1. Overview

1.1. Purpose

The International Accounting Standards Committee Foundation (IASC Foundation) and XBRL International (http://www.xbrl.org) are leading the development of this eXtensible Business Reporting Language (XBRL) Primary Financial Statements (EDAP) Taxonomy for the purpose of expressing financial statements according to the International Accounting Standards Board’s International Accounting Standards (IAS) and forthcoming International Financial Reporting Standards (IFRS) (http://www.iasb.org.uk) .

This Explanatory Disclosures and Accounting Policies (EDAP) Taxonomy is designed to facilitate the creation of XBRL instance documents that reflect business and financial reporting for Commercial and Industrial companies according to the International Accounting Standards Board’s (http://www.iasb.org.uk) IAS Generally Accepted Accounting Principles. The purpose of the EDAP Taxonomy, along with the Primary Financial Statements (PFS) Taxonomy is to provide a framework for the consistent creation of XBRL documents for financial reporting purposes by private sector and certain public sector entities. The purpose of this and other taxonomies produced using XBRL is to supply a framework that will facilitate data exchange among software applications used by companies and individuals as well as other financial information stakeholders, such as lenders, investors, auditors, attorneys, and regulators.

The authority for this EDAP Taxonomy is based upon the International Accounting Standards Board’s (http://www.iasb.org.uk) International Accounting Standards (“IAS”) and Statements of Interpretation (“SIC”) effective 01 January 2002 (http://www.iasplus.com/standard/standard.htm) and from best practice. As this Taxonomy primarily addresses the reporting considerations of Commercial and Industrial companies, IAS 26 and IAS 30 disclosure requirements are not represented in the Taxonomy’s content.

The particular disclosures in this EDAP Taxonomy models are:

1. Required by particular IASs

2. Typically represented in IAS model financial statements, checklists and guidance materials as provided from each of the major international accounting firms.

3. Found in common reporting practice, or

4. Flow logically from items 1-3, for example, sub-totals and totals.

This EDAP Taxonomy is in compliance with XBRL Specification Version 2.0, dated 2001-12-14 (http://www.xbrl.org/tr/2001/).

1.2. Taxonomy Status

The Taxonomy is an Internal Working Draft. Its content and structure have been reviewed both accounting and technical teams of the IASCF(http://www.iascf.com) and the IAS Taxonomy Development Working Group. The Draft is now open to comment from throughout the XBRL community. The XBRL element names should be considered complete and stable within the domain of the Taxonomy. Conversely, the XBRL labels, linkbases and references are subject to change. Changes may occur to any of this XBRL data.

The following is a summary of meanings of the status of taxonomies:

- Internal Working Draft – Internal Working Draft version of a taxonomy exposed to XBRL.ORG members for internal review and testing. An Internal Working Draft is subject to significant changes as initial testing undertaken. Its structure may not be stable and its content may not be complete.

- Working Draft – Working Draft version of a taxonomy exposed to public for review and testing. A Working Draft has been tested and its structure is unlikely to change although its contents may still change as the result of broader testing.

- Recommendation – Final version of taxonomy, released for use by the public.

1.3. Scope of Taxonomy

This Explanatory Disclosures and Accounting Policies (EDAP) Taxonomy is released in tandem with the XBRL Global Common Document (GCD) Taxonomy and the Primary Financial Statements (PFS) Taxonomy. The GCD Taxonomy incorporates elements that are common to the great majority of XBRL instance documents, regardless of type. The GCD Taxonomy has elements that describe the XBRL instance document itself and the entity to which the instance document relates. The PFS Taxonomy encompasses the core financial statements that private sector and certain public sector entities report typically in annual, semi-annual or quarterly financial disclosures.

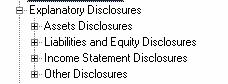

The EDAP Taxonomy has elements that provide enhanced disclosure over and above the disclosures made in the primary financial statements. These disclosures are, in the context of annual financial statements, typically made in the notes to the financial statements. The EDAP taxonomy also provides elements to identify the accounting policies adopted by the reporting entity. Elements in this EDAP taxonomy include:

- Accounting Policies

- Explanatory Disclosures to the Financial Statements

- Auditor’s Report

- Management Commentary

Taken together, these three taxonomies will meet the reporting needs of companies that meet three criteria, viz (i) they reporting under International Accounting Standards (IASs), (ii) are in the broad category of “commercial and industrial” industries and (iii) have relatively common reporting elements in their financial statements. In practice, these three criteria are unlikely to hold for any company. Additional taxonomies are likely to be required. These taxonomies are likely to identify the particular needs of:

- International industries, for example, airlines, pharmaceuticals or agribusiness.

- National jurisdictions for those companies that adopt the IASB’s IASs as the core financial standards setting foundation and may include supplementary reporting requirements or prevent use of available options by local accounting standards setters as well as stock exchanges etc.

- National industry or common practice, for example, agriculture or credit reporting.

- An individual company

These extension taxonomies will either extend the GCD, PFS and EDAP taxonomies to meet the particular reporting requirements of that industry, country or company and/or restrict the use of particular by limiting the use of particular PFS or EDAP taxonomy elements.

The inter-relationships of the various taxonomies are show in Figure 1:

Figure 1: Interrelationship of Taxonomies and Instance Document

Validates

At the date of release of this document no other taxonomy had been formally released, but extension taxonomies are under development for the some national jurisdictions such as Australia.

1.4. Relationship to Other Work

XBRL utilizes the World Wide Web consortium (W3C www.w3.org ) recommendations, specifically:

- XML 1.0 (http://www.w3.org/TR/2000/REC-xml-20001006)

- XML Namespaces (http://www.w3.org/TR/1999/REC-xml-names-19990114/)

- XML Schema 1.0 (http://www.w3.org/TR/xmlschema-1/ and http://www.w3.org/TR/xmlschema-2/), and

- XLink 1.0 (http://www.w3.org/TR/xlink/).

2. Overview of Taxonomy

The following is an overview of the taxonomy. It is assumed that the reader is familiar with financial and business reporting and has a basic understanding of XBRL.

2.1. Contents of the Taxonomy

This EDAP Taxonomy makes available to users the disclosures of financial and other performance information and accounting policies under the IASB’s IAS Standards.

The EDAP Taxonomy is made up of a “package” of interrelated XML files:

- XML Schema File (.XSD file): An XBRL Version 2.0 Taxonomy XML Schema file.

- XBRL Linkbases (.XML files): “Linkbases” for:

- Labels

- References

- Presentation information

- Calculation relationships between elements, and

- Definitional relationships between elements.

2.2. Taxonomy Structure

The EDAP Taxonomy contains more than 2,000 elements or unique, individually identified pieces of information. The XML schema file at the heart of the taxonomy package provides a straightforward listing of the elements in the taxonomy. The linkbases provide the other information necessary to interpret (e.g. Label and Definition linkbases) taxonomy elements or place a given taxonomy element in context of other taxonomy elements (e.g. Calculation and Presentation linkbases).

Given that information on the Taxonomy is included in XML schema and linkbase files, it is best rendered for human interpretation in a “paper” paradigm. Users are encouraged to review versions of the taxonomy elements in Adobe Acrobat (PDF) (http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.pdf) or Excel http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15-elements.xls formats.

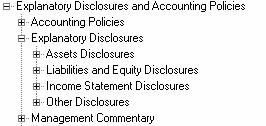

The EDAP Taxonomy has three major components, as shown in Figure 2:

Figure 2: Structure of the EDAP Taxonomy

Financial Statements disclosures typically incorporate qualitative disclosures on accounting policies (see Section 3.2 Accounting Policies) and mixed quantitative and qualitative disclosures on financial statements that expand and explain the disclosures made in the Primary Financial Statements (PFS) Taxonomy (see Section 3.3 Enhanced Disclosures).

The Management Commentary provides the typical disclosures made in the Management Discussion and Analysis (MD&A) as it is named in the USA or its equivalently named section of the financial statements made in other jurisdictions (see Section 3.4 Management Commentary).

2.3. Element Naming Convention

XBRL naming conventions follows that of XML Schema. Each name within a taxonomy must be unique and must start with an alpha character or the underscore character. Element names are case-sensitive. Therefore, “myelement”, “MyElement” and “MYELEMENT” can all exist within the same taxonomy because they are considered unique. The PFS Taxonomy naming convention follows these rules. In particular, element names should not be interpreted as containing a reliably “hierarchical” structure, or as indicating relationships with other elements. Taxonomy structure is only expressed in the XBRL linkbases.

A PFS Taxonomy XBRL “element name” is called a composite element name. A composite element is comprised of IASC Foundation “components”. Each component represents an IAS concept, definition or best practice, etc. Each component is three characters in length and each three-character component is cross referenced (in a separate file) with the concept it represents. Combining multiple components yields a composite element name. For example, “ast” and “inv” abbreviate, in English, “asset” and “inventory” respectively. Combining the two components produces the composite element “ast.inv”. For further details of the naming convention, see Section 5 - Naming Convention and the Appendix.

2.4. Label Languages

Currently, labels for taxonomy elements are provided in English. In the future, taxonomy labels will be expressed in additional languages.

2.5. References

This Taxonomy provides references to IAS standards. Figure 3 shows the reference elements are used in this taxonomy, using “IAS 1, para 5.6(i)” to illustrate how a reference is matched to these elements:

Figure 3: Reference Naming Structure

|

Name: |

IAS |

|

Number: |

1 |

|

Paragraph: |

5 |

|

Subparagraph: |

6 |

|

Clause: |

i |

2.6. Element Documentation

Many elements use the XML Schema Documentation fields to provide additional information that users may find useful, including the following four descriptors that identify the element and its position in the taxonomy:

- IAS Mandatory – compulsory disclosure items

- IAS Recommended – IAS recommended or discretionary disclosure items

- IAS Common Practice – line items “expected” to be found in financial statements

- Balancing Item – non-mandatory, but otherwise essential line items e.g. subtotals

2.7. Further Documentation Available

The intent of this document is to explain the Taxonomy. This document assumes a general understanding of accounting and XBRL. If the reader desires additional information relating to XBRL, the XBRL International web site (http://www.xbrl.org) is recommended. Specifically, a reading of the XBRL Specification Version 2.0 is highly recommended (http://www.xbrl.org/tr/2001/). The purpose of this document is to explain how XBRL is being applied in this specific case, for this taxonomy.

The following documentation is available to assist those wishing to understand and use this taxonomy. This documentation is available on the XBRL International web site (http://www.xbrl.org):

These Explanatory Notes:

This overview document describing objectives of the IASC Foundation, XBRL International IAS Working Party and the Taxonomy:

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15.htm (HTML Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15.doc (Word Format)

Taxonomy Elements:

This is a summary listing of taxonomy elements in a human readable format for the purpose of obtaining an overview of this taxonomy.

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-elements.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-elements.xls (Excel Format)

The explanatory documents for the Primary Financial Statements (PFS) Taxonomy elaborate a number of concepts that are relevant for this EDAP Taxonomy. The Explanatory documentation for the PFS Taxonomy is at:

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.htm (HTML Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.pdf (PDF Format)

http://www.xbrl.org/taxonomy/int/iascf/ci/pfs/2002-09-15/iascf-ci-pfs-2002-09-15.doc (Word Format)

Taxonomy Package

These documents correspond to a set of interrelated files comprising an XBRL taxonomy package:

- XML Schema File (.XSD file): An XBRL Version 2.0 Taxonomy XML Schema file.

- XBRL Linkbases (.XML files): Linkbases for

- References

- Labels

- Presentation

- Calculations, and

- Definitions.

These files are located as follows:

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15.xsd (Schema)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-references.xml (References linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-labels.xml (Labels linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-presentation.xml (Presentation linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-calculation.xml (Calculation linkbase)

http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-definition.xml (Definition linkbase)

3. Items to Note in Using the Taxonomy

3.1. Introduction

The following explanation of the taxonomy, the taxonomies with which this EDAP Taxonomy is designed to interoperate, and examples of how to interpret the EDAP Taxonomy are provided to make the EDAP Taxonomy easier to use. Please refer to the detailed printout of the EDAP Taxonomy as you go through this explanation (http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-elements.pdf). This explanatory document is designed to provide an overview of the EDAP Taxonomy to be a brief and concise overview. We expect that the XBRL community will create courses, books and other materials to provide a through explanation of every aspect of using the EDAP Taxonomy and other cognate taxonomies.

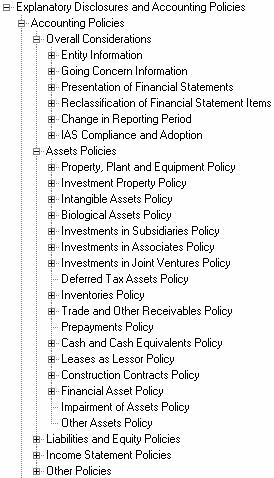

3.2. Accounting Policies

The Accounting Policies section of the EDAP taxonomy is designed to provide pointers to appropriate constituents of accounting policies adopted by entity. This disclosure is typically made in the first note to the financial statements. The elements of the Accounting Policies section of the EDAP taxonomy is shown in Figure 4:

Figure 4: Structure of Accounting Policies

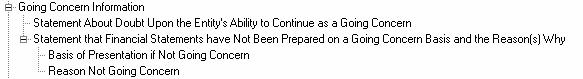

Within each of these major sections are a variety of elements that meet the particular reporting requirements of corporations and the IAS standards. For example, the element the element apy.ocn.inf.gcn represent firms’ accounting policies of its going concern status (“Going Concern Information” ID 14 on Page 1 of http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15-elements.pdf). There are four other elements that relate to this element, as shown in Figure 5.

Figure 5: Going Concern Disclosures

These four elements draw their authority from the following section of IAS 1:

23. The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Hence, it is assumed that the enterprise has neither the intention nor the need to liquidate or curtail materially the scale of its operations; if such an intention or need exists, the financial statements may have to be prepared on a different basis and, if so, the basis used is disclosed.

3.3. Enhanced Disclosures

The Explanatory Disclosures are modeled on the structure found in the PFS Taxonomy. The major elements of the Enhanced Disclosures are shown in Figure 6:

Figure 6: Enhanced Disclosures

In financial statements, a number of elements may be find either in the core financial statements or in explanatory notes. For example, details of inventories, such as “Raw Materials” or “Inventories” may be included on the Balance Sheet or in an Inventory note to the financial statements. Each reporting elements that could be either in the notes or in the primary financial statements are included in the Primary Financial Statement (PFS) taxonomy. The only reporting elements included in this EDAP taxonomy are those elements that enhance meaning of financial statement.

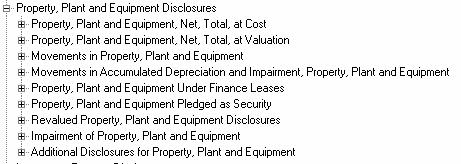

For each element in the Balance Sheet component of the Financial Statement Enhanced Disclosures, there is a relatively consistent structure that determines the closing balance of the asset or liability. This structure is illustrated in Figure 7. Whilst this general pattern holds, there are differences between classes of assets or liabilities that arise from the particular disclosure requirements of the IASs and/or from the essential nature of the item. For example, the disclosures for Investment Properties are necessarily somewhat different from those of Property, Plant and Equipment.

Figure 7: Structure of Changes in Assets or Liabilities

The makeup of Property, Plant and Equipment is shown in Figure 8:

Figure 8: Makeup of Property, Plant and Equipment

In addition, the nature of enhanced disclosures vary with the nature of assets or liabilities. Required disclosures on Deferred Tax are, for example, driven by the particular requirements of IAS 12.

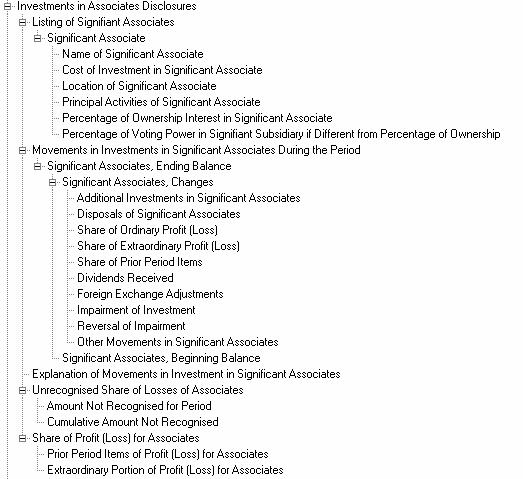

Certain classes of assets require additional disclosures beyond the details of movements. For example, a corporation may have an asset “Investments in Associates.” IAS 28 requires a number of additional disclosures that further explain these investments and particularly the changes in investments over the accounting period. These additional disclosures are covered by the elements shown in Figure 9:

Figure 9: Additional Disclosures on Investments in Associates.

The “Significant Associate” (dis.ass.sig.asc) is a tuple that contains required disclosures on each significant associate, including name (dis.ass.nam.sig.asc), cost (dis.ass.cst.ivm.sig.asc), location (dis.ass.loc.sig.asc), significant (dis.ass.pri.act.sig.asc), percentage of ownership (dis.ass.per.own.itt.sig.asc) and “Percentage of Voting Power in Signifiant Subsidiary if Different from Percentage of Ownership” (dis.ass.per.vot.pow.sig.sub.dif.per.own). These elements will be repeated for each associate.

By contrast, the section “Movements in Investments in Significant Associates During the Period” provides the closing balance of all investments in significant associates (dis.ass.sig.ass.end.bal “Significant Associates, Ending Balance”). The opening balance of the significant associates (dis.ass.sig.ass.beg.bal “Significant Associates, Beginning Balance”) and the various changes (e.g. dis.ass.shr.ord.pro.los “Share of Ordinary Profit (Loss)”; dis.ass.div.rec “Dividends Received” and dis.ass.imp.ivm “Impairment of Investment”).

The enhanced disclosures on the Income Statement component of the taxonomy provide both descriptive, qualitative disclosures which explain the primary disclosures made in the PFS Taxonomy as well provide additional quantitative disclosures to supplement the disclosures made in that taxonomy.

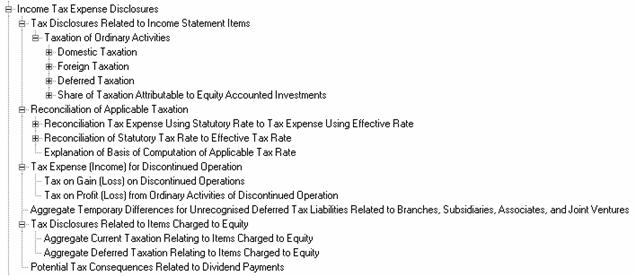

For example, the disclosures required by IAS 12 on income taxation are primarly additional quantitative disclosures to supplement the disclosure of income taxation in the PFS taxonomy, as shown in Figure 10:

Figure 10: Disclosures on Revenue

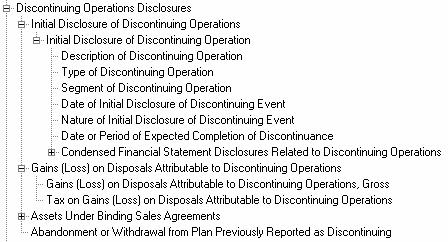

Similarly the disclosures relating to Discontinuing Operations primarily provide enhanced explanatory disclosures which supplement the Primary Financial Statements, as shown in Figure 11:

Figure 11: Discontinuing Operations Disclosures

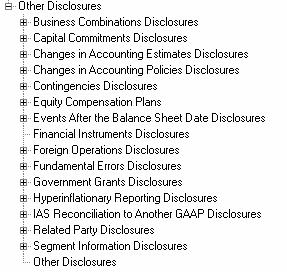

There are a variety of Other Disclosures, as shown in Figure 12:

Figure 12: Other Disclosures

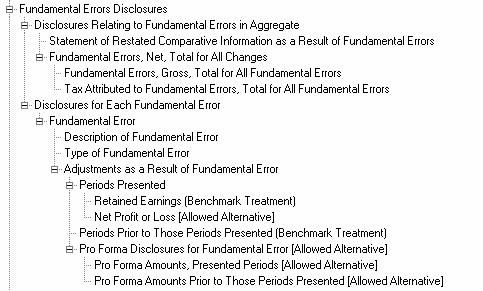

For example, IAS 8 requires a variety of disclosures on fundamental errors in the financial statements. The benchmark treatment of fundamental errors is shown in paragraphs 34 to 37 of IAS 8, reproduced below:

Benchmark Treatment

34. The amount of the correction of a fundamental error that relates to prior periods should be reported by adjusting the opening balance of retained earnings. Comparative information should be restated, unless it is impracticable to do so.

35. The financial statements, including the comparative information for prior periods, are presented as if the fundamental error had been corrected in the period in which it was made. Therefore, the amount of the correction that relates to each period presented is included within the net profit or loss for that period. The amount of the correction relating to periods prior to those included in the comparative information in the financial statements is adjusted against the opening balance of retained earnings in the earliest period presented. Any other information reported with respect to prior periods, such as historical summaries of financial data, is also restated.

36. The restatement of comparative information does not necessarily give rise to the amendment of financial statements which have been approved by shareholders or registered or filed with regulatory authorities. However, national laws may require the amendment of such financial statements.

37. An enterprise should disclose the following:

(a) the nature of the fundamental error;

(b) the amount of the correction for the current period and for each prior period presented;

(c) the amount of the correction relating to periods prior to those included in the comparative information; and

(d) the fact that comparative information has been restated or that it is impracticable to do so.

The standard also allows an alternative treatment, as shown in Paragraphs 38-40:

Allowed Alternative Treatment

38. The amount of the correction of a fundamental error should be included in the determination of net profit or loss for the current period. Comparative information should be presented as reported in the financial statements of the prior period. Additional pro forma information, prepared in accordance with paragraph 34, should be presented unless it is impracticable to do so.

39. The correction of the fundamental error is included in the determination of the net profit or loss for the current period. However, additional information is presented, often as separate columns, to show the net profit or loss of the current period and any prior periods presented as if the fundamental error had been corrected in the period when it was made. It may be necessary to apply this accounting treatment in countries where the financial statements are required to include comparative information which agrees with the financial statements presented in prior periods.

40. An enterprise should disclose the following:

(a) the nature of the fundamental error;

(b) the amount of the correction recognised in net profit or loss for the current period; and

(c) the amount of the correction included in each period for which pro forma information is presented and the amount of the correction relating to periods prior to those included in the pro forma information. If it is impracticable to present pro forma information, this fact should be disclosed.

These disclosure items are reflected in the taxonomy by the elements shown in Figure 13:

Figure 13: Fundamental Errors Disclosures

Important note: Where appropriate, disclosures in this section of the EDAP Taxonomy are linked to the PFS Taxonomy by “same-as” links.

3.4. Management Commentary

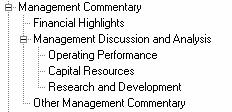

The Management Commentary provides a skeleton for tagging the MD&A or similar management performance overview, as shown in Figure 14:

Figure 14: Management Commentary

3.5. Namespaces

Namespaces are an XML concept. XBRL, using XML Schema 1.0, uses XML namespaces in its schemas and instance documents. The purpose of a namespace is to identify the context of any particular XML element. Using namespaces removes any ambiguity or confusion that may arise as a result of elements from different contexts sharing the same element name.

For example, the PFS Taxonomy uses the composite name “ast.cce” to represent “cash and cash equivalents”. If the United Kingdom creates an XBRL taxonomy that also uses “ast.cce”, there needs to be a “differentiating” mechanism. Using qualified namespaces – the XML way to say “required” – namespaces, the PFS Taxonomy “cash and cash equivalents” becomes iascf-pfs:ast.cce and the United Kingdom’s would be uk:ast.cce. The namespace simply adds a contextual prefix to any given XML element.

The namespaces relevant to this EDAP Taxonomy are:

· iascf-edap, Explanatory Disclosure and Accounting Policies

· xbrl-gcd, XBRL Global Common Document

· iascf-pfs, IAS Primary Financial Statements

4. Reviewing this Taxonomy[1]

4.1. Introduction

This section is designed to provide guidance in reviewing this taxonomy. This will assist the user of this documentation and of the taxonomy provide feedback to the IASCF and XBRL International. There are three levels of review

- Global Review: A high level review of completeness.

- Detailed Review: A detailed review of accounting disclosures and completeness

- XBRL Review: A review of appropriate treatment of disclosures within the context of the XBRL specification and good practice in building taxonomies.

4.2. Global Review

This is a high level review, undertaken with the objective of ensuring the taxonomy has not omitted any key sections. This contrasts with the Detailed Review, which is concerned with a line-by line analysis. If a crucial part of the taxonomy is missing, such as a specific Disclosure Note, this should be picked up in the Global Review. Knowledge of GAAP and Financial Reporting is required to undertake this review. It is intended to identify missing sections of the taxonomy rather than a missing element within a section. A question that would be asked in the Global Review might be “are there elements that capture operating leases?” rather than validating each of the individual Lease Standard disclosures.

Other issues include:

Structure – nesting and completeness

Are the elements grouped in a sensible manner? To illustrate, this review would ask whether the elements that are nested under, for example, Finance Costs are appropriate. To answer this requires a determination as to whether Finance Costs should reflect net or gross finance costs and an assessment as to whether the list of sub-elements seems complete.

Do the elements seem to roll up properly?

For example, does the indirect method of presenting the statement of cash flows roll-up in an intuitive manner? The construction of similar sections should be consistent. For example, net elements should have the ending balance as the parent with the components and opening balance being expressed as its children.

Consistency

Are elements aggregated in a consistent manner? There may be cases where some parent elements appear to have a disproportionate number of children, and therefore provide detail that is more appropriately included elsewhere in the PFS or EDAP taxonomies.

4.3. Detailed Review

The objective of the Detailed Review is to ensure the taxonomy correctly captures GAAP. It has two components, the first driven from GAAP and the second driven from XBRL.

GAAP Review

This review has a Financial Reporting focus, and involves validating the elements and disclosures in the taxonomy on a line-by-line basis against GAAP.

The accuracy is checked by reviewing the taxonomy against:

- GAAP standards and reference materials

- GAAP disclosure checklists

- Model financial statements; and against

- Actual financial statements

GAAP to XBRL

Reviewers should be able to identify an element in the taxonomy for every item required to be disclosed under GAAP, in this case the International Accounting Standards. This requires a 100% mapping from GAAP to the Taxonomy. This includes checking all the appropriate Accounting Standard references.

There are many generic requirements to disclose a component for which there may be several classes. Examples include classes of shares, PPE (Property, Plant & Equipment) and expenses. The taxonomy should only capture the most common classes observed in practice, to limit the need to build supplementary enterprise-specific taxonomies. In a similar manner, a standard may require the discourse of all “movements” in a particular item, such as capital.

This review should ensure that the element list is sufficiently complete in relation to all of these matters.

XBRL to GAAP

Not all elements in the Taxonomy will map directly to a GAAP disclosure requirement. Such elements should exist in the taxonomy because it is either 1) common practice for enterprises to disclose the fact or 2) the fact is a sub-total that helps the structural completeness of the taxonomy.

4.4. XBRL Review

This review has an XBRL focus, and involves verifying some of the attributes of the elements. The principal attributes to be verified are weights, labels and data type.

Weights

Is the weight correct, so that the children correctly roll-up to the parent?

Labels

Label names should be consistent. For example, the net carrying amount of an asset might be labeled as “Description – Net”, such as “Goodwill – Net”. There should therefore be no cases of “Net Description” or any other variations. All abbreviations should also be consistent.

Data-Types

Is the element data-type correct?

5. Naming Convention

5.1. Introduction

This section explains the naming conventions created and used in the EDAP Taxonomy to associate XBRL element names to concepts from the IASB Standards and other related materials. The purpose of this “translation” is to provide a consistent, reliable, language-independent, unambiguous way for relevant parties to use and integrate IAS standards into their software applications.

5.2. Key Terms

The following terms are used throughout this section:

· Component: A three-character representation of a term that relates to the Standards. This term may represent, among other things, an accounting term, an accounting concept, or an IAS-defined definition. Examples: [ast] = “asset”; [exy] = “extraordinary”.

· Composite: A composite element name is a series of two or more components. A composite represents a more specific concept than a component. Examples: [inx.grp.fna.cto] = “Income (Expense) from Financing Activities Continuing Operations”; [inx.npl] = “Net Profit (Loss) for the Period Transferred to Equity”.

· Reference: A reference to literature that supports the existence and necessity of a component and/or composite. Each component and composite has at least one reference. Typically these refer to chapter/subchapter/paragraphs/etc., as denoted in the IAS Bound Volume. However, other references may also be present.

· Label: A label is text that describes a component and/or composite to a user. A single component or composite may have multiple labels, typically one per language.

· Extended Component: A component that occurs so infrequently that it too insignificant to be considered a regular component. An extended component is represented by a number, must always be accompanied by ordinary components, and must never be the first component in a composite.

5.3. Concepts and Considerations

Composites have one overriding requirement: to represent uniquely and unambiguously, a type of financial reporting fact. This requirement ensures that computers and software can “understand” the data they are processing and storing. With this sole purpose, it would be enough simply to supply each fact with a unique identifier and then keep a repository that matches each identifier with its references and labels.

EDAP Taxonomy composite element names go beyond this minimal requirement of uniqueness. The EDAP Taxonomy uses composite names and these names follow a pattern that, while of not sufficient rigor and consistency that the names can be decomposed and interpreted by software, it is nevertheless structured well enough to assist humans who must do taxonomy maintenance with a hint as to the meaning of each concept. Composite names are like the lines, arrows and other indicators painted on an airplane fuselage: the plane flies just as well without them, but the maintenance engineers can do their work more efficiently because they can quickly spot what they are looking for.

Basic Considerations

The EDAP Taxonomy composite element names are XML-compliant element names. As such, each begins with a letter and is devoid of spaces and other XML Schema-prohibited characters. Composites are made up of two or more components, including extended components. Each component in a composite is separated with a ‘dot’ [ . ] The intent of ‘dot’ is to facilitate searching and scanning. Although computers may or may not be able to make sense out of a composite element name, a human can, provided the naming convention follows rules.

The goal of each composite element name is to contain a small number of components that define major distinctions. If the composite element has too many components and too much detail, the additional detail adds little value – it is better to just use an extended component, so as to ensure uniqueness.

Composite Element Names are not Hierarchical in Nature

The order in which components in a composite element name are combined should not be interpreted as a hierarchy. Although some composite element names may “appear” to resemble this relationship, it is mere coincidence. All components in a composite element name are equal in stature and there is no implied hierarchy within the composite element name. Hierarchy is expressed in the XBRL linkbases.

For example, the composite element name [inx.npl], which is linked to the English label “Net Profit (Loss) Transferred to Income”, does not include the component that represents “Income Statement”. This is because [inx.npl] completely and sufficiently represents the fact “Net Profit (Loss) Transferred to Income”. In addition to appearing as a descendant of “Income Statement”, [inx.npl] is also a descendant of “Statement of Changes in Equity” and “Statement of Cash Flows”.

Detailed Considerations

Nearly all PFS Taxonomy composite element names contain a component that represents one of the concepts outlined in the IAS Framework, IAS 7 and IAS 8: Position (asset, liability, equity), performance (income, expense, profit or loss), or cash flow (flow).

There are exceptions to this general rule. One such example is when a fact that can be either income or expense depending on circumstances represented by the instance document where it is used. In this example, a third ‘state’ – income or expense – exists. The composite [inx.dsp.dto] represents “Gain (Loss) on Disposal of Discontinuing Operation”, which can be either an income or an expense.

5.4. Primary Components

The primary components are the “commonly reused” components. There are two types of primary components: a) prefix, and b) suffix.

Prefix Components

Prefix components are the “building blocks” of every PFS Taxonomy composite element name. Every composite name must contain at least one prefix component. Essentially, every possible financial disclosure is a refinement of one of the prefix components. Prefix components usually (but do not have to) appear first in a composite element name. These components typically fall into one of four categories:

1.

Position: These

are: a) asset, b) liability, c) equity, and d) asset or liability. These are

essentially, the “real” accounts. When one of these four components is present,

none of the other three will be present. They are mutually exclusive.

Typically, the prefix position components are followed immediately by more

descriptive position element, such as “cash” or “payables”, although, in the

case of assets and liabilities, a “current/non-current” component may be

inserted between, if such designations are used. In addition, when summary

accounts (e.g., total assets) are present, the prefix position element may not

be accompanied by a more descriptive position element.

2.

Performance:

These are a) income, b) expense, c) income or expense, d) profit or loss. These

are essentially the “nominal” accounts. When one of these four components is

present, none of the other three will be present. They too are mutually

exclusive.

Income and expense [inx] is used to represent unknown future values, as

mentioned in Detailed

Considerations, and also “gains and losses”, as

there is no gain/loss component (as IAS Framework considers gains and losses to

be income and expenses, respectively).

3. Stand-alone Components: These are essentially groupings of position, performance and other elements. The include the a) income statement, b) balance sheet c) statement of cash flows, d) statement of changes in equity, e) statement of recognized gains and losses, and f) notes and disclosures. These composite elements are also components (by themselves) in that they are each fully represented by only one component.

4. General Prefix Components: These include a) cash flows, b) change (in) and, c) disclosures.

Position and performance components will not appear together in a composite name. However, both position and performance elements may appear with the general prefix components.

Suffix Components

The suffix components are of two basic types that can broadly be categorized as either “flows” or “adjectives”. Flow components typically represent changes in position elements. The “adjective” components (general suffix components) typically describe the state of a composite element. The “other” [otr] suffix component is always last in a composite name when used and simply represents the catchall term “other.”

6. Review and Testing, Updates and Changes

6.1. Change Log

None at this time.

6.2. Updates to this Taxonomy

This taxonomy will be updated with revisions for errors and new features within the following guidelines:

· Since financial statements created using a taxonomy must be available indefinitely, the taxonomy must be available indefinitely. All updates will take the form of new versions of the taxonomy with a different date. For example, the taxonomy http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2002-09-15/iascf-ci-edap-2002-09-15.xsd will never change. New versions will be issued under a different name, such as http://www.xbrl.org/taxonomy/int/iascf/ci/edap/2003-12-31/iascf-ci-edap-2003-12-31.xsd. This will ensure that any taxonomy created will be available indefinitely.

- It is anticipated that this taxonomy will be updated as required to incorporate changes in generally accepted accounting principles and business reporting norms.

6.3. Errors and Clarifications

The following information relating to this taxonomy will be accumulated:

- Errors which are brought to the attention of the preparers of this specification

- Workarounds where appropriate and available

- Clarification of items which come to the attention of the editors via comments and feedback

If you wish to report an error or require a clarification, please provide feedback as indicated in the “Comments and Feedback” section of this document.

6.4. Comments and Feedback

Comments and feedback are welcome, particularly ideas to improve this taxonomy. If you have a comment or feedback or wish to report an error, post comments to:

xbrlfeedback@iasb.org.uk (mailto:xbrlfeedback@iasb.org.uk)

7. Acknowledgements

A tremendous effort has gone into creating this piece of intellectual property that is being placed in the public domain by the IASCF and XBRL International for use and benefit of all. The IASCF and members of XBRL International believe that this cooperative effort will benefit all participants in the financial information supply chain.

The IASCF and XBRL International would like to acknowledge the contributions of the following individuals for their work in the creation of this taxonomy, and to their organizations that provided funds and time for their participation in this effort:

Name |

Organization |

Accounting Jurisdiction |

|

Alastair Boult |

Audit New Zealand |

New Zealand |

|

Roger Debreceny |

Nanyang Technological University |

Singapore |

|

Kersten Droste |

PricewaterhouseCoopers |

Germany |

|

Thomas Egan |

Deloitte and Touche |

Singapore |

|

Dave Garbutt |

FRS |

South Africa |

|

Preetisura Gupta |

PricewaterhouseCoopers |

Singapore |

|

David Hardidige |

Ernst and Young |

Australia |

|

David Huxtable |

KPMG |

Australia |

|

Walter Hamscher |

Standard Advantage |

USA |

|

Charles Hoffman |

UBMatrix |

USA |

|

Josef Macdonald |

Ernst and Young |

New Zealand |

|

Gillian Ong |

Nanyang Technological University |

Singapore |

|

Ong Suat Ling |

Andersen |

Singapore |

|

Paul Phenix |

Australian Stock Exchange |

Australia |

|

Kurt Ramin |

IASB |

IAS |

|

David Prather |

IASB |

IAS |

|

Julie Santoro |

KPMG |

IAS |

|

Mark Schnitzer |

Morgan Stanley |

USA |

|

Geoff Shuetrim |

KPMG |

Australia |

|

Bruno Tesniere |

PricewaterhouseCoopers |

Belgium |

|

Stephen Taylor |

Deloitte and Touche |

Hong Kong |

|

Alan Teixeira |

University of Auckland |

New Zealand |

|

Jan Wentzel |

PricewaterhouseCoopers |

South Africa |

|

Charles Yeo |

Ernst and Young |

Singapore |

8. XBRL International Members

A current listing of members of XBRL International is available at www.xbrl.org

9. Appendix – Naming Convention

9.1. Primary Components

Prefix Components

Prefix components are typically (but do not have to be) the first component in a composite element name.

Position Prefix Components

|

Component |

Component Label |

Rule |

|

ast |

asset |

Always first when expressing a numeric position value |

|

eqy |

equity |

|

|

lia |

liability |

|

|

lqy |

Equity or liability |

Performance Prefix Components

|

Component |

Component Label |

Rule |

|

exp |

expense |

Always first when expressing a numeric performance value |

|

inc |

income |

|

|

inx |

income or expense |

|

|

pls |

profit or loss |

Stand-alone Prefix Components

Stand-alone components are groupings in the taxonomy for other composites.

|

Component |

Component Label |

Rule |

|

bst |

balance sheet |

Stand-alone component. All are containers for groups of other composites |

|

cfs |

cash flow statement |

|

|

cne |

changes in net equity (statement of) |

|

|

ist |

income statement |

|

|

rgl |

recognized gains and losses (statement of) |

|

|

nds |

notes and disclosures |

General Prefix Components

|

Component |

Component Label |

Rule |

|

dcl |

disclosure |

Always first when used; can be used with any other elements |

|

cfl |

cash flow |

Always first when expressing a numeric item. |

|

chg |

change (change in) |

Applies to position elements and precedes position elements. Typically follows the [cfl] component. |

Suffix Components

Suffix components are typically (but do not have to be) the last component in a composite element name and are commonly exist with other suffix components.

Flow Suffix Components

|

Component |

Component Label |

Rule |

|

flw |

flow |

Typically the last component unless any “general suffix components” are present, in which case the flow components will precede any “general suffix components”. If one of these three suffix components is present in a composite name, neither of the other two will be present. |

|

ifl |

inflow |

|

|

ofl |

outflow |

General Suffix Components

|

Component |

Description |

|

|

end |

Label |

ending, conclusion |

|

Rule |

Last unless [net], [otr] or [xtl] are present, in which it precedes these |

|

|

Context |

Applies to amounts that represent an ending balance for a specific reporting period. Only position elements may contain the [end] component |

|

|

Example |

[ast.cce.end] = Cash and cash equivalents at end of period |

|

Component |

Description |

|

|

beg |

Label |

beginning, start |

|

Rule |

Last unless [net], [otr] or [xtl] are present, in which it precedes them. |

|

|

Context |

Applies to amounts that represent a beginning balance for a specific reporting period (e.g., from 2002-01-01 to 2002-12-31) versus the ending balance of another period (2001-12-31). Only position elements may contain the [beg] component. |

|

|

Example |

[eqy.rrv.beg.net] = Revaluation Reserves Beginning Balance (net) |

|

Component |

Description |

|

|

ttl |

Label |

total |

|

Rule |

Last unless [cur] or [otr] or both are present, in which it precedes either or both |

|

|

Context |

Used to express Y-axis totals in XBRL |

|

|

Example |

[ast.tor.rec.rel.ttl.cur] = Related Party Receivables, Net, Current |

|

Component |

Description |

|

|

adj |

Label |

adjustment, adjusting (event) |

|

|

Rule |

Typically follows [rsm] or [cim] |

|

|

Context |

1) Can represent capital maintenance adjustments (increases or decreases) to equity. Often used with [rvl] and [rsm] 2) Can represent a non-cash adjustment |

|

|

Example |

[cfl.ops.inx.adj] = Adjustments to Reconcile to Profit (Loss) From Operations |

|

Component |

Description |

|

|

otr |

Label |

other |

|

|

Rule |

Always last |

|

|

Context |

Represents any “other” designation. Only one [otr] per composite element name |

|

|

Example |

[cfl.ops.cdm.otr] = Other Cash Flows from (Used in) Operations” |

|

Key |

Component |

Component Label |

|

1 |

1qr |

1q |

|

2 |

2qr |

2q |

|

3 |

3qr |

3q |

|

4 |

4qr |

4q |

|

5 |

aar |

amount at risk |

|

6 |

aat |

allowed alternative treatment |

|

7 |

abp |

assets to be disposed |

|

8 |

abs |

alternative balance sheet totals |

|

9 |

abt |

asbestos treatment |

|

10 |

aca |

agricultural activity |

|

11 |

acc |

Accumulated |

|

12 |

ace |

accrued expenses |

|

13 |

acf |

accounted for/ accounting for |

|

14 |

ach |

accounting change |

|

15 |

aco |

acquired company |

|

16 |

acp |

accounts payable |

|

17 |

acq |

acquisition/ acquired |

|

18 |

acr |

accrue/ accrued/ accrual |

|

19 |

acs |

administrative cost |

|

20 |

act |

actuarial |

|

21 |

add |

addition/ additional |

|

22 |

ade |

Addressee |

|

23 |

adj |

adjustment, adjusting (event) |

|

24 |

adm |

advertisements/ advertising |

|

25 |

ado |

Adoption |

|

26 |

ads |

Address |

|

27 |

adt |

Advertising |

|

28 |

adv |

Advance |

|

29 |

aet |

Services of employees terminated |

|

30 |

afl |

Affiliate(s) |

|

31 |

afs |

Available for sale (financial asset) |

|

32 |

agg |

Aggregate |

|

33 |

agp |

Agricultural produce |

|

34 |

agr |

Agreements |

|

35 |

ahu |

Asset held and used |

|

36 |

aif |

Accountant information |

|

37 |

ail |

Aaccumulated impairment loss |

|

38 |

ale |

Assets, liabilities and equity |

|

39 |

all |

Allowance for loan losses |

|

40 |

alt |

Alternative |

|

41 |

alw |

Allowance |

|

42 |

amk |

Active market (for trading assets) |

|

43 |

amo |

Amortization |

|

44 |

amt |

Amount |

|

45 |

amz |

Amortized/ amortizable |

|

46 |

aol |

Asset or liability |

|

47 |

aos |

Acquisition of own stock/ share |

|

48 |

apc |

Additional paid-in capital |

|

49 |

apd |

Applied |

|

50 |

apl |

Accumulated profit or loss |

|

51 |

app |

Appropriated |

|

52 |

aps |

Amount per share |

|

53 |

apy |

Accounting policy/ principle |

|

54 |

aqr |

Available for sale movements to equity reserves |

|

55 |

arc |

Accounts receivable |

|

56 |

ard |

Acquired in-process research and development |

|

57 |

arg |

Arrangements |

|

58 |

arp |

Audit report |

|

59 |

arr |

In arrears |

|

60 |

art |

artisitic |

|

61 |

asc |

associate |

|

62 |

asd |

accounting standards |

|

63 |

asg |

assigned [to] |

|

64 |

asm |

assessments |

|

65 |

asr |

asset retirement |

|

66 |

ass |

assumed/ assumptions |

|

67 |

ast |

asset |

|

68 |

atp |

anticipate/ anticipated |

|

69 |

ats |

applicable/ attributable to common stockholders |

|

70 |

att |

accountant's report |

|

71 |

atx |

after tax |

|

72 |

aty |

activity; activities |

|

73 |

aul |

allowance for uncollectible lease payments |

|

74 |

avo |

average over |

|

75 |

avs |

adverse |

|

76 |

bas |

basis of; basis used to |

|

77 |

bat |

ending accumulated balances of all type |

|

78 |

bbl |

bank balances |

|

79 |

bcs |

borrowing cost |

|

80 |

bcw |

before changes in working capital |

|

81 |

bec |

billings in excess of cost |

|

82 |

bef |

before |

|

83 |

beg |

beginning, start |

|

84 |

bel |

basic earnings (loss) per share |

|

85 |

bet |

ending accumulated balances of each type |

|

86 |

bia |

biological asset |

|

87 |

blg |

building |

|

88 |

bmt |

benchmark treatment |

|

89 |

bnd |

bonds |

|

90 |

bnk |

bank |

|

91 |

bns |

bonus shares |

|

92 |

bod |

bank overdrafts |

|

93 |

boe |

breakdown of ordinary and extraordinary net profit |

|

94 |

bon |

bonus |

|

95 |

bps |

basic earnings per share |

|

96 |

brc |

bankruptcy.code |

|

97 |

brw |

borrowing(s) |

|

98 |

bsg |

business segment |

|

99 |

bso |

balance sheet classification based on operating cycle |

|

100 |

bst |

balance sheet |

|

101 |

btx |

before tax, pre-tax |

|

102 |

bus |

business |

|

103 |

bzc |

business combinations |

|

104 |

bzd |

business divestiture |

|

105 |

caa |

ias compliance and adoption |

|

106 |

cad |

customer advances or deposits |

|

107 |

cae |

change in accounting estimate |

|

108 |

cal |

charged against liability |

|

109 |

can |

cancellation |

|

110 |

cap |

change in accounting policy/ principle |

|

111 |

cas |

contingent asset |

|

112 |

cbd |

cannot be determined |

|

113 |

cbo |

contributions by owners |

|

114 |

cbp |

cannot be provided |

|

115 |

cce |

cash and cash equivalents |

|

116 |

ccm |

claims subject to compromise |

|

117 |

ccp |

concepts |

|

118 |

ccr |

concentration of credit risk |

|

119 |

ccs |

current service cost (of defined benefit obligation) |

|

120 |

cda |

changes in and disagreements with accountants |

|

121 |

cdl |

credit losses |

|

122 |

cdm |

cash flow reconciliation for operating activities, direct method |

|

123 |

cdt |

credit |

|

124 |

cdv |

cash dividend |

|

125 |

ceq |

cash equivalents |

|

126 |

cer |

certain |

|

127 |

ces |

cash cash equivalents and short term investments |

|

128 |

cfh |

cash flow hedge/ hedging |

|

129 |

cfi |

compound financial instrument |

|

130 |

cfl |

cash flow |

|

131 |

cfs |

cash flow statement |

|

132 |

cgs |

cost of goods sold |

|

133 |

cha |

charges |

|

134 |

chg |

change, change in |

|

135 |

chi |

comprehensive income |

|

136 |

chr |

characteristics/ features |

|

137 |

cim |

cash flow reconciliation for operating activities, indirect method |

|

138 |

cip |

construction in progress |

|

139 |

cit |

city |

|

140 |

cla |

capital leased assets |

|

141 |

clc |

compliance |

|

142 |

cli |

contingent liability |

|

143 |

clm |

claim |

|

144 |

clo |

call option |

|

145 |

cls |

class, classification, category |

|

146 |

cma |

Compensated Absences |

|

147 |

cmm |

commitments |

|

148 |

cmp |

commercial paper |

|

149 |

cms |

common (ordinary) stock/ share |

|

150 |

cmy |

commodity |

|

151 |

cne |

changes in net equity (statement of) |

|

152 |

cnt |

control (corporate governance) |

|

153 |

cnv |

converted, convertible, conversion |

|

154 |

cob |

constructive obligation |

|

155 |

col |

collateralize (pledge as security) |

|

156 |

com |

compensation |

|

157 |

con |

consolidated/ consolidation+c865 |

|

158 |

cop |

comparable/ comparability |

|

159 |

cor |

contract receivables |

|

160 |

cos |

cost of sales |

|

161 |

cot |

contractor |

|

162 |

cpa |

comparative |

|

163 |

cpc |

cost plus [construction] contract |

|

164 |

cpe |

complete |

|

165 |

cpl |

capital reserves |

|

166 |

cpo |

component |

|

167 |

cpr |

compliance report |

|

168 |

cps |

common (ordinary) earnings per share |

|

169 |

cpt |

capital |

|

170 |

cpu |

computer |

|

171 |

cpy |

copyrights |

|

172 |

cpz |

capitalized (capitilization of) |

|

173 |

cro |

creditor |

|

174 |

crr |

capital redemption reserves |

|

175 |

cry |

currency |

|

176 |

csc |

construction contract |

|

177 |

csh |

cash |

|

178 |

csm |

cost method (accounting for investments) |

|

179 |

csn |

consideration |

|

180 |

csp |

consolidation principles |

|

181 |

css |

cost of services sold |

|

182 |

cst |

cost |

|

183 |

csv |

cash surrender value |

|

184 |

csw |

computer software |

|

185 |

cta |

current tax asset |

|

186 |

cta |

contract accounting |

|

187 |

ctg |

contingency |

|

188 |

ctl |

current tax liability |

|

189 |

cto |

continuing operation |

|

190 |

ctr |

contracts or contractual rights |

|

191 |

cty |

country |

|

192 |

cul |

customer lists |

|

193 |

cum |

cumulative/ cumulative effect |

|

194 |

cur |

current |

|

195 |

cus |

customer |

|

196 |

cwc |

changes in working capital |

|

197 |

cya |

carrying amount |

|

198 |

cyf |

carryforwards |

|

199 |

daa |

depreciation and amortization |

|

200 |

dat |

date |

|

201 |

dbl |

debt related |

|

202 |

dbo |

distributions to owners |

|

203 |

dbp |

defined [employee] benefit plan |

|

204 |

dbt |

debenture |

|

205 |

dcl |

disclosure |

|

206 |

dcm |

disclaimer |

|

207 |

dcn |

discontinue/ discontinuance |

|

208 |

dcp |

defined [employee] contribution plan |

|

209 |

dcr |

decrease |

|

210 |

ddp |

details of departures from ias |

|

211 |

deb |

debt |

|

212 |

def |

deferred |

|

213 |

del |

diluted earnings (loss) per share |

|

214 |

dep |

depreciation |

|

215 |

des |

debt and equity securities |

|

216 |

det |

debt extinguishment |

|

217 |

dev |

development |

|

218 |

dfd |

deferred debt |

|

219 |

dfg |

departure from gaap |

|

220 |

dfi |

derivative [financial] instrument |

|

221 |

dfm |

deferred items |

|

222 |

dfn |

debt forgiveness |

|

223 |

dft |

definition |

|

224 |

dic |

deferred income |

|

225 |

dif |

different |

|

226 |

din |

debt instrument |

|

227 |

dis |

discount |

|

228 |

dlc |

divisions/ lesser components |

|

229 |

dld |

dual date |

|

230 |

dlo |

debt and capital lease obligations |

|

231 |

dmc |

domicile |

|

232 |

dmp |

determinable portion |

|

233 |

dmt |

depreciable amount (of an asset) |

|

234 |

dom |

domestic |

|

235 |

dor |

debtor |

|

236 |

dpr |

depreciation rate |

|

237 |

dps |

diluted earnings per share |

|

238 |

dpt |

deposits |

|

239 |

drl |

direct labor |

|

240 |

drm |

direct materials |

|

241 |

drt |

discount rate/ discounted rate |

|

242 |

drv |

derivative |

|

243 |

dsb |

distribution |

|

244 |

dsc |

description |

|

245 |

dsg |

design |

|

246 |

dsp |

disposal |

|

247 |

dta |

deferred tax asset |

|

248 |

dtd |

deductible temporary [tax] difference |

|

249 |

dte |

debt to equity |

|

250 |

dtl |

deferred tax liability |

|

251 |

dto |

discontinuing/ discontinued operation |

|

252 |

dts |

details |

|

253 |

duf |

due from |

|

254 |

dut |

due to |

|

255 |

dvc |

development stage companies |

|

256 |

dvd |

dividend |

|

257 |

dvs |

dividends per share |

|

258 |

ebd |

event after the balance sheet date |

|

259 |

ebf |

employee benefit |

|

260 |

ebp |

employee benefit plan |

|

261 |

ecd |

economic dependence |

|

262 |

eco |

emerged company |

|

263 |

ecp |

equity compensation plan |

|

264 |

ecy |

executory |

|

265 |

edo |

excluding discontinued operations |

|

266 |

eep |

effects of equity instruments being issued or received from partners |

|

267 |

ees |

effect on earnings per share if fas 123 applied |

|

268 |

eff |

effective |

|

269 |

eim |

effective interest method |

|

270 |

eit |

exit |

|

271 |

emb |

embedded (derivative) |

|

272 |

emp |

employee |

|

273 |

end |

ending, conclusion |

|

274 |

eni |

effect on net income if fas 123 applied |

|

275 |

enr |

environmental |

|

276 |

env |

environmental liability |

|

277 |

eob |

expense/ benefit |

|

278 |

eoo |

effect on operations |

|

279 |

epa |

exit plan action |

|

280 |

epc |

exercise price |

|

281 |

epe |

expose/ exposure |

|

282 |

epl |

explanatory |

|

283 |

epr |

expire/ expiration |

|

284 |

eps |

earnings per share |

|

285 |

ept |

expect/ expected |

|

286 |

eqb |

equity compensation benefit |

|

287 |

eqi |

equity [financial] instrument |

|

288 |

eqm |

equity method (accounting for investments) |

|

289 |

eqp |

equipment |

|

290 |

eqy |

equity |

|

291 |

erf |

expected to be refinanced |

|

292 |

erl |

employee related liabilities |

|

293 |

erp |

employer repurchase |

|

294 |

ers |

equity reserves |

|

295 |

esb |

esop benefit |

|

296 |

eso |

employee stock ownership plan |

|

297 |

esp |

employee stock purchase plan |

|

298 |

est |

estimate/ estimated |

|

299 |

etd |

equity to debt |

|

300 |

etl |

equity to liability |

|

301 |

etn |

external |

|

302 |

etr |

effective income tax rate |

|

303 |

ett |

employees to be terminated |

|

304 |

eur |

euro |

|

305 |

evr |

environmental remediation |

|

306 |

evt |

event (and circumstances) |

|

307 |

exc |

exclude/ excluding |

|

308 |

exe |

exercise/ exercisable |

|

309 |

exi |

extraordinary item |

|

310 |

exp |

expense |

|

311 |

exr |

exchange rate (currency) |

|

312 |

ext |

extended component (future use) |

|

313 |

exy |

extraordinary |

|

314 |

fas |

financial assistance |

|

315 |

fcr |

franchise rights |

|

316 |

fcs |

finance cost |

|

317 |

fct |

foreign currency translation |

|

318 |

fde |

fundamental error |

|

319 |

fdt |

federal tax |

|

320 |

fed |

federal |

|

321 |

fee |

fees |

|

322 |

fgn |

foreign |

|

323 |

fia |

financial asset |

|

324 |

fil |

financial liability |

|

325 |

fin |

financial instrument |

|

326 |

fip |

financial impact |

|

327 |

fir |

finance receivables |

|

328 |

fix |

fixtures |

|

329 |

fli |

financial liability instrument |

|

330 |

flr |

failure |

|

331 |

fls |

finance (capital) lease |

|

332 |

flw |

flow (inflow or outflow) |

|

333 |

fma |

formula |

|

334 |

fna |

financing activity |

|

335 |

fnd |

financial data |

|

336 |

fng |

finished goods |

|

337 |

fnl |

financial accounting concepts |

|

338 |

fnr |

finance revenue |

|

339 |

fop |

foreign operation |

|

340 |

fpc |

fixed price [construction] contract |

|

341 |

fps |

fair presentation |

|

342 |

frm |

financial risk managemetn |

|

343 |

frt |

foreign tax |

|

344 |

frv |

financial review |

|

345 |

fsp |

funded status of the plan |

|

346 |

fst |

financial statement |

|

347 |

fsy |

fiscal year |

|

348 |

fta |

first time application |

|

349 |

ftc |

future contracts |

|

350 |

ftg |

fittings |

|

351 |

fun |

function |

|

352 |

fur |

furniture |

|

353 |

fut |

future |

|

354 |

fvh |

fair value hedge/ hedging |

|

355 |

fvl |

fair value |

|

356 |

fwc |

forward contracts |

|

357 |

fxm |

foreign exchange movement |

|

358 |

fxr |

foreign exchange translation reserve |

|

359 |

fyr |

five year |

|

360 |

gaa |

general and administrative |

|

361 |

gai |

gain |

|

362 |

gas |

goods and services |

|

363 |

gcn |

going concern |

|

364 |

gds |

goods |

|

365 |

gdw |

goodwill |

|

366 |

gen |

general |

|

367 |

gep |

group enterprises |

|

368 |

ggc |

geographic concentration |

|

369 |

ggr |

government grant |

|

370 |

gle |

gain(s) and loss(es) recognized in equity |

|

371 |

gln |

gains (losses) not recognised in income |

|

372 |

gol |

gain or loss |

|

373 |

gpt |

gross profit |

|

374 |

gro |

gross |

|

375 |

gsg |

geographical (business) segment |

|

376 |

gtp |

guarantee of debt for third parties [others] |

|

377 |

gur |

guaranteed |

|

378 |

gvi |

government investigations |

|

379 |

hdg |

hedge |

|

380 |

hfd |

held for trading |

|

381 |

hfi |

hedging [financial] instrument |

|

382 |

hfs |

held for sale |

|

383 |

hgh |

high/ highly |

|

384 |

hgl |

hedging gain/loss |

|

385 |

hgr |

hedging reserve |

|

386 |

hie |

hedge ineffectiveness |

|

387 |

hlc |

health care |

|

388 |

hlg |

holding |

|

389 |

hnf |

hedged commitment no longer qualifies as fair value hedge |

|

390 |

hrv |

harvest (of biological asset) |

|

391 |

hsc |

historical cost |

|

392 |

htm |

held-to-maturity [financial asset] |

|

393 |

hyp |

hyperinflationary |

|

394 |

ibr |

interest bearing |

|

395 |

ica |

internally constructed (generated) asset |

|

396 |

ico |

incorporation |

|

397 |

icp |

ias common practice(s) |

|

398 |

icr |

increase |

|

399 |

ido |

including discontinued operations |

|

400 |

ids |

initial disclosure |

|

401 |

ifh |

ineffective hedging |

|

402 |

ifl |

inflow |

|

403 |

ifn |

inflation |

|

404 |

ifp |

interim financial report (statement) |

|

405 |

iic |

impact of 1% increase of health cost rate on retirement benefit obligation |

|

406 |

iid |

impact of 1% decrease of health cost rate on retirement benefit obligation |

|

407 |

imp |

impairment/ impaired |

|

408 |

inc |

income |

|

409 |

ind |

individual |

|

410 |

ine |

income and expenses |

|

411 |

inf |

information |

|

412 |

inr |

interest rate |

|

413 |

ins |

insurance |

|

414 |

int |

intangible asset |

|

415 |

inv |

inventory |

|

416 |

inx |

income or expense |

|

417 |

iod |

impairment or disposal |

|

418 |

ipc |

immediately preceeding |

|

419 |

ipd |

interim financial reporting period |

|

420 |

ipl |

impairment loss |

|

421 |

ipo |

initial public offering |

|

422 |

ipt |

impact |

|

423 |

ipv |

improvements |

|

424 |

irm |

interim |

|

425 |

isc |

issued capital |

|

426 |

iss |

issuance/ issue |

|

427 |

ist |

income statement |

|

428 |

itl |

interest and dividends on loans to, other debt of, and equity of other entities |

|

429 |

itr |

income taxes receivable |

|

430 |

its |

interest in a subsidiary |

|

431 |

itt |

interest |

|

432 |

ity |

introductory |

|

433 |

iva |

investing activity |

|

434 |

ive |

investee |

|

435 |

ivh |

investment hedge |

|

436 |

ivm |

investment |

|

437 |

ivp |

investment property |

|

438 |

jce |

jointly-controlled entity (joint venture) |

|

439 |

jnp |

justification of accounting principle change not provided |

|

440 |

laa |

loan against allowance |

|

441 |

lab |

land and buildings |

|

442 |

lbi |

land, buildings and improvements |

|

443 |

lcm |

lower of cost or net realisable value |

|

444 |

lct |

location |

|

445 |

lea |

lease, leasing, leasehold |

|

446 |

lee |

lessee |

|

447 |

lev |

leverage/ leveraged |

|

448 |

lfi |

life insurance (officer) |

|

449 |

lgf |

legal form |

|

450 |

lgp |

legal proceedings |

|

451 |

lgt |

long term |

|

452 |

lia |

liability |

|

453 |

lic |

license |

|

454 |

lif |

lifo |

|

455 |

lim |

loan impairment |

|

456 |

lip |

life insurance policy |

|

457 |

liq |

liquidity |

|

458 |

lir |

life or rate |

|

459 |

lla |

long lived assets |

|

460 |

lli |

land and land improvements |

|

461 |

llp |

limited liability companies and partnerships |

|

462 |

lnd |

land |

|

463 |

loa |

loan |

|

464 |

lob |

legal obligation/ litigation |

|

465 |

loc |

line of credit |

|

466 |

loi |

lack of independence |

|

467 |

lop |

loans payable |

|

468 |

lor |

lessor |

|

469 |

los |

loss |

|

470 |

lqy |

liability and equity |

|

471 |

lre |

labor and related expenses |

|

472 |

lse |

leases in financial statements of lessees |

|

473 |

lso |

leases in financial statements of lessees |

|

474 |

lsr |

leasing receivables |

|

475 |

ltd |

long term debt |

|

476 |

lte |

liability to equity |

|

477 |

lts |

litigation settlement |

|

478 |

maa |

marketing and advertising |

|

479 |

mac |

machinery |

|