) .

This Primary Financial Statements (PFS) Taxonomy is designed to facilitate the creation of XBRL instance documents that reflect business and financial reporting for Commercial and Industrial companies according to the International Accounting Standards Board’s (http://www.iasb.org.uk) IAS Generally Accepted Accounting Principles. The purpose of the PFS Taxonomy is to provide a framework for the consistent creation of XBRL documents for financial reporting purposes by private sector and certain public sector entities. The purpose of this and other taxonomies produced using XBRL is to supply a framework that will facilitate data exchange among software applications used by companies and individuals as well as other financial information stakeholders, such as lenders, investors, auditors, attorneys, and regulators.

The authority for this PFS Taxonomy is based upon the International Accounting Standards Board’s (http://www.iasb.org.uk) International Accounting Standards (“IAS”) and Statements of Interpretation (“SIC”) effective 01 January 2002 (http://www.iasplus.com/standard/standard.htm) and from best practice. As this Taxonomy primarily addresses the reporting considerations of Commercial and Industrial companies, IAS 26 and IAS 30 disclosure requirements are not represented in the Taxonomy’s content.

The particular disclosures in this PFS Taxonomy models are:

1. Required by particular IASs

2. Typically represented in IAS model financial statements, checklists and guidance materials as provided from each of the major international accounting firms.

3. Found in common reporting practice, or

4. Flow logically from items 1-3, for example, sub-totals and totals.

This PFS Taxonomy is in compliance with XBRL Specification Version 2.0, dated 2001-12-14 (http://www.xbrl.org/tr/2001/).

1.2. Taxonomy Status

The Taxonomy is a final Working Draft. Its content and structure have been reviewed both accounting and technical teams of the IASCF (http://www.iascf.com) and the IAS Taxonomy Development Working Group. As such, the XBRL element names, labels, linkbases and references should be considered complete and stable within the domain of the Taxonomy. Although changes may occur to any of this XBRL data, the probability of any changes significantly altering the content of the Taxonomy is very low.

The following is a summary of meanings of the status of taxonomies:

- Internal Working Draft – Internal Working Draft version of a taxonomy exposed to XBRL.ORG members for internal review and testing. An Internal Working Draft is subject to significant changes as initial testing undertaken. Its structure may not be stable and its content may not be complete.

- Working Draft – Working Draft version of a taxonomy exposed to public for review and testing. A Working Draft has been tested and its structure is unlikely to change although its contents may still change as the result of broader testing.

- Recommendation – Final version of taxonomy, released for use by the public.

1.3. Scope of Taxonomy

This Primary Financial Statements (PFS) Taxonomy is released in tandem with the XBRL Global Common Document (GCD) Taxonomy. At a later date, the Explanatory Disclosures and Accounting Policies (EDAP) Taxonomy will be released. The GCD Taxonomy incorporates elements that are common to the great majority of XBRL instance documents, regardless of type. The GCD Taxonomy has elements that describe the XBRL instance document itself and the entity to which the instance document relates. The PFS Taxonomy encompasses the core financial statements that private sector and certain public sector entities typically report in annual, semi-annual or quarterly financial disclosures.

Those financial statements are the

- Balance Sheet,

- Income statement,

- Statement of Cash Flows

- Statement of Changes in Equity.

Reporting elements from those financial statements may be incorporated into a wide variety of other disclosures from press releases to multi-period summaries.

The EDAP Taxonomy has elements that provide enhanced disclosure over and above the disclosures made in the primary financial statements. These disclosures are, in the context of annual financial statements, typically made in the notes to the financial statements. The EDAP taxonomy also provides elements to identify the accounting policies adopted by the reporting entity. Elements in the EDAP taxonomy include:

- Accounting Policies

- Explanatory Disclosures to the Financial Statements

- Management Discussion and Analysis / Director report

- Financial Highlights

- Auditor’s Report

Taken together, these three taxonomies will meet the reporting needs of companies that meet three criteria, viz (i) they reporting under International Accounting Standards (IASs), (ii) are in the broad category of “commercial and industrial” industries and (iii) have relatively common reporting elements in their financial statements. In practice, all three criteria are unlikely to hold for any company. Additional taxonomies are likely to be required. These taxonomies are likely to identify the particular needs of:

- International industries, for example, airlines, pharmaceuticals or agribusiness.

- National jurisdictions for those companies that adopt the IASB’s IASs as the core financial standards setting foundation and may include supplementary reporting requirements or prevent use of available options by local accounting standards setters as well as stock exchanges etc.

- National industry or common practice, for example, agriculture or credit reporting.

- An individual company

These extension taxonomies will either extend the GCD, PFS and EDAP taxonomies to meet the particular reporting requirements of that industry, country or company and/or restrict the use of particular by limiting the use of particular PFS or EDAP taxonomy elements.

The inter-relationships of the various taxonomies are show in Figure 1:

Figure 1: Interrelationship of Taxonomies and Instance Document

Validates

At the date of release of this document no other taxonomy had been formally released, but extension taxonomies are under development for the some national jurisdictions such as Australia.

1.4. Relationship to Other Work

XBRL utilizes the World Wide Web consortium (W3C www.w3.org ) recommendations, specifically:

- XML 1.0 (http://www.w3.org/TR/2000/REC-xml-15001006)

- XML Namespaces (http://www.w3.org/TR/1999/REC-xml-names-19990114/)

- XML Schema 1.0 (http://www.w3.org/TR/xmlschema-1/ and http://www.w3.org/TR/xmlschema-2/), and

- XLink 1.0 (http://www.w3.org/TR/xlink/).

2. Overview of Taxonomy

The following is an overview of the taxonomy. It is assumed that the reader is familiar with financial and business reporting and has a basic understanding of XBRL.

2.1. Contents of the Taxonomy

This PFS Taxonomy makes available to users the most commonly disclosed financial information under the IASB’s IAS Standards. This taxonomy is an expression of financial information in terms that are understandable to humans, but more importantly also understandable by a computer application.

The PFS Taxonomy is made up of a “package” of interrelated XML files:

- XML Schema File (.XSD file): An XBRL Version 2.0 Taxonomy XML Schema file.

- XBRL Linkbases (.XML files): “Linkbases” for:

- Labels

- References

- Presentation information

- Calculation relationships between elements, and

- Definitional relationships between elements.

The package is represented visually; with an example based on Balance Sheet reporting of Non-Current Investment Property is shown in Figure 2:

Figure 2: PFS Taxonomy Package and Example

2.2. Taxonomy Structure

The PFS Taxonomy contains nearly eight hundred elements or unique, individually identified pieces of information. The XML schema file at the heart of the taxonomy package provides a straightforward listing of the elements in the taxonomy. The linkbases provide the other information necessary to interpret (e.g. Label and Definition linkbases) taxonomy elements or place a given taxonomy element in context of other taxonomy elements (e.g. Calculation and Presentation linkbases).

Given that information on the Taxonomy is included in XML schema and linkbase files, it is best rendered for human interpretation in a “paper” paradigm. Users are encouraged to review versions of the taxonomy elements in Adobe Acrobat (PDF) (http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf) or Excel http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.xls formats.

However, in this rendering much of the characteristics of taxonomy are not obvious. The paper paradigm is two dimensional, whereas the information in the taxonomy is multidimensional. The application of a metaphor assists in understanding taxonomies. The PFS Taxonomy is organized using a “Balance Sheet” metaphor. This organization is used because it is understood by most accountants who use this metaphor to organize their audit working papers; to put the notes to the financial statements in order and in a variety of other uses. This metaphor is also familiar to the users of financial statements.

However, this metaphor and organization somewhat limits an understanding of the power behind an XBRL taxonomy. A taxonomy has multiple “dimensions”. Relationships can be expressed in terms of definitions, calculations, links to labels in one or more languages, links to one or more references, etc. The metaphor used expresses only one such relationship.

The PFS Taxonomy is divided logically into sections that correspond to typical financial statement components. While there is no true concept of “sections” in the Taxonomy, their purpose is to group similar concepts together and facilitate navigation within the Taxonomy. The following is a listing of “sections” and a brief explanation (where necessary) of those sections:

The higher-level sections of the Taxonomy are shown in Figure 3:

Figure 3: High Level Sections of PFS Taxonomy

|

Section |

Explanatory Guidance |

|

Balance Sheet |

See Section 3.3 for additional details |

|

Income Statement |

See Section 3.4 for additional details |

|

Statement of Cash Flows |

See Section 3.5 for additional details |

|

Statement of Changes in Equity |

See Section 3.6 for additional details |

2.3. Element Naming Convention

XBRL naming conventions follows that of XML Schema. Each name within a taxonomy must be unique and must start with an alpha character or the underscore character. Element names are case-sensitive. Therefore, “myelement”, “MyElement” and “MYELEMENT” can all exist within the same taxonomy because they are considered unique. The PFS Taxonomy naming convention follows these rules. In particular, element names should not be interpreted as containing a reliably “hierarchical” structure, or as indicating relationships with other elements. Taxonomy structure is only expressed in the XBRL linkbases.

A PFS Taxonomy XBRL “element name” is called a composite element name. A composite element is comprised of IASC Foundation “components”. Each component represents an IAS concept, definition or best practice, etc. Each component is three characters in length and each three-character component is cross referenced (in a separate file) with the concept it represents. Combining multiple components yields a composite element name. For example, “ast” and “inv” abbreviate, in English, “asset” and “inventory” respectively. Combining the two components produces the composite element “ast.inv”. For further details of the naming convention, see Section 5 - Naming Convention and the Appendix.

2.4. Label Languages

In this release, labels for taxonomy elements are provided only in English. Additional linkbases can be developed later to express taxonomy labels in additional languages.

2.5. References

This Taxonomy provides references to IAS standards and other authoritative sources. These sources are:

- IAS standards, referenced as: IAS x para y(z)

- IASB Standing Interpretations Committee (SIC), referenced as SIC x para y(z)

- IAS Framework, referenced as: F para y(z) ()

- IAS common practice, referenced as: IAS-CP ( This is)

- Structural completeness (ie a sub-total), referenced as: IAS-SC

2.6. Further Documentation Available

The intent of this document is to explain the Taxonomy. This document assumes a general understanding of accounting and XBRL. If the reader desires additional information relating to XBRL, the XBRL International web site (http://www.xbrl.org) is recommended. Specifically, a reading of the XBRL Specification Version 2.0 is highly recommended (http://www.xbrl.org/tr/2001/). The purpose of this document is to explain how XBRL is being applied in this specific case, for this taxonomy.

The following documentation is available to assist those wishing to understand and use this taxonomy. This documentation is available on the XBRL International web site (http://www.xbrl.org):

These Explanatory Notes:

This overview document describing objectives of the IASC Foundation, XBRL International IAS Working Party and the Taxonomy:

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.htm (HTML Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.doc (Word Format)

Taxonomy Elements:

This is a summary listing of taxonomy elements in a human readable format for the purpose of obtaining an overview of this taxonomy.

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.xls (Excel Format)

Taxonomy Package

These documents correspond to a set of interrelated files comprising an XBRL taxonomy package:

- XML Schema File (.XSD file): An XBRL Version 2.0 Taxonomy XML Schema file.

- XBRL Linkbases (.XML files): Linkbases for

- References

- Labels

- Presentation

- Calculations, and

- Definitions.

These files are located as follows:

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.xsd (Schema)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-references.xml (References linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-labels.xml (Labels linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-presentation.xml (Presentation linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-calculation.xml (Calculation linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-definition.xml (Definition linkbase)

“Sample Company” Instance Documents

The “Sample Company” instance documents are provided as a practical example of the application of the taxonomy. The instance document is provided in unstyled XML; and in Adobe Acrobat:

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/SampleCompany-2002-09-15.xml. (XBRL/XML Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/SampleCompany-2002-09-15.pdf. (PDF Format)

3. Items to Note in Using the Taxonomy

3.1. Introduction

The following explanation of the taxonomy, the taxonomies with which this PFS Taxonomy is designed to interoperate, and examples of how to interpret the PFS Taxonomy are provided to make the PFS Taxonomy easier to use. Please refer to the detailed printout of the PFS Taxonomy as you go through this explanation (http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf). This explanatory document is designed to provide an overview of the PFS Taxonomy to be a brief and concise overview. We expect that the XBRL community will create courses, books and other materials to provide a through explanation of every aspect of using the PFS Taxonomy and other cognate taxonomies.

3.2. How to Interpret the Taxonomy Structure

The element fragment shown in Figure 4 exists within the Taxonomy:

Figure 4: Sample Elements

|

Element |

Label |

ID Number |

Page |

|

ast.ncr |

Non Current Assets |

4 |

1 |

|

ast.ppe |

Property, Plant and Equipment |

5 |

1 |

|

ast.ivp |

Investment Property |

14 |

1 |

|

ast.int |

Intangible Assets |

15 |

1 |

This means that for a commercial and industrial company, there is a type of non-current asset called “Property Plant and Equipment”. This is represented by the element with that label, and a composite name of “ast.ppe”.

If a company reports their financials using an XBRL instance document, then because “Property Plant and Equipment” is an element in the taxonomy, and this element has children that roll up to it, then one of the following will be true:

· All of the “ Property Plant and Equipment” of the entity must be recorded within one of those child elements, OR

· The instance document will include an extension to the taxonomy that consists of a new element or elements and an indication of how those new elements relate to “Property Plant and Equipment”.

All of the elements in the fragment shown are of a data type “monetary” with a weight of “1”. Having a weight of “1” indicates that the element value of all children of an element, multiplied by the weight, then add up or “roll up” to the value of the parent element. For example, “Property Plant and Equipment,” “Investment Property” and “Intangible Assets” are part of the make up of the value of “Non Current Assets,” along with other assets such as “Biological Assets” (ast.bia, ID 22) and “Investments in Subsidiaries (ast.ivm.sub, ID 23). This continues up the Calculation linkbase tree so that “Assets” has a value of the children “Current Assets” (ast.cur, ID 41, Page 1) and “Non Current Assets”, and so forth throughout the entire taxonomy.

The taxonomy is laid out with parents coming before children. For example, in the Income Statement component of the taxonomy, the element “IAS 1 75 Net Profit (Loss) for Period After Tax and Net of Minority Interests Transferred toEquity” (inx.npl, ID 157) comes before the other elements of the Income Statement such as Minority Interests Included in Group Profit (Loss), (inx.mnr, ID 158) or “Profit (Loss) After Tax and Before Minority Interests” (inx.pls.atx, ID 159). This pattern is followed throughout the taxonomy.

3.3. Balance Sheet Structure

The major sections of the Balance Sheet structure (refer to (http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf for IDs and page numbers)are shown in Figure 5:

Figure 5: Balance Sheet Structure

|

Element Names |

Element Labels |

ID |

|

bst |

Balance Sheet |

2 |

|

ast |

Assets |

3 |

|

ast.ncr |

Non Current Assets |

4 |

|

ast.cur |

Current Assets |

49 |

|

lqy |

Liabilities and Equity |

71 |

|

lqy.eqy |

Equity |

72 |

|

lqy.lia |

Liabilities |

96 |

|

lqy.lia.ncr |

Non Current Liabilities |

97 |

|

lqy.lia.cur |

Current Liabilities |

126 |

3.4. Income Statement Structure

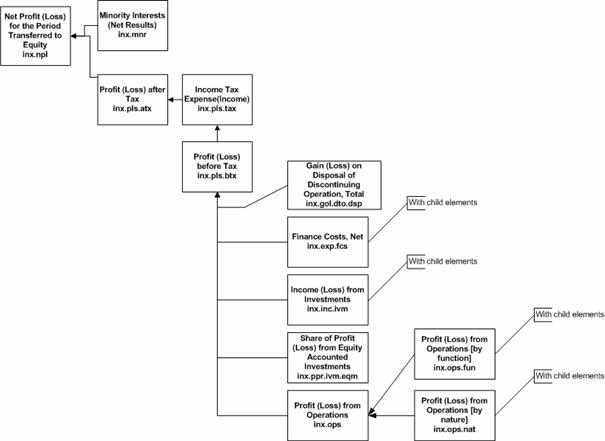

The structure of the Income Statement and Cash Flows statement (see Section 3.5), and other structures, may not appear intuitive at first glance. The structure of the Income Statement is shown in Figure 6:

Figure 6: Income Statement – Major Structures

The distinction between results for continuing and

discontinued operations is captured in XBRL context segments, not in the

taxonomy.

An income statement's fundamental purpose is to show net income for an entity, and the items which comprise that net income. The final result is “Net Profit (Loss) for the Period Transferred to Equity”. The most important element of the structure of the Income Statement is Profit (Loss) after Tax. This element is comprised in turn of other elements:

- Income Tax Expense

- Total Profit (Loss) before Tax

The element Total Profit (Loss) before Tax in turn has a set of disclosures to represent gains and losses on disposals, finance costs, income from investments, and income from operations. The last of these further breaks down into Continuing Operations [by function] or by nature (e.g. Raw Materials and Consumables Used, Continuing Operations [by nature] ).

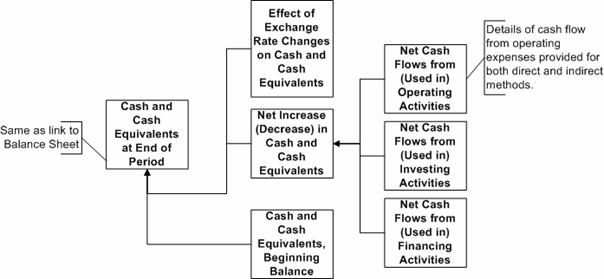

3.5. Cash Flow Structure

The structure of the Cash Flow disclosures is closely modeled on the disclosures required in IAS 7. Support provided is provided for both the direct and indirect method. There is a “same as” link between the “Cash and Cash Equivalents, Endin Balance” in the Cash Flow section of the taxonomy (cfl.cce.end) and the equivalent tag in the Balance Sheet “Cash and Cash Equivalents” (ast.cce). The structure of the Cash Flow disclosures is shown in Figure 7:

Figure 7: Cash Flow Structure

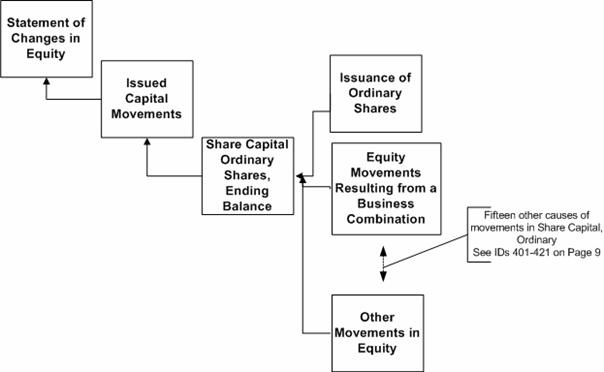

3.6. Statement of Changes in Equity Structure

Figure 8: Structure of Statement of Changes in Equity

- Statement of Changes in Equity

- Issued Capital

- Subscribed Capital

- Reserves

- Treasury Shares

- Retained Profits (Accumulated Losses)

- Equity, Total, Ending Balance

For each of the sections, with the exception of Total Changes in Equity, model the opening balance, changes and closing balance. The structure of these sub-sections is typified by the elements for disclosures in changes in Share Capital at Par, shown in Figure 9:

Figure 9: Changes in Share Capital at Par

ID References to http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf

The element “Issued Capital Movements” is made up of changes not recognized in the Income Statement and changes in in the beginning balance of equity.

3.7. Equivalent facts

These exceptions require the use of “same-as” links. The “same as” concept is part of XBRL Specification Version 2.0, and its interpretation is as follows: there will be an error if an instance document having two elements linked by a “same as” definition relationship and which have the same numeric context have different content values.

3.8. Namespaces

Namespaces are an important XML concept. XBRL, using XML Schema 1.0, uses XML namespaces extensively in its schemas and instance documents. The purpose of a namespace, in the context of XBRL is to identify the taxonomy to which any particular XML element belongs. Using namespaces allows software to resolve any ambiguity or confusion that may arise as a result of elements from different taxonomies sharing the same element name.

For example, the PFS Taxonomy uses the composite name “ast.cce” to represent “cash and cash equivalents”. If a different XBRL taxonomy from the United Kingdom also uses “ast.cce”, there needs to be a “differentiating” mechanism. The way this is done is that each taxonomy has a unique namespace. A namespace is a URI (Uniform Resource Identifier) such as http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/, which is the namespace of this release of the PFS taxonomy. A namespace is not a URL that one is meant to use with a browser; it is a simply a globally unique identifier. Within any particular XML document, however, it is quite unnecessary to repeat such a huge identifier with every taxonomy element – instead, XML allows one to define an abbreviation for each of the namespaces one uses. Using “qualified” namespaces in this way, instance documents and taxonomies can define an alias such as iascf-pfs for the IAS taxonomy, and uk for the UK taxonomy. Thus the IAS element would be referred to as iascf-pfs:ast.cce and the UK element as uk:ast.cce – the namespace alias therefore adds a context-establishing prefix to any given XML element.

Using qualified namespaces, the PFS Taxonomy “cash and cash equivalents” becomes iascf-pfs:ast.cce and the United Kingdom Taxonomy’s would be uk:ast.cce. The namespace simply adds a contextual prefix to any given XML element.

It is a convention used in the IAS PFS and related taxonomies to use namespace aliases consistently. The namespaces relevant to this PFS Taxonomy are:

· xbrl-gcd, XBRL Global Common Document

· iascf-pfs, IAS Primary Financial Statements

· iascf-edap, Explanatory Disclosure and Accounting Policies

Note that these particular aliases reflect a usage convention only within the IAS taxonomies themselves as an aid to communication between humans. Software applications must not depend on these particular prefixes being used; they should process namespace identifiers and aliases as specified by the XML specifications.

3.9. Entering Numeric Values into Instance Documents

Figure 10 describes how weights have been incorporated into the PFS Taxonomy and how corresponding values will be entered into an instance document.

Figure 10: Numeric Value Conventions

|

Balance |

Normally appears in instance document as |

|

|

Asset |

Debit |

Positive |

|

Liability & Equity |

Credit |

Positive |

|

Revenue |

Credit |

Positive |

|

Expense |

Debit |

Positive |

|

|

|

|

|

Other Income (Expenses) |

|

Positive or (Negative) |

|

|

|

|

|

Cash Inflows |

|

Positive |

|

Cash Outflows |

|

Positive |

|

|

|

|

|

Number of Employees |

|

Positive |

3.10. Segmentation

XBRL instance documents distinguish facts relating to different segments of an entity in nonNumericContexts and numericContexts. For example, revenues for the entire company, and segmented into revenues for the Americas, Asia-Pacific, and EMEA, are represented in four different numericContexts.

Important note: Instance documents using the IAS taxonomy use the entity segment mechanism to distinguish disclosures related to continuing and discontinued operations.

4. Reviewing this Taxonomy[1]

4.1. Introduction

This section is designed to provide guidance in reviewing this taxonomy. This will assist the user of this documentation and of the taxonomy provide feedback to the IASCF and XBRL International. There are three levels of review

- Global Review: A high level review of completeness.

- Detailed Review: A detailed review of accounting disclosures and completeness

- XBRL Review: A review of appropriate treatment of disclosures within the context of the XBRL specification and good practice in building taxonomies.

4.2. Global Review

This is a high level review, undertaken with the objective of ensuring the taxonomy has not omitted any key sections. This contrasts with the Detailed Review, which is concerned with a line-by line analysis. If a crucial part of the taxonomy is missing, such as a specific Disclosure Note, this should be picked up in the Global Review. Knowledge of GAAP and Financial Reporting is required to undertake this review. It is intended to identify missing sections of the taxonomy rather than a missing element within a section. A question that would be asked in the Global Review might be “are there elements that capture operating leases?” rather than validating each of the individual Lease Standard disclosures.

Other issues include:

Structure – nesting and completeness

Are the elements grouped in a sensible manner? To illustrate, this review would ask whether the elements that are nested under, for example, Finance Costs are appropriate. To answer this requires a determination as to whether Finance Costs should reflect net or gross finance costs and an assessment as to whether the list of sub-elements seems complete.

Do the elements seem to roll up properly?

For example, does the indirect method of presenting the statement of cash flows roll-up in an intuitive manner? The construction of similar sections should be consistent. For example, net elements should have the ending balance as the parent with the components and opening balance being expressed as its children.

Consistency

Are elements aggregated in a consistent manner? There may be cases where some parent elements appear to have a disproportionate number of children, and therefore provide detail that is more appropriately included elsewhere in the PFS or EDAP taxonomies.

4.3. Detailed Review

The objective of the Detailed Review is to ensure the taxonomy correctly captures GAAP. It has two components, the first driven from GAAP and the second driven from XBRL.

GAAP Review

This review has a Financial Reporting focus, and involves validating the elements and disclosures in the taxonomy on a line-by-line basis against GAAP.

The accuracy is checked by reviewing the taxonomy against:

- GAAP standards and reference materials

- GAAP disclosure checklists

- Model financial statements; and against

- Actual financial statements

GAAP to XBRL

Reviewers should be able to identify an element in the taxonomy for every item required to be disclosed under GAAP, in this case the International Accounting Standards. This requires a 100% mapping from GAAP to the Taxonomy. This includes checking all the appropriate Accounting Standard references.

There are many generic requirements to disclose a component for which there may be several classes. Examples include classes of shares, PPE (Property, Plant & Equipment) and expenses. The taxonomy should only capture the most common classes observed in practice, to limit the need to build supplementary enterprise-specific taxonomies. In a similar manner, a standard may require the discourse of all “movements” in a particular item, such as capital.

This review should ensure that the element list is sufficiently complete in relation to all of these matters.

XBRL to GAAP

Not all elements in the Taxonomy will map directly to a GAAP disclosure requirement. Such elements should exist in the taxonomy because it is either 1) common practice for enterprises to disclose the fact or 2) the fact is a sub-total that helps the structural completeness of the taxonomy.

4.4. XBRL Review

This review has an XBRL focus, and involves verifying some of the attributes of the elements. The principal attributes to be verified are weights, labels and data type.

Weights

Is the weight correct, so that the children correctly roll-up to the parent?

Labels

Label names should be consistent. For example, the net carrying amount of an asset might be labeled as “Description – Net”, such as “Goodwill – Net”. There should therefore be no cases of “Net Description” or any other variations. All abbreviations should also be consistent.

Data-Types

Is the element data-type correct?

5. Naming Convention

5.1. Introduction

This section explains the naming conventions created and used in the PFS Taxonomy to associate XBRL element names to concepts from the IASB Standards and other related materials. The purpose of this “translation” is to provide a consistent, reliable, language-independent, unambiguous way for relevant parties to use and integrate IAS standards into their software applications.

5.2. Key Terms

The following terms are used throughout this section:

· Component: A three-character representation of a term that relates to the Standards. This term may represent, among other things, an accounting term, an accounting concept, or an IAS-defined definition. Examples: [ast] = “asset”; [exy] = “extraordinary”.

· Composite: A composite element name is a series of two or more components. A composite represents a more specific concept than a component. Examples: [inx.grp.fna.cto] = “Income (Expense) from Financing Activities Continuing Operations”; [inx.npl] = “Net Profit (Loss) for the Period Transferred to Equity”.

· Reference: A reference to literature that supports the existence and necessity of a component and/or composite. Each component and composite has at least one reference. Typically these refer to chapter/subchapter/paragraphs/etc., as denoted in the IAS Bound Volume. However, other references may also be present.

· Label: A label is text that describes a component and/or composite to a user. A single component or composite may have multiple labels, typically one per language.

· Extended Component: A component that occurs so infrequently that it too insignificant to be considered a regular component. An extended component is represented by a number, must always be accompanied by ordinary components, and must never be the first component in a composite.

5.3. Concepts and Considerations

Composites have one overriding requirement: to represent uniquely and unambiguously, a type of financial reporting fact. This requirement ensures that computers and software can “understand” the data they are processing and storing. With this sole purpose, it would be enough simply to supply each fact with a unique identifier and then keep a repository that matches each identifier with its references and labels.

Basic Considerations

The PFS Taxonomy composite element names are XML-compliant element names. As such, each begins with a letter and is devoid of spaces and other XML Schema-prohibited characters. Composites are made up of two or more components, including extended components. Each component in a composite is separated with a ‘dot’ [ . ] The intent of ‘dot’ is to facilitate searching and scanning. Although computers may or may not be able to make sense out of a composite element name, a human can, provided the naming convention follows rules.

The goal of each composite element name is to contain a small number of components that define major distinctions. If the composite element has too many components and too much detail, the additional detail adds little value – it is better to just use an extended component, so as to ensure uniqueness.

Composite Element Names are not Hierarchical in Nature

The order in which components in a composite element name are combined should not be interpreted as a hierarchy. Although some composite element names may “appear” to resemble this relationship, it is mere coincidence. All components in a composite element name are equal in stature and there is no implied hierarchy within the composite element name. Hierarchy is expressed in the XBRL linkbases.

For example, the composite element name [inx.npl], which is linked to the English label “Net Profit (Loss) Transferred to Income”, does not include the component that represents “Income Statement”. This is because [inx.npl] completely and sufficiently represents the fact “Net Profit (Loss) Transferred to Income”. In addition to appearing as a descendant of “Income Statement”, [inx.npl] is also a descendant of “Statement of Changes in Equity” and “Statement of Cash Flows”.

Detailed Considerations

Nearly all PFS Taxonomy composite element names contain a component that represents one of the concepts outlined in the IAS Framework, IAS 7 and IAS 8: Position (asset, liability, equity), performance (income, expense, profit or loss), or cash flow (flow).

There are exceptions to this general rule. One such example is when a fact that can be either income or expense depending on circumstances represented by the instance document where it is used. In this example, a third ‘state’ – income or expense – exists. The composite [inx.dsp.dto] represents “Gain (Loss) on Disposal of Discontinuing Operation”, which can be either an income or an expense.

5.4. Primary Components

The primary components are the “commonly reused” components. There are two types of primary components: a) prefix, and b) suffix.

Prefix Components

Prefix components are the “building blocks” of every PFS Taxonomy composite element name. Every composite name must contain at least one prefix component. Essentially, every possible financial disclosure is a refinement of one of the prefix components. Prefix components usually (but do not have to) appear first in a composite element name. These components typically fall into one of four categories:

1.

Position: These

are: a) asset, b) liability, c) equity, and d) asset or liability. These are

essentially, the “real” accounts. When one of these four components is present,

none of the other three will be present. They are mutually exclusive.

Typically, the prefix position components are followed immediately by more

descriptive position element, such as “cash” or “payables”, although, in the

case of assets and liabilities, a “current/non-current” component may be

inserted between, if such designations are used. In addition, when summary

accounts (e.g., total assets) are present, the prefix position element may not

be accompanied by a more descriptive position element.

2.

Performance:

These are a) income, b) expense, c) income or expense, d) profit or loss. These

are essentially the “nominal” accounts. When one of these four components is

present, none of the other three will be present. They too are mutually

exclusive.

Income and expense [inx] is used to represent unknown future values, as

mentioned in Detailed Considerations,

and also “gains and losses”, as there is no gain/loss component (as IAS

Framework considers gains and losses to be income and expenses, respectively).

3. Stand-alone Components: These are essentially groupings of position, performance and other elements. The include the a) income statement, b) balance sheet c) statement of cash flows, d) statement of changes in equity, e) statement of recognized gains and losses, and f) notes and disclosures. These composite elements are also components (by themselves) in that they are each fully represented by only one component.

4. General Prefix Components: These include a) cash flows, b) change (in) and, c) disclosures.

Position and performance components will not appear together in a composite name. However, both position and performance elements may appear with the general prefix components.

Suffix Components

The suffix components are of two basic types that can broadly be categorized as either “flows” or “adjectives”. Flow components typically represent changes in position elements. The “adjective” components (general suffix components) typically describe the state of a composite element. The “other” [otr] suffix component is always last in a composite name when used and simply represents the catchall term “other.”

6. Sample Company Sample Instance Document

6.1. Introduction

An example instance document that accords with the PFS Taxonomy, Sample Company, at http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/SampleCompany-2002-09-15.xml (xml) and a Acrobat version of the accounts is at http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/SampleCompany-2002-09-15.pdf (PDF). Sample Company provides an example of how instance documents will apply the taxonomy.

6.2. Balance Sheet Example

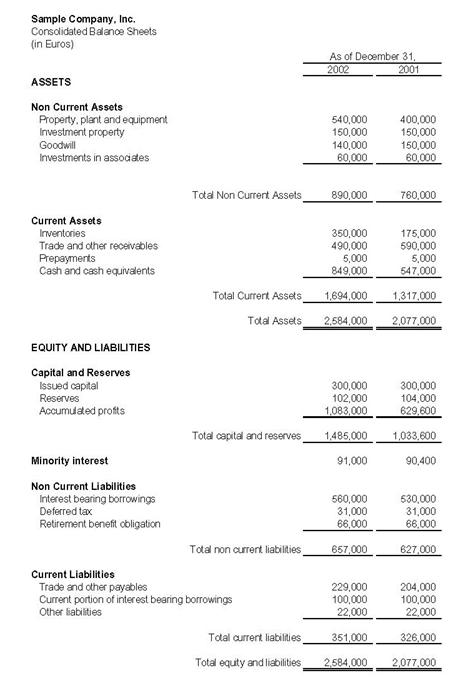

Figure 11 shows the Consolidate Balance Sheet for Sample Company for the Year Ended 31 December 2002 with comparative information for 31 December 2001.

Figure 11: Balance Sheet of Sample Company

The instance document uses a total of five contexts to represent information in the four statements. Three context represent instants of time: “Current_AsOf” for the 31 December 2002, “Prior_AsOf” for the 31 December 2001 and “PriorPrior_AsOf” for the 31 December 2000. The last item is required for the Statement of Changes in Equity There are two contexts for periods: “Current_ForPeriod” for the year ended 31 December 2002 and “Prior_ForPeriod” for the year ended 31 December 2001.

Taking Minority Interest as an example, the Balance Sheet shows €91,000 as at 31 December 2002 and €90,400 as at 31 December 2001. These facts are represented in the instance document as:

<iascf-pfs:lqy.mna numericContext="Current_AsOf">91000</iascf-pfs:lqy.mna>

<iascf-pfs:lqy.mna numericContext="Prior_AsOf">90400</iascf-pfs:lqy.mna>

The shows a namespace declaration “iascf-pfs”. When we follow the links within the instance document we find:

xmlns:iascf-pfs="http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15"

The namespace declaration links the instance document back to the XBRL IASCF PFS taxonomy.

The fact for Minority Interest for the Year Ended 31 December 2002 in the instance document also refer to the following Numeric Context: “numericContext="Current_AsOf"”

When we follow the links within the instance document we find:

<numericContext id="Current_AsOf" precision="18" cwa="true">

<entity>

<identifier scheme="http://www.sampleCompany.com">Sample Company</identifier>

</entity>

<period>

<instant>2002-12-31</instant>

</period>

<unit>

<measure>iso4217:EUR</measure>

</unit>

We can see that this provides information on the entity, in this case Sample Company; the period, in this case the instant in time of 31 December 2002 and the currency, in this case Euros, according to the ISO 4217 enumerated list of currencies.

7. Review and Testing, Updates and Changes

7.1. Change Log

None at this time.

7.2. Updates to this Taxonomy

This taxonomy will be updated with revisions for errors and new features within the following guidelines:

· Since financial statements created using a taxonomy must be available indefinitely, the taxonomy must be available indefinitely. All updates will take the form of new versions of the taxonomy with a different date. For example, the taxonomy http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.xsd will never change. New versions will be issued under a different name, such as “http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2003-12-31/iascf-ci-pfs-2002-12-31.xsd”. This will ensure that any taxonomy created will be available indefinitely.

- It is anticipated that this taxonomy will be updated as required to incorporate changes in generally accepted accounting principles and business reporting norms.

7.3. Errors and Clarifications

The following information relating to this taxonomy will be accumulated:

- Errors that are brought to the attention of the preparers of this specification;

- Workarounds where appropriate and available;

- Clarification of items which come to the attention of the editors via comments and feedback.

If you wish to report an error or require a clarification, please provide feedback as indicated in the “Comments and Feedback” section of this document.

7.4. Comments and Feedback

Comments and feedback are welcome, particularly ideas to improve this taxonomy. If you have a comment or feedback or wish to report an error, post comments to:

xbrlfeedback@iasb.org.uk (mailto:xbrlfeedback@iasb.org.uk)

8. Acknowledgements

A tremendous effort has gone into creating this piece of intellectual property that is being licensed royalty-free worldwide by the IASCF and XBRL International for use and benefit of all. The IASCF and members of XBRL International believe that this cooperative effort will benefit all participants in the financial information supply chain.

The IASCF and XBRL International would like to acknowledge the contributions of the following individuals for their work in the creation of this taxonomy, and to their organizations that provided funds and time for their participation in this effort:

Name |

Organization |

Accounting Jurisdiction |

|

Alastair Boult |

Audit New Zealand |

New Zealand |

|

Roger Debreceny |

Nanyang Technological University |

Singapore |

|

Kersten Droste |

PricewaterhouseCoopers |

Germany |

|

Thomas Egan |

Deloitte and Touche |

Singapore |

|

Dave Garbutt |

FRS |

South Africa |

|

Preetisura Gupta |

PricewaterhouseCoopers |

Singapore |

|

David Hardidige |

Ernst and Young |

Australia |

|

David Huxtable |

KPMG |

Australia |

|

Walter Hamscher |

Standard Advantage |

USA |

|

Charles Hoffman |

UBMatrix |

USA |

|

Josef Macdonald |

Ernst and Young |

New Zealand |

|

Gillian Ong |

Nanyang Technological University |

Singapore |

|

Ong Suat Ling |

Andersen |

Singapore |

|

Paul Phenix |

Australian Stock Exchange |

Australia |

|

Kurt Ramin |

IASB |

IAS |

|

David Prather |

IASB |

IAS |

|

Julie Santoro |

KPMG |

IAS |

|

Mark Schnitzer |

Morgan Stanley |

USA |

|

Geoff Shuetrim |

KPMG |

Australia |

|

Stephen Taylor |

Deloitte and Touche |

Hong Kong |

|

Bruno Tesniere |

PricewaterhouseCoopers |

Belgium |

|

Alan Teixeira |

University of Auckland |

New Zealand |

|

Jan Wentzel |

PricewaterhouseCoopers |

South Africa |

|

Charles Yeo |

Ernst and Young |

Singapore |

9. XBRL International Members

A current list of corporate members of XBRL International can be found at the www.xbrl.org web site.

10. Appendix – Naming Convention

10.1. Primary Components

Prefix Components

Prefix components are typically (but do not have to be) the first component in a composite element name.

Position Prefix Components

|

Component |

Component Label |

Rule |

|

ast |

asset |

Always first when expressing a numeric position value |

|

eqy |

equity |

|

|

lia |

liability |

|

|

lqy |

Equity or liability |

Performance Prefix Components

|

Component |

Component Label |

Rule |

|

exp |

expense |

Always first when expressing a numeric performance value |

|

inc |

income |

|

|

inx |

income or expense |

|

|

pls |

profit or loss |

Stand-alone Prefix Components

Stand-alone components are groupings in the taxonomy for other composites.

|

Component |

Component Label |

Rule |

|

bst |

balance sheet |

Stand-alone component. All are containers for groups of other composites |

|

cfs |

cash flow statement |

|

|

cne |

changes in net equity (statement of) |

|

|

ist |

income statement |

|

|

rgl |

recognized gains and losses (statement of) |

|

|

nds |

notes and disclosures |

General Prefix Components

|

Component |

Component Label |

Rule |

|

dcl |

disclosure |

Always first when used; can be used with any other elements |

|

cfl |

cash flow |

Always first when expressing a numeric item. |

|

chg |

change (change in) |

Applies to position elements and precedes position elements. Typically follows the [cfl] component. |

Suffix Components

Suffix components are typically (but do not have to be) the last component in a composite element name and are commonly exist with other suffix components.

Flow Suffix Components

|

Component |

Component Label |

Rule |

|

flw |

flow |

Typically the last component unless any “general suffix components” are present, in which case the flow components will precede any “general suffix components”. If one of these three suffix components is present in a composite name, neither of the other two will be present. |

|

ifl |

inflow |

|

|

ofl |

outflow |

General Suffix Components

|

Component |

Description |

|

|

end |

Label |

ending, conclusion |

|

Rule |

Last unless [net], [otr] or [xtl] are present, in which it precedes these |

|

|

Context |

Applies to amounts that represent an ending balance for a specific reporting period. Only position elements may contain the [end] component |

|

|

Example |

[ast.cce.end] = Cash and cash equivalents at end of period |

|

Component |

Description |

|

|

beg |

Label |

beginning, start |

|

Rule |

Last unless [net], [otr] or [xtl] are present, in which it precedes them. |

|

|

Context |

Applies to amounts that represent a beginning balance for a specific reporting period (e.g., from 2002-01-01 to 2002-12-31) versus the ending balance of another period (2001-12-31). Only position elements may contain the [beg] component. |

|

|

Example |

[eqy.rrv.beg.net] = Revaluation Reserves Beginning Balance (net) |

|

Component |

Description |

|

|

ttl |

Label |

total |

|

Rule |

Last unless [cur] or [otr] or both are present, in which it precedes either or both |

|

|

Context |

Used to express Y-axis totals in XBRL |

|

|

Example |

[ast.tor.rec.rel.ttl.cur] = Related Party Receivables, Net, Current |

|

Component |

Description |

|

|

adj |

Label |

adjustment, adjusting (event) |

|

|

Rule |

Typically follows [rsm] or [cim] |

|

|

Context |

1) Can represent capital maintenance adjustments (increases or decreases) to equity. Often used with [rvl] and [rsm] 2) Can represent a non-cash adjustment |

|

|

Example |

[cfl.ops.inx.adj] = Adjustments to Reconcile to Profit (Loss) From Operations |

|

Component |

Description |

|

|

otr |

Label |

other |

|

|

Rule |

Always last |

|

|

Context |

Represents any “other” designation. Only one [otr] per composite element name |

|

|

Example |

[cfl.ops.cdm.otr] = Other Cash Flows from (Used in) Operations” |

|

Key |

Component |

Component Label |

|

1 |

1qr |

1q |

|

2 |

2qr |

2q |

|

3 |

3qr |

3q |

|

4 |

4qr |

4q |

|

5 |

aar |

amount at risk |

|

6 |

aat |

allowed alternative treatment |

|

7 |

abp |

assets to be disposed |

|

8 |

abs |

alternative balance sheet totals |

|

9 |

abt |

asbestos treatment |

|

10 |

aca |

agricultural activity |

|

11 |

acc |

Accumulated |

|

12 |

ace |

accrued expenses |

|

13 |

acf |

accounted for/ accounting for |

|

14 |

ach |

accounting change |

|

15 |

aco |

acquired company |

|

16 |

acp |

accounts payable |

|

17 |

acq |

acquisition/ acquired |

|

18 |

acr |

accrue/ accrued/ accrual |

|

19 |

acs |

administrative cost |

|

20 |

act |

actuarial |

|

21 |

add |

addition/ additional |

|

22 |

ade |

Addressee |

|

23 |

adj |

adjustment, adjusting (event) |

|

24 |

adm |

advertisements/ advertising |

|

25 |

ado |

Adoption |

|

26 |

ads |

Address |

|

27 |

adt |

Advertising |

|

28 |

adv |

Advance |

|

29 |

aet |

Services of employees terminated |

|

30 |

afl |

Affiliate(s) |

|

31 |

afs |

Available for sale (financial asset) |

|

32 |

agg |

Aggregate |

|

33 |

agp |

Agricultural produce |

|

34 |

agr |

Agreements |

|

35 |

ahu |

Asset held and used |

|

36 |

aif |

Accountant information |

|

37 |

ail |

Aaccumulated impairment loss |

|

38 |

ale |

Assets, liabilities and equity |

|

39 |

all |

Allowance for loan losses |

|

40 |

alt |

Alternative |

|

41 |

alw |

Allowance |

|

42 |

amk |

Active market (for trading assets) |

|

43 |

amo |

Amortization |

|

44 |

amt |

Amount |

|

45 |

amz |

Amortized/ amortizable |

|

46 |

aol |

Asset or liability |

|

47 |

aos |

Acquisition of own stock/ share |

|

48 |

apc |

Additional paid-in capital |

|

49 |

apd |

Applied |

|

50 |

apl |

Accumulated profit or loss |

|

51 |

app |

Appropriated |

|

52 |

aps |

Amount per share |

|

53 |

apy |

Accounting policy/ principle |

|

54 |

aqr |

Available for sale movements to equity reserves |

|

55 |

arc |

Accounts receivable |

|

56 |

ard |

Acquired in-process research and development |

|

57 |

arg |

Arrangements |

|

58 |

arp |

Audit report |

|

59 |

arr |

In arrears |

|

60 |

art |

artisitic |

|

61 |

asc |

associate |

|

62 |

asd |

accounting standards |

|

63 |

asg |

assigned [to] |

|

64 |

asm |

assessments |

|

65 |

asr |

asset retirement |

|

66 |

ass |

assumed/ assumptions |

|

67 |

ast |

asset |

|

68 |

atp |

anticipate/ anticipated |

|

69 |

ats |

applicable/ attributable to common stockholders |

|

70 |

att |

accountant's report |

|

71 |

atx |

after tax |

|

72 |

aty |

activity; activities |

|

73 |

aul |

allowance for uncollectible lease payments |

|

74 |

avo |

average over |

|

75 |

avs |

adverse |

|

76 |

bas |

basis of; basis used to |

|

77 |

bat |

ending accumulated balances of all type |

|

78 |

bbl |

bank balances |

|

79 |

bcs |

borrowing cost |

|

80 |

bcw |

before changes in working capital |

|

81 |

bec |

billings in excess of cost |

|

82 |

bef |

before |

|

83 |

beg |

beginning, start |

|

84 |

bel |

basic earnings (loss) per share |

|

85 |

bet |

ending accumulated balances of each type |

|

86 |

bia |

biological asset |

|

87 |

blg |

building |

|

88 |

bmt |

benchmark treatment |

|

89 |

bnd |

bonds |

|

90 |

bnk |

bank |

|

91 |

bns |

bonus shares |

|

92 |

bod |

bank overdrafts |

|

93 |

boe |

breakdown of ordinary and extraordinary net profit |

|

94 |

bon |

bonus |

|

95 |

bps |

basic earnings per share |

|

96 |

brc |

bankruptcy.code |

|

97 |

brw |

borrowing(s) |

|

98 |

bsg |

business segment |

|

99 |

bso |

balance sheet classification based on operating cycle |

|

100 |

bst |

balance sheet |

|

101 |

btx |

before tax, pre-tax |

|

102 |

bus |

business |

|

103 |

bzc |

business combinations |

|

104 |

bzd |

business divestiture |

|

105 |

caa |

ias compliance and adoption |

|

106 |

cad |

customer advances or deposits |

|

107 |

cae |

change in accounting estimate |

|

108 |

cal |

charged against liability |

|

109 |

can |

cancellation |

|

110 |

cap |

change in accounting policy/ principle |

|

111 |

cas |

contingent asset |

|

112 |

cbd |

cannot be determined |

|

113 |

cbo |

contributions by owners |

|

114 |

cbp |

cannot be provided |

|

115 |

cce |

cash and cash equivalents |

|

116 |

ccm |

claims subject to compromise |

|

117 |

ccp |

concepts |

|

118 |

ccr |

concentration of credit risk |

|

119 |

ccs |

current service cost (of defined benefit obligation) |

|

120 |

cda |

changes in and disagreements with accountants |

|

121 |

cdl |

credit losses |

|

122 |

cdm |

cash flow reconciliation for operating activities, direct method |

|

123 |

cdt |

credit |

|

124 |

cdv |

cash dividend |

|

125 |

ceq |

cash equivalents |

|

126 |

cer |

certain |

|

127 |

ces |

cash cash equivalents and short term investments |

|

128 |

cfh |

cash flow hedge/ hedging |

|

129 |

cfi |

compound financial instrument |

|

130 |

cfl |

cash flow |

|

131 |

cfs |

cash flow statement |

|

132 |

cgs |

cost of goods sold |

|

133 |

cha |

charges |

|

134 |

chg |

change, change in |

|

135 |

chi |

comprehensive income |

|

136 |

chr |

characteristics/ features |

|

137 |

cim |

cash flow reconciliation for operating activities, indirect method |

|

138 |

cip |

construction in progress |

|

139 |

cit |

city |

|

140 |

cla |

capital leased assets |

|

141 |

clc |

compliance |

|

142 |

cli |

contingent liability |

|

143 |

clm |

claim |

|

144 |

clo |

call option |

|

145 |

cls |

class, classification, category |

|

146 |

cma |

Compensated Absences |

|

147 |

cmm |

commitments |

|

148 |

cmp |

commercial paper |

|

149 |

cms |

common (ordinary) stock/ share |

|

150 |

cmy |

commodity |

|

151 |

cne |

changes in net equity (statement of) |

|

152 |

cnt |

control (corporate governance) |

|

153 |

cnv |

converted, convertible, conversion |

|

154 |

cob |

constructive obligation |

|

155 |

col |

collateralize (pledge as security) |

|

156 |

com |

compensation |

|

157 |

con |

consolidated/ consolidation+c865 |

|

158 |

cop |

comparable/ comparability |

|

159 |

cor |

contract receivables |

|

160 |

cos |

cost of sales |

|

161 |

cot |

contractor |

|

162 |

cpa |

comparative |

|

163 |

cpc |

cost plus [construction] contract |

|

164 |

cpe |

complete |

|

165 |

cpl |

capital reserves |

|

166 |

cpo |

component |

|

167 |

cpr |

compliance report |

|

168 |

cps |

common (ordinary) earnings per share |

|

169 |

cpt |

capital |

|

170 |

cpu |

computer |

|

171 |

cpy |

copyrights |

|

172 |

cpz |

capitalized (capitilization of) |

|

173 |

cro |

creditor |

|

174 |

crr |

capital redemption reserves |

|

175 |

cry |

currency |

|

176 |

csc |

construction contract |

|

177 |

csh |

cash |

|

178 |

csm |

cost method (accounting for investments) |

|

179 |

csn |

consideration |

|

180 |

csp |

consolidation principles |

|

181 |

css |

cost of services sold |

|

182 |

cst |

cost |

|

183 |

csv |

cash surrender value |

|

184 |

csw |

computer software |

|

185 |

cta |

current tax asset |

|

186 |

cta |

contract accounting |

|

187 |

ctg |

contingency |

|

188 |

ctl |

current tax liability |

|

189 |

cto |

continuing operation |

|

190 |

ctr |

contracts or contractual rights |

|

191 |

cty |

country |

|

192 |

cul |

customer lists |

|

193 |

cum |

cumulative/ cumulative effect |

|

194 |

cur |

current |

|

195 |

cus |

customer |

|

196 |

cwc |

changes in working capital |

|

197 |

cya |

carrying amount |

|

198 |

cyf |

carryforwards |

|

199 |

daa |

depreciation and amortization |

|

200 |

dat |

date |

|

201 |

dbl |

debt related |

|

202 |

dbo |

distributions to owners |

|

203 |

dbp |

defined [employee] benefit plan |

|

204 |

dbt |

debenture |

|

205 |

dcl |

disclosure |

|

206 |

dcm |

disclaimer |

|

207 |

dcn |

discontinue/ discontinuance |

|

208 |

dcp |

defined [employee] contribution plan |

|

209 |

dcr |

decrease |

|

210 |

ddp |

details of departures from ias |

|

211 |

deb |

debt |

|

212 |

def |

deferred |

|

213 |

del |

diluted earnings (loss) per share |

|

214 |

dep |

depreciation |

|

215 |

des |

debt and equity securities |

|

216 |

det |

debt extinguishment |

|

217 |

dev |

development |

|

218 |

dfd |

deferred debt |

|

219 |

dfg |

departure from gaap |

|

220 |

dfi |

derivative [financial] instrument |

|

221 |

dfm |

deferred items |

|

222 |

dfn |

debt forgiveness |

|

223 |

dft |

definition |

|

224 |

dic |

deferred income |

|

225 |

dif |

different |

|

226 |

din |

debt instrument |

|

227 |

dis |

discount |

|

228 |

dlc |

divisions/ lesser components |

|

229 |

dld |

dual date |

|

230 |

dlo |

debt and capital lease obligations |

|

231 |

dmc |

domicile |

|

232 |

dmp |

determinable portion |

|

233 |

dmt |

depreciable amount (of an asset) |

|

234 |

dom |

domestic |

|

235 |

dor |

debtor |

|

236 |

dpr |

depreciation rate |

|

237 |

dps |

diluted earnings per share |

|

238 |

dpt |

deposits |

|

239 |

drl |

direct labor |

|

240 |

drm |

direct materials |

|

241 |

drt |

discount rate/ discounted rate |

|

242 |

drv |

derivative |

|

243 |

dsb |

distribution |

|

244 |

dsc |

description |

|

245 |

dsg |

design |

|

246 |

dsp |

disposal |

|

247 |

dta |

deferred tax asset |

|

248 |

dtd |

deductible temporary [tax] difference |

|

249 |

dte |

debt to equity |

|

250 |

dtl |

deferred tax liability |

|

251 |

dto |

discontinuing/ discontinued operation |

|

252 |

dts |

details |

|

253 |

duf |

due from |

|

254 |

dut |

due to |

|

255 |

dvc |

development stage companies |

|

256 |

dvd |

dividend |

|

257 |

dvs |

dividends per share |

|

258 |

ebd |

event after the balance sheet date |

|

259 |

ebf |

employee benefit |

|

260 |

ebp |

employee benefit plan |

|

261 |

ecd |

economic dependence |

|

262 |

eco |

emerged company |

|

263 |

ecp |

equity compensation plan |

|

264 |

ecy |

executory |

|

265 |

edo |

excluding discontinued operations |

|

266 |

eep |

effects of equity instruments being issued or received from partners |

|

267 |

ees |

effect on earnings per share if fas 123 applied |

|

268 |

eff |

effective |

|

269 |

eim |

effective interest method |

|

270 |

eit |

exit |

|

271 |

emb |

embedded (derivative) |

|

272 |

emp |

employee |

|

273 |

end |

ending, conclusion |

|

274 |

eni |

effect on net income if fas 123 applied |

|

275 |

enr |

environmental |

|

276 |

env |

environmental liability |

|

277 |

eob |

expense/ benefit |

|

278 |

eoo |

effect on operations |

|

279 |

epa |

exit plan action |

|

280 |

epc |

exercise price |

|

281 |

epe |

expose/ exposure |

|

282 |

epl |

explanatory |

|

283 |

epr |

expire/ expiration |

|

284 |

eps |

earnings per share |

|

285 |

ept |

expect/ expected |

|

286 |

eqb |

equity compensation benefit |

|

287 |

eqi |

equity [financial] instrument |

|

288 |

eqm |

equity method (accounting for investments) |

|

289 |

eqp |

equipment |

|

290 |

eqy |

equity |

|

291 |

erf |

expected to be refinanced |

|

292 |

erl |

employee related liabilities |

|

293 |

erp |

employer repurchase |

|

294 |

ers |

equity reserves |

|

295 |

esb |

esop benefit |

|

296 |

eso |

employee stock ownership plan |

|

297 |

esp |

employee stock purchase plan |

|

298 |

est |

estimate/ estimated |

|

299 |

etd |

equity to debt |

|

300 |

etl |

equity to liability |

|

301 |

etn |

external |

|

302 |

etr |

effective income tax rate |

|

303 |

ett |

employees to be terminated |

|

304 |

eur |

euro |

|

305 |

evr |

environmental remediation |

|

306 |

evt |

event (and circumstances) |

|

307 |

exc |

exclude/ excluding |

|

308 |

exe |

exercise/ exercisable |

|

309 |

exi |

extraordinary item |

|

310 |

exp |

expense |

|

311 |

exr |

exchange rate (currency) |

|

312 |

ext |

extended component (future use) |

|

313 |

exy |

extraordinary |

|

314 |

fas |

financial assistance |

|

315 |

fcr |

franchise rights |

|

316 |

fcs |

finance cost |

|

317 |

fct |

foreign currency translation |

|

318 |

fde |

fundamental error |

|

319 |

fdt |

federal tax |

|

320 |

fed |

federal |

|

321 |

fee |

fees |

|

322 |

fgn |

foreign |

|

323 |

fia |

financial asset |

|

324 |

fil |

financial liability |

|

325 |

fin |

financial instrument |

|

326 |

fip |

financial impact |

|

327 |

fir |

finance receivables |

|

328 |

fix |

fixtures |

|

329 |

fli |

financial liability instrument |

|

330 |

flr |

failure |

|

331 |

fls |

finance (capital) lease |

|

332 |

flw |

flow (inflow or outflow) |

|

333 |

fma |

formula |

|

334 |

fna |

financing activity |

|

335 |

fnd |

financial data |

|

336 |

fng |

finished goods |

|

337 |

fnl |

financial accounting concepts |

|

338 |

fnr |

finance revenue |

|

339 |

fop |

foreign operation |

|

340 |

fpc |

fixed price [construction] contract |

|

341 |

fps |

fair presentation |

|

342 |

frm |

financial risk managemetn |

|

343 |

frt |

foreign tax |

|

344 |

frv |

financial review |

|

345 |

fsp |

funded status of the plan |

|

346 |

fst |

financial statement |

|

347 |

fsy |

fiscal year |

|

348 |

fta |

first time application |

|

349 |

ftc |

future contracts |

|

350 |

ftg |

fittings |

|

351 |

fun |

function |

|

352 |

fur |

furniture |

|

353 |

fut |

future |

|

354 |

fvh |

fair value hedge/ hedging |

|

355 |

fvl |

fair value |

|

356 |

fwc |

forward contracts |

|

357 |

fxm |

foreign exchange movement |

|

358 |

fxr |

foreign exchange translation reserve |

|

359 |

fyr |

five year |

|

360 |

gaa |

general and administrative |

|

361 |

gai |

gain |

|

362 |

gas |

goods and services |

|

363 |

gcn |

going concern |

|

364 |

gds |

goods |

|

365 |

gdw |

goodwill |

|

366 |

gen |

general |

|

367 |

gep |

group enterprises |

|

368 |

ggc |

geographic concentration |

|

369 |

ggr |

government grant |

|

370 |

gle |

gain(s) and loss(es) recognized in equity |

|

371 |

gln |

gains (losses) not recognised in income |

|

372 |

gol |

gain or loss |

|

373 |

gpt |

gross profit |

|

374 |

gro |

gross |

|

375 |

gsg |

geographical (business) segment |

|

376 |

gtp |

guarantee of debt for third parties [others] |

|

377 |

gur |

guaranteed |

|

378 |

gvi |

government investigations |

|

379 |

hdg |

hedge |

|

380 |

hfd |

held for trading |

|

381 |

hfi |

hedging [financial] instrument |

|

382 |

hfs |

held for sale |

|

383 |

hgh |

high/ highly |

|

384 |

hgl |

hedging gain/loss |

|

385 |

hgr |

hedging reserve |

|

386 |

hie |

hedge ineffectiveness |

|

387 |

hlc |

health care |

|

388 |

hlg |

holding |

|

389 |

hnf |

hedged commitment no longer qualifies as fair value hedge |

|

390 |

hrv |

harvest (of biological asset) |

|

391 |

hsc |

historical cost |

|

392 |

htm |

held-to-maturity [financial asset] |

|

393 |

hyp |

hyperinflationary |

|

394 |

ibr |

interest bearing |

|

395 |

ica |

internally constructed (generated) asset |

|

396 |

ico |

incorporation |

|

397 |

icp |

ias common practice(s) |

|

398 |

icr |

increase |

|

399 |

ido |

including discontinued operations |

|

400 |

ids |

initial disclosure |

|

401 |

ifh |

ineffective hedging |

|

402 |

ifl |

inflow |

|

403 |

ifn |

inflation |

|

404 |

ifp |

interim financial report (statement) |

|

405 |

iic |

impact of 1% increase of health cost rate on retirement benefit obligation |

|

406 |

iid |

impact of 1% decrease of health cost rate on retirement benefit obligation |

|

407 |

imp |

impairment/ impaired |

|

408 |

inc |

income |

|

409 |

ind |

individual |

|

410 |

ine |

income and expenses |

|

411 |

inf |

information |

|

412 |

inr |

interest rate |

|

413 |

ins |

insurance |

|

414 |

int |

intangible asset |

|

415 |

inv |

inventory |

|

416 |

inx |

income or expense |

|

417 |

iod |

impairment or disposal |

|

418 |

ipc |

immediately preceeding |

|

419 |

ipd |

interim financial reporting period |

|

420 |

ipl |

impairment loss |

|

421 |

ipo |

initial public offering |

|

422 |

ipt |

impact |

|

423 |

ipv |

improvements |

|

424 |

irm |

interim |

|

425 |

isc |

issued capital |

|

426 |

iss |

issuance/ issue |

|

427 |

ist |

income statement |

|

428 |

itl |

interest and dividends on loans to, other debt of, and equity of other entities |

|

429 |

itr |

income taxes receivable |

|

430 |

its |

interest in a subsidiary |

|

431 |

itt |

interest |

|

432 |

ity |

introductory |

|

433 |

iva |

investing activity |

|

434 |

ive |

investee |

|