Calculations 1.1: getting rid of the noise

XBRL Calculations can play an important role in ensuring the quality and accuracy of a financial report, and can flag up errors in both the XBRL tagging and the underlying numbers. Unfortunately, until now, calculation validation reports have been hampered by false positives — validation messages that don’t reflect real issues in the report.

The Calculations 1.1 specification update in February 2023 offers an incremental enhancement to the existing XBRL calculation features and is intended to reduce these false positives. In this blog post, we will look at a sample of European Single Electronic Format (ESEF) reports to see how effective Calculations 1.1 has been at cleaning up validation reports.

The Calculation tree in an XBRL taxonomy describes simple total and subtotal relationships between concepts, such as “Assets = Current Assets + Non-Current Assets”. If the fact values in an XBRL report do not add up according to the calculation relationships in the taxonomy, XBRL validation software will flag this discrepancy as a calculation inconsistency.

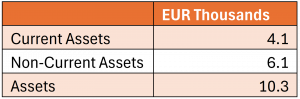

Numeric figures in human-readable reports are often scaled and rounded for better readability. This rounding creates a problem for calculation consistency validation. It is not uncommon to see something similar to the values shown in the Balance Sheet extract shown in Figure 1.

Although on the face of it, these numbers don’t add up (4.1+ 6.1 ≠ 10.3), once you consider that these presented figures have been rounded to the nearest thousand, there is no inconsistency here. Refer to this blog post on rounding issues for a more detailed discussion of this.

Calculations 1.0 (existing calculations functionality) would flag this as a calculation inconsistency as it computes totals based on the reported values without considering the effects of rounding. As the underlying numbers may well satisfy the prescribed calculation relationship, this flagged inconsistency would be considered a false positive.

Calculations 1.1 takes into account the stated accuracy of the reported figures, and will not flag an error if the reported figures could have been rounded from a set of figures that do satisfy the prescribed calculation relationship, as is the case in the above example.

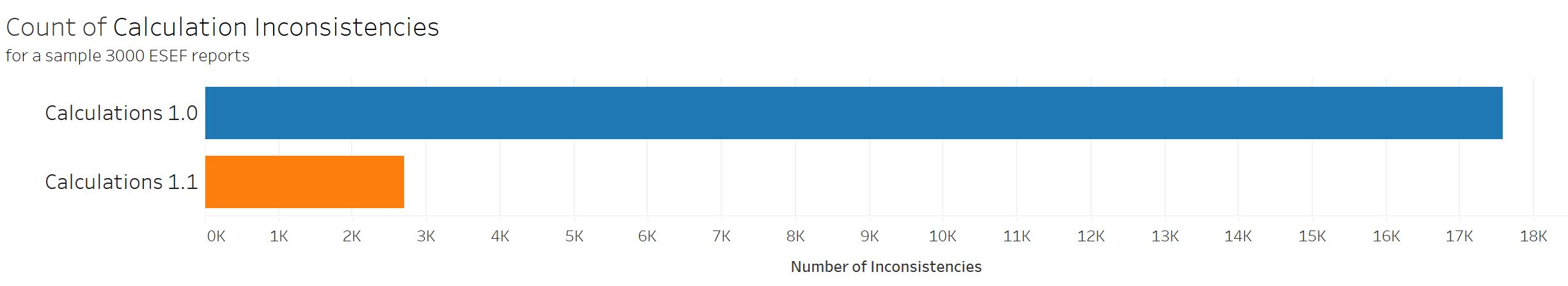

For this blog, we took a sample of over 3,000 reports, and compared the results of applying Calculations 1.0 and Calculations 1.1 validation in order to assess how effective is Calculation 1.1 in minimising false positive results.

A sample of European Single Electronic Format (ESEF) reports with a reporting period ending on December 31, 2022, was taken for analysis. These 3,080 reports were sourced from XBRL International’s filings.xbrl.org – a repository of Inline XBRL filings. These filings were originally submitted to national regulators and data collectors as per the regulatory mandate.

The analysis focused on identifying the number of calculation inconsistencies flagged under Calculations 1.0 and 1.1 for the same set of reports. The comparative results are tabled in Figure 2.

The total number of calculation inconsistencies across the 3,000 ESEF reports was 17,585 under Calculations 1.0 and 2,696 under Calculations 1.1. The significant reduction in inconsistencies is primarily due to improved handling of rounded figures, resulting in far fewer false positives.

In a few reports, it is also seen that the number of inconsistencies had actually increased compared to Calculations 1.0. This is typically to the presence of inconsistent duplicate facts, and is usually indicative of a real problem in either the tagging or the reported figures.

From a preparer’s perspective, this significant reduction in false positives means that they can and should focus on the remaining inconsistencies, which often point to real errors in either the tagging or the reported numbers. Please note Calculations 1.1 can still generate false positives under some circumstances.

This calculation inconsistency analysis of ESEF reports provides compelling evidence to switch to Calculation 1.1 to reduce false positives due to rounding in the reports. Read about the recommended adoption path for the transition to Calculations 1.1 in this separate guidance document.