The myth

“In the age of AI, we no longer need structured data like XBRL.”

The reality

AI and XBRL work best together.

Why? Because AI is a powerful engine, and high-quality XBRL data is the fuel it needs.

Why XBRL matters more than ever

Modern AI tools can do amazing things with unstructured data—but it’s risky. They rely on probabilistic methods and can misinterpret key facts, especially when encountering novel or nuanced information. The reality is that almost every corporate report does contain nuanced information unique to that company. When data and data definitions are already structured with XBRL, AI models can:

- Instantly identify concepts (like “Net Profit”, “Total Employees” or “Going Concern Note”) without guesswork.

- Compare figures across many reports in seconds.

- Deliver more accurate, consistent, and trustworthy insights.

In short: AI needs a solid foundation of verified, machine-readable data to reach its true potential.

The risk of unstructured data

Relying on AI to “read” PDF or HTML documents is a gamble. Different AI models—or even different versions of the same model, or the same model given slightly different prompts —may interpret the same report differently. That leads to:

- Conflicting conclusions

- Hard-to-trace errors

- Additional risk for decision-makers

When there’s no single, definitive version of the truth, uncertainty rises—and in corporate reporting, uncertainty can translate to costly mistakes.

The value of digital, structured reporting

1. Clarity & comparability

Each disclosure in XBRL is tied to a specific concept, ensuring everyone—from CFOs to regulators—understands exactly what it means.

2. Efficiency & cost savings

Machine-readable tags accurately identify each fact. Automated data extraction speeds up analysis and reduces manual work.

3. Traceability & accountability

Each fact is company-verified and fully traceable back to its source. It’s possible to drill down from any analytic or AI-generated summary straight to the precise information being relied on.

4. Future-proof insights

In an evolving AI landscape, training models on structured data protects against misinterpretation. As AI gets smarter, XBRL ensures it has the best possible starting point.

Creating high-quality digital data, faster

AI doesn’t just use structured data; it can also help create it. AI-driven tagging tools are making it simpler and more cost-effective for companies to prepare XBRL filings:

- Automated tag suggestions: AI proposes the right tag for each disclosure.

- Human oversight: People confirm the final choices, focusing in on the most challenging and complex areas, ensuring accuracy and compliance.

This partnership between humans and AI will lead to streamlined workflows, so companies can publish high-quality, authoritative digital reports faster than ever.

A powerful combination for business outcomes

- Rapid insights: Automated collation and comparison of data from multiple companies or time periods.

- Early risk detection: Users can quickly flag anomalies or emerging trends.

- Transparency for investors: Trust is built when anyone can trace an AI conclusion to a digitally signed, company-verified data point.

- Lower costs, less manual work: Data flows directly from companies to regulators, analysts, and investors, cutting out tedious and inaccurate re-keying or manual review of machine interpretations.

Bottom line: In an AI-driven future, the best analysis starts with structured data.

The road ahead

Breakthroughs in AI are coming fast, opening new horizons for the ways in which we create, consume, and understand corporate reports. XBRL remains the gold standard for ensuring that everyone—machines and people alike—can access, compare, and trust the core facts. If AI is the self-driving car, XBRL is the well-built road network that allows it to travel safely and efficiently.

In an age of extraordinary technology, XBRL is more indispensable than ever.

Read more

|

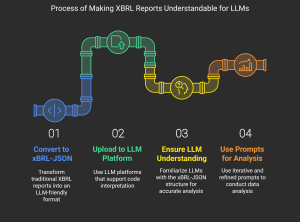

A Getting Started Guide: Experimenting with LLMs for XBRL Analysis Want to see what LLMs like ChatGPT can do with XBRL data? Here’s how to get started, leveraging the xBRL-JSON format that’s easy for LLMs to understand. Go to article |

|

AI and Digital Tagging in Sustainability Reporting: From Magic to Reality Interview: How organisations can move beyond compliance and gain strategic insights from sustainability data by integrating AI and digital tagging. Go to article |

|

Leveraging LLMs for Smarter Taxonomy Interactions Exploring how LLMs can help create smarter, more interactive XBRL taxonomy experiences, including clearer labels, user-friendly quality checks and easier navigation. Go to article |

|

Why AI needs XBRL XBRL is outdated? That’s news to AI! The reality: AI without structured data is like a self-driving car without roads or maps. It might get somewhere, but not where you want to go. An editorial from XBRL International CEO John Turner. Go to article |

|

Why Structured Data and Definitions Vastly Outperform Unstructured PDFs in LLM Analysis An exploratory demonstration of the power of structured data to achieve more accurate and insightful analysis. Go to article |

|

Narrative disclosure analysis with GPT-4 Sustainability disclosures are rich in narrative data, aka text blocks, and require new analytic approaches. A foray into what ChatGPT can do with this information, and how it enables easy analysis using simple queries in natural language. Go to article |

|

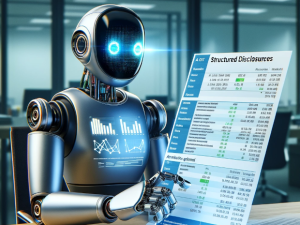

How well do AI models like GPT-4 understand XBRL Data? Initial findings on the ability of ChatGPT to understand structured disclosures in XBRL, and use them to produce decision-useful insights. The results are promising! Go to article |