Investor and data user requirements for entity-specific disclosures

[TOC]

The requirements of different user groups discussed in this document supports the "How to address Entity Specific Disclosures in XBRL reports" guidance produced by the Entity Specific Disclosure Task Force (ESDTF).

Introduction

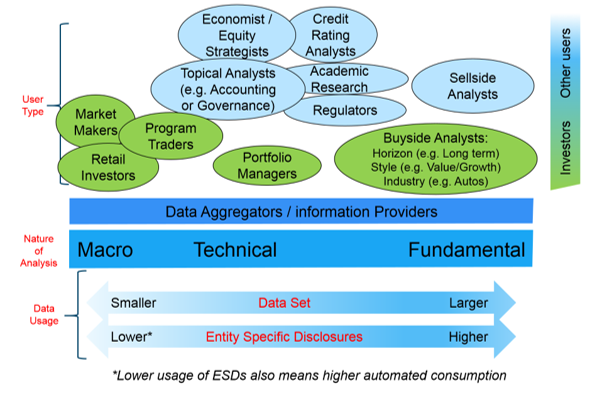

As the following diagram illustrates for an open reporting environment, many parties utilize digital financial reports; from the investors that trade on the information to other users setting policy, performing macro analysis, or enforcing the rules. Even though each user group tends to focus on one type of analysis (e.g., a retail investor may focus on macro analysis), all these users have diverse and overlapping requirements from macro to technical to fundamental analysis. And while not always the case, these users frequently get their data from data aggregators that have their own special requirements commonly focused on the efficient and accurate automated consumption of the available data.

Digital Financial Reporting User Requirement

Figure 1: Digital Financial Reporting User Requirement (as developed by the task force)

Figure 1: Digital Financial Reporting User Requirement (as developed by the task force)When setting the requirements the task force mainly aimed to fulfil the needs of investors and data providers. Multiple user groups have expressed a concern that the way ESDs are currently being tagged impairs the benefits of using XBRL reports. In addition, we think it is reasonable to assume that the other user requirements are generally being met by meeting the needs of the investors and data aggregators.

There are several generalised requirements we believe are shared by many of these user groups relative to entity-specific disclosures (ESDs) in digital financial reporting.

These requirements include:

- Ability for users to efficiently and effectively identify, access, and understand reported facts that are specific to the entity through automated consumption

- Ability to easily derive meaning when necessary, e.g., mathematical roll-ups

- Ability to choose from macro to fundamental analysis for any given data set, i.e., the user isn't forced into one or the other

- Consistent and comparable representation between entities for similar types of reported information

- Consistent and comparable representation for a single company over time for time series analysis.

- Consistent and comparable representation of certain fundamental reporting requirements such as Assets, Revenue, Net Income, etc.

In summary any solution for ESDs must allow for:

- Efficient and effective numeric analysis of ESDs, in particular mathematical roll-ups.

- Easy identification of the higher-level reporting requirement while still reporting the ESD specifics

A recent report on technology in corporate reporting published by the CFA institute 1 included a comment on general investor requirements:

Investors need information to also be entity specific in order for it to be meaningful to their financial analysis. Neither the prohibition on extensions nor the form-based approach allows companies the flexibility to provide information that is specific to them. We, therefore, believe that it is necessary to allow for the use of company-specific extensions as well as the development of 'an extension anchor' - that is, a technical connection between extension elements to official or base taxonomy concepts. And in our view, XBRL International should develop the technical connection.

Having to anchor each company-specific extension to the base taxonomy concept may result in an incremental cost to reporting entities but a reduction in cost to users because it would allow for automated analysis of company-specific extensions."

Digital financial reporting user requirements are very diverse and exist on a nature of analysis continuum from macro to technical to fundamental analysis2. Additionally, the user requirements vary depending where they reside in the consumption equation, e.g., data aggregators/providers versus end user investors. It is not within the scope of this report to cover the entire continuum of requirements but the ESDTF recommendations do attempt to address both ends of the spectrum.

Other business requirements

The primary consideration for this guidance is how to most effectively represent ESDs in XBRL reports to support automatic consumption by users. However, other parties in the supply chain have a role to play and the task force has endeavored to understand and balance its recommendations based on these other user needs. The main additional parties involved in the XBRL reporting chain are the report preparers (whether reporting entity or filing agents), audit and assurance professionals and the regulators and other collectors of XBRL reports.

Some of the requirements for these different types of user overlap with those described for investors and data providers, in particular the requirements for the regulators and other collectors.

Reporting entity requirements considered include:

- Properly communicating the facts in their financial statements in a digital format

- Simple mechanisms to include ESDs

- Minimising the time for XBRL Report preparation and related cost

Assurance requirements include:

- Requirements similar to those detailed for investor and data users

- A consistent approach for ESD's so that suitable criteria to analyze and review the accuracy of the tagging of ESDs can be developed and leveraged for various XBRL-related engagements conducted by auditors.

Regulators, standard setters, and other collector's primary requirements include:

- Requirements similar to those detailed for investor and data users

- Balance the needs of all reporting supply chain stakeholders (creation through consumption) while meeting their own needs for utilizing digital reporting

This document was produced by the Entity-Specific Disclosures Task Force.

Published on: 2019-04-23.