Audited Digital Financial Statements: They Improve The Process Too

This is the third in a series of guest posts from Mohini Singh, ACA, Director, Financial Reporting Standards, CFA Institute.

This is the third in a series of guest posts from Mohini Singh, ACA, Director, Financial Reporting Standards, CFA Institute.

The SEC has required filers to submit their financial statements in both the paper-based and digital formats since 2009. However, there is no requirement to audit or provide any level of assurance on the digital format.

This is not in the interest of investors. First, more than any other reader, investors are consuming the digital information for making investment decisions. If they are fiduciaries, their decisions impact many others. Second, the SEC is considering and ESMA will require filers to submit their digital information in an Inline XBRL format. This format embeds the machine-readable XBRL tags into the human-readable financial statements and investors would expect both layers to be audited.

As Lou Rohman in his article Should XBRL Financials be Audited? points out there are other advantages of having a level of assurance over the digital financial statements.

“One significant consequence of an audit is that it would motivate those companies that are currently submitting poorly-tagged XBRL to start paying attention, and do it the right way. Unfortunately, poor quality XBRL is submitted too often today, whereby the XBRL computer-readable financials don’t provide the same information as the HTML human-readable financials. Some companies are unaware they are doing XBRL improperly. For others, the ‘care-factor’ is just too low; minimal effort is given since they see no tangible negative consequences to submitting low quality XBRL data. But an audit would likely change this. Since companies would need a ‘clean’ auditor’s report on the XBRL tagging, it would be motivated to transform the quality of the XBRL filing.

A less obvious, but longer term equally critical benefit of an audit is to remove the need for consumers of XBRL statements to ‘fix’ the data prior to using it. Can you imagine this occurring in traditional, paper driven audits? Far too much effort is put forth by consumers to correct the tagged data submitted by registrants. Better data would also increase the ability of less-sophisticated consumers to use the as-submitted data and rely on the output of their analysis.”

This shortcoming is validated by investor behaviour. Specifically, in large part, investors continue to get the information they require for their analyses from third party data providers. [Although, increasingly, these data providers obtain their fundamental information from XBRL filings, reviewing the data in house before releasing it — Ed]

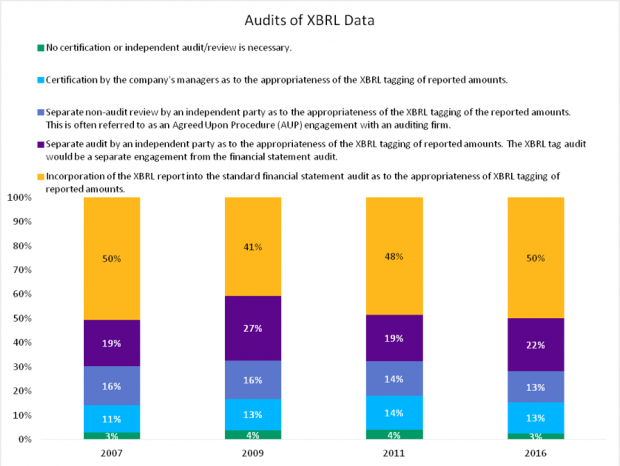

An audit requirement would overcome these challenges. Accordingly, per a 2016 survey of CFA Institute members, seventy seven percent of respondents who are aware of XBRL want some level of assurance over the XBRL report — with fifty percent agreeing that the XBRL report should be incorporated into standard financial statement audit. This result is similar to that found in prior surveys.

We urge regulators and audit standard setters to take heed of what investors want.

Mohini Singh, ACA, is director of financial reporting policy at CFA Institute.