Sentiment Analysis | Using LLMs to Analyse Narrative Disclosures

This is the third entry in the blog series “Using LLMs to Analyse Narrative Disclosures.” In the previous analysis, we explored how liquidity risk disclosures revealed clear patterns and outliers, offering valuable signals through structured XBRL tagging and LLM-powered summarisation.

In this part, we shift focus to sentiment analysis — examining how management frames its outlook, the tone of disclosures, and how this may reflect underlying risk posture or market confidence. By combining structured tagging with narrative analysis, we can uncover subtle signals that go beyond numbers and provide a richer understanding of disclosure behavior.

Sentiment Analysis

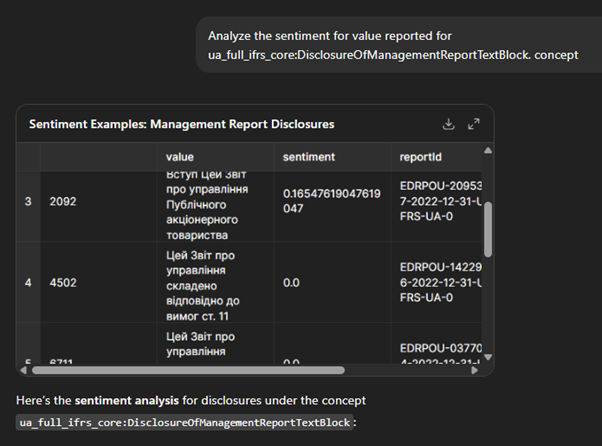

Certain disclosures—particularly management reports—reflect the tone and outlook of management, making them suitable for this type of analysis. For this experiment, I asked ChatGPT to analyze sentiment for the concept ‘DisclosureOfManagementReport’. This approach provides a quick, high-level view of whether the narrative carries a positive, neutral, or negative tone.

Traditionally, sentiment analysis would involve reading lengthy text, applying formulas, and classifying passages—a task both time-consuming and subjective. Text sentiment analysis models make it easier, but the real efficiency comes when the data is structured. Instead of manually extracting text from PDFs, XBRL tagging ensures the relevant piece of narrative (in this case, the management report) is already isolated and ready for analysis.

Let’s look at an example:

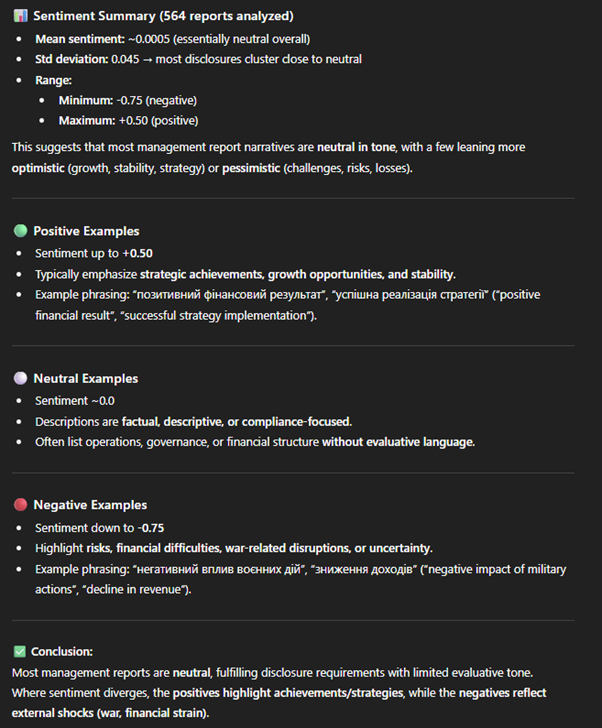

This proves how a quick sentiment overview can be useful for understanding the broader landscape. Across this sample of 900+ Ukrainian Annual Reports for 2022, most management reports were neutral, fulfilling disclosure requirements with limited evaluative tone. Where sentiment diverges, the positives typically highlight achievements or strategic initiatives, while the negatives often reflect external shocks such as war or financial strain. From here, one can dig deeper into the companies with negative sentiment reports—an area of potential interest for analysts and investors alike.

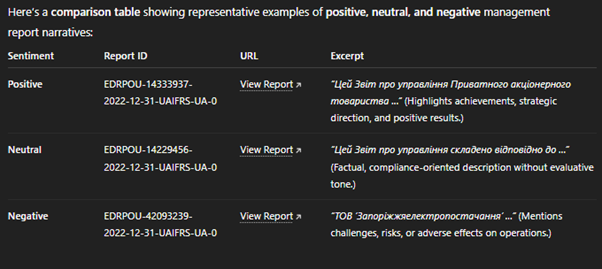

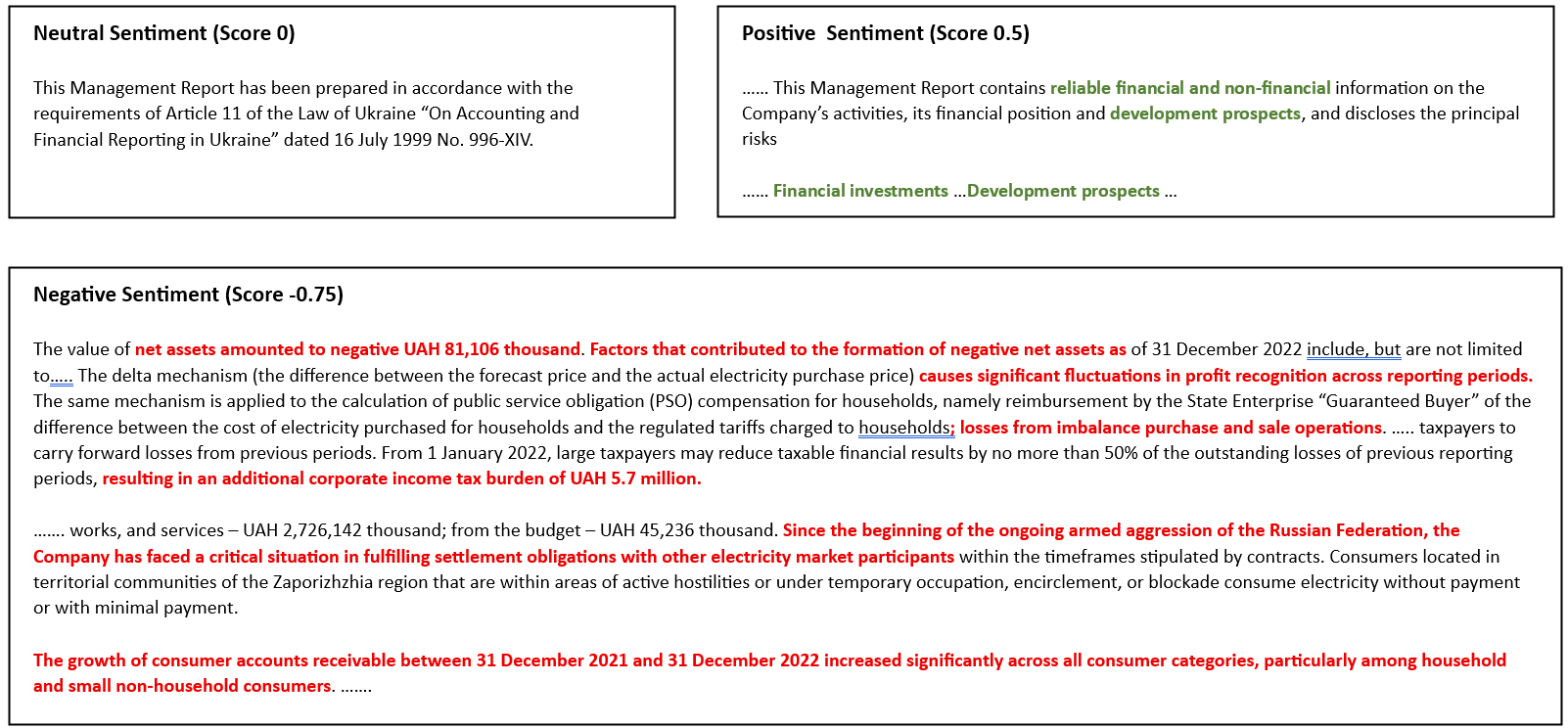

To make the sentiment analysis more tangible, let’s look at examples of how management report disclosures fall into positive, neutral, and negative categories. These comparisons enhance our understanding of how LLMs classify tone in narrative text:

In the extracts below (translated from the original Ukrainian narratives into English), positive and negative terms are highlighted to illustrate how word choice influences sentiment classification.

- A neutral sentiment score (close to zero) reflects text that is largely legalistic or procedural in nature, focusing on compliance and factual description rather than evaluative language. Source Report

- A positive score of approximately 0.5 indicates only mildly positive sentiment, driven by a small number of positive expressions (e.g., references to stability, development, or performance) rather than consistently optimistic or strongly affirmative language. Source Report

- By contrast, a negative score of –0.75 indicates a markedly negative tone, in which negative terms occur more frequently and are used with greater emphasis, often reflecting heightened focus on challenges, disruptions, or adverse conditions. Source Report

Just as anomaly detection revealed companies deviating from common liquidity patterns, sentiment analysis highlights where management narratives diverge in tone. Together, these approaches demonstrate how LLMs can surface both structural differences and emotional signals in disclosures, offering a richer foundation for deeper analysis.

The key enabler here is the structured tagging of specific data within XBRL, which makes it easy to isolate relevant sections and apply targeted analytical techniques even across numerous reports. LLMs then make it simple and flexible to layer methods like sentiment analysis or anomaly detection on top of this structured foundation — without heavy data engineering.

Next in the series: we’ll take this a step further by comparing consecutive reports from the same company, examining what text has changed compared to previous year. This will help highlight how narratives evolve over time — revealing shifts in tone, emphasis, or disclosure strategy, and offering deeper insights into how companies communicate risk and outlook.