This document is a review draft. Readers are invited to submit comments to the Entity Specific Disclosure Task Force.

Table of Contents

- 1 Example 1 – Inappropriate use of "other" concept with documentation label excluding separately disclosed items

- 2 Example 2 – Anchor is "too wide"

- 3 Example 3 – Appropriate use of "other" concept

- 4 Example 4 – Anchoring a 'net' concept

- 5 Example 5 – Inappropriate narrower anchoring

- 6 Example 6 – Inappropriate anchoring of entity specific domain member

The examples of appropriate and inappropriate anchoring and considerations discussed in this document expand the guidance on Using the ESEF rules for anchoring extensions produced by the Entity Specific Disclosure Task Force (ESDTF). This guidance is primarily aimed at preparers to assist with creating anchoring relationships in ESEF reports.

Guidance provided in this note is based on ESDTF interpretation of the rules as published by ESMA and the European Commission (see ESEF rules and guidance) and is not intended to act as a complete or authoritative statement of those rules.

1 Example 1 – Inappropriate use of "other" concept with documentation label excluding separately disclosed items

1.1 Case 1 – Items are separately disclosed in the notes

Here is an example illustrating an inappropriate use of an "other" concept as a wider anchor when the documentation label of the concept in the base taxonomy indicates it is for items that are not separately disclosed, when in fact the extension was for items that were separately disclosed in the notes.

Background

An extension concept was used to tag the amount for "Investment securities" in the following excerpt from an unclassified statement of financial position.

|

20xy €m |

Concepts used to tag certain line items: |

||

|

Cash and cash equivalents |

1,150 |

||

|

Financial assets held for trading |

80 |

ifrs-full_Financial assets at fair value through profit or loss, classified as held for trading |

|

|

Loans and receivables |

3,600 |

||

|

Investment securities |

850 |

extension_Investment securities |

|

|

Property, plant and equipment |

74 |

||

|

Intangible assets |

36 |

||

|

Other assets |

18 |

ifrs-full_Other assets |

|

|

Total assets |

5,808 |

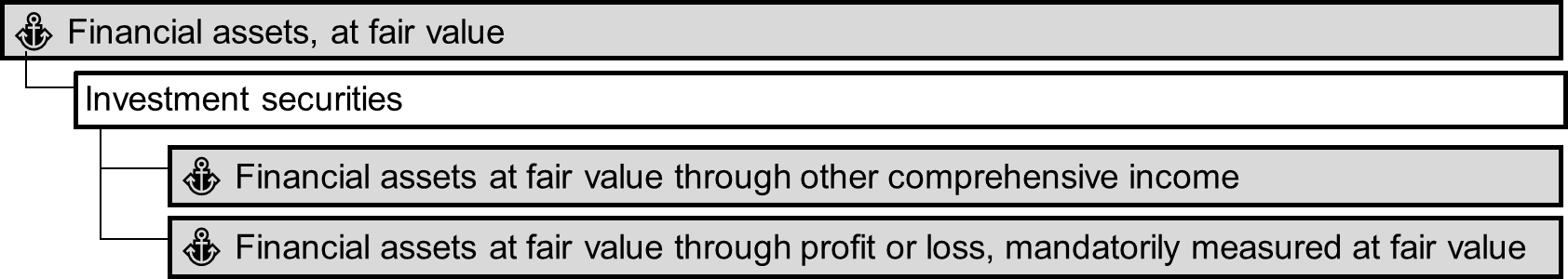

Inappropriate Anchoring Relationship

The following inappropriate wider-narrower relationship was provided for this extension:

Figure 1: Inappropriate Anchoring Relationship | Example 1.1

Figure 1: Inappropriate Anchoring Relationship | Example 1.1Additional Information about Extension from Notes to Financial Statements

The corresponding note disclosure for "Investment securities" indicated that these securities consisted of both financial assets at fair value through other comprehensive income totaling Euro 500 million and financial assets mandatorily at fair value through profit or loss totaling Euro 350 million.

Anchoring Considerations

The documentation label for the base taxonomy concept, "Other Financial Assets", explicitly excludes separately disclosed items for financial assets that could be disclosed in the notes. Therefore, this base taxonomy concept is not an appropriate anchor on the wider end of the wider-narrower relationship for the extension because information about these financial assets is separately disclosed. Generally, a base taxonomy "other" concept containing a documentation label with the language "that the entity does not separately disclose in the same statement or note" is not expected to be an appropriate wider anchor when amounts are separately disclosed.

The location of a concept in the base taxonomy should not preclude its use for anchoring an extension in a primary financial statement. As noted in Paragraph 143 of the Preparer's Guide for Using the IFRS Taxonomy preparers need to consider the IFRS Taxonomy content in its entirety when tagging primary financial statements. This also applies to anchoring. The base taxonomy concepts intended to be used for anchoring extension concepts in primary financial statements could be located in any presentation group in this base taxonomy.

A check of the base taxonomy shows that there is no concept aggregating both categories of the financial assets included in the Investment securities line item in the above excerpt, but there are separate base taxonomy concepts for each category. These concepts are as follows: "Financial assets at fair value through other comprehensive income" and "Financial assets at fair value through profit or loss, mandatorily measured at fair value".

Furthermore, there is a base taxonomy concept, "Financial assets, at fair value", where the accounting meaning also encompasses what the extension concept is intended to represent and is therefore considered wider than the extension concept. It should be noted that "Financial assets, at fair value" would not be the appropriate concept for tagging the line item "Investment securities" in this statement of financial position because to do so would indicate that financial assets measured at fair value total 850 million Euro for this entity when in fact that total is 930 million Euro. As noted in the excerpt above, there are other financial assets also measured at fair value totaling 80 million Euro, which are included as a separate line item in the statement of financial position and tagged with "Financial assets at fair value through profit or loss, classified as held for trading".

Also, there is another base taxonomy concept, "Financial Assets", which consists of different types of financial assets, including those measured at amortised cost. This concept would not be considered the appropriate concept for tagging, for the reasons noted above, or for including as an anchor on the wider end of the wider-narrower relationship because it does not have the closest wider accounting meaning for this extension.

Appropriate Anchoring Relationship

Since the base taxonomy concept, "Financial assets at fair value", is wider than the extension concept and the extension concept is an aggregation of two base taxonomy concepts, the following represents the appropriate wider-narrower relationships for the fact pattern outlined in this example:

Figure 2: Appropriate Anchoring Relationship | Example 1.1

Figure 2: Appropriate Anchoring Relationship | Example 1.11.2 Case 2 – Extension is more specific than an aggregation of immaterial items

Here is an example illustrating an inappropriate use of an "other" concept as a wider anchor when the documentation label of the concept in the base taxonomy indicates it is for items that are not separately disclosed, and the extension was more specific than an aggregation of immaterial items.

Background

An extension concept was used to tag the amount for "Provisions" in the following excerpt from a statement of comprehensive income, profit, or loss, by nature of expense.

|

20xy |

Concept used to tag extension: |

||

|

Revenue |

20,783 |

||

|

Purchases consumed |

(805) |

||

|

Personnel expenses |

(15,290) |

||

|

External expenses |

(3,260) |

||

|

Taxes and duties |

(617) |

||

|

Other operating revenues and expenses |

1,034 |

||

|

Depreciation allowance |

(1,153) |

||

|

Provisions |

(460) |

extension_Provision Expense |

|

|

Operating income |

232 |

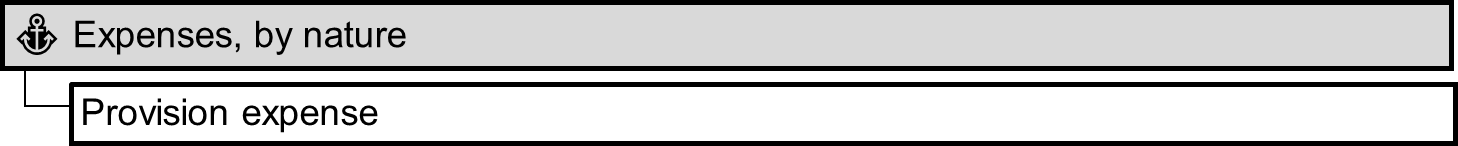

Inappropriate Anchoring Relationship

The following inappropriate wider-narrower relationship was provided for this extension:

Figure 3: Inappropriate Anchoring Relationship | Example 1.2

Figure 3: Inappropriate Anchoring Relationship | Example 1.2Anchoring Considerations

A separate line item was disclosed for a specific type of expense, provisions, which does not represent an aggregation of immaterial items. Therefore, anchoring this extension to the base taxonomy concept for "Other expenses, by nature" is not appropriate on the wider end of the wider-narrower relationship because it is considered to be too narrow.

Generally, a base taxonomy "other" concept containing a documentation label with the language "that the entity does not separately disclose in the same statement or note" is not expected to be an appropriate wider anchor when amounts are separately disclosed.

A check of the base taxonomy shows that there is not a specific concept for the nature of the expense disclosed here for the provision line item, but there is a more encompassing concept, "Expenses, by nature", which is an aggregation of all expenses by nature.

Appropriate Anchoring Relationship

Since the base taxonomy concept, "Expenses, by nature", is wider in accounting meaning than the extension concept, the following represents the appropriate wider-narrower relationship for the fact pattern outlined in this example:

Figure 4: Appropriate Anchoring Relationship | Example 1.2

Figure 4: Appropriate Anchoring Relationship | Example 1.2As this extension is not an aggregation of concepts existing in the base taxonomy, there is no appropriate narrower anchor.

2 Example 2 – Anchor is "too wide"

Here are examples illustrating the use of anchors that are too wide.

2.1 Case 1 – Current and Non-current Assets

Two extension concepts were used to tag the current and non-current amounts of "Capitalised contract costs" in the following excerpt from a classified statement of financial position.

|

20xy €m |

|

Concepts used to tag certain line items: |

|

|

Cash and cash equivalents |

498 |

||

|

Accounts receivable |

199 |

||

|

Inventories |

174 |

||

|

Capitalised contract costs |

57 |

extension_Current capitalised contract costs |

|

|

Other current assets |

83 |

ifrs-full_Other current assets |

|

|

Total current assets |

1,011 |

ifrs-full_Current assets |

|

|

Property, plant and equipment |

369 |

||

|

Goodwill |

46 |

||

|

Other intangible assets |

189 |

||

|

Investments in joint ventures and associates |

668 |

||

|

Capitalised contract costs |

165 |

extension_Noncurrent capitalised contract costs |

|

|

Other non-current assets |

45 |

ifrs-full_Other non-current assets |

|

|

Total non-current assets |

1,482 |

ifrs-full_Non-current assets |

|

|

Total assets |

2,493 |

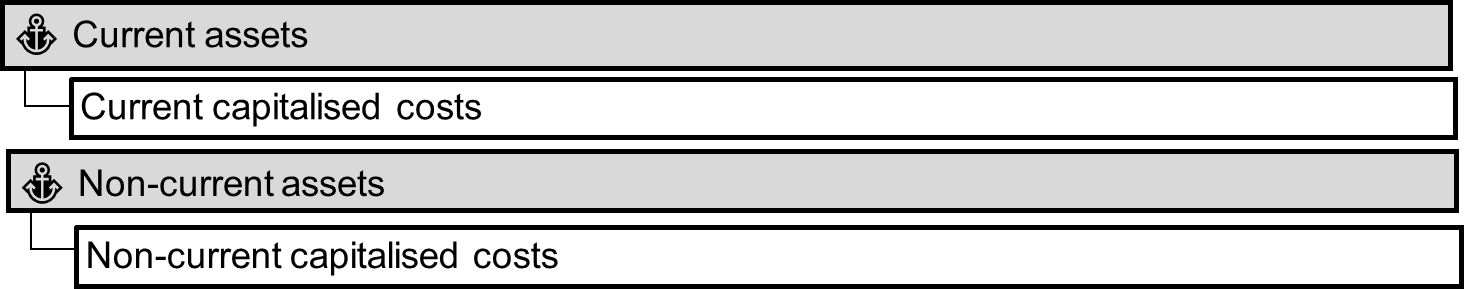

Inappropriate Anchoring Relationship

The following inappropriate wider-narrower relationships were provided for these extension concepts:

Figure 5: Inappropriate Anchoring Relationship | Example 2.1

Figure 5: Inappropriate Anchoring Relationship | Example 2.1Additional Information about Extension from Notes to Financial Statements

The corresponding note disclosure for "Capitalised contract costs" indicated that these are assets recognised for incremental costs to obtain certain revenue contracts with customers, which are expected to be recovered. Total capitalised contract costs were EUR 222 million, which consisted of the current and non-current portions reported in the statement of financial position.

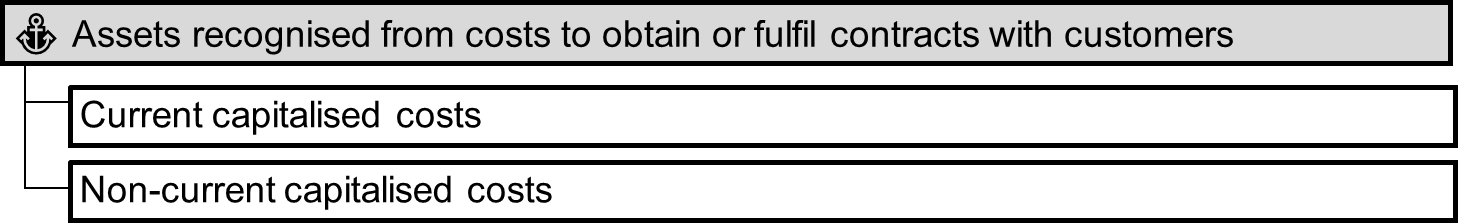

Anchoring Considerations

Anchoring these extension concepts to the base taxonomy concepts "Current assets" and "Non-current assets" is not appropriate because there are other concepts in the base taxonomy that do have a closer wider accounting meaning for these extensions. Therefore, these base taxonomy concepts are considered to be too wide. If there were no other closer wider concepts in the base taxonomy, then these would be appropriate anchors.

Based on the presentation and calculation relationships provided by the XBRL data for this statement of financial position, users know that these extensions are included in current and non-current assets. It would be helpful to consider other base taxonomy concepts that would provide users of the XBRL data with information about the nature or type of these extension assets.

The location of a concept in the base taxonomy should not preclude its use for anchoring an extension in a primary financial statement. As noted in Paragraph 143 of the Preparer's Guide for Using the IFRS Taxonomy preparers need to consider the IFRS Taxonomy content in its entirety when tagging primary financial statements. This also applies to anchoring. The base taxonomy concepts intended to be used for anchoring extension concepts in primary financial statements could be located in any presentation group in this base taxonomy.

A check of the base taxonomy shows that there is a concept, "Assets recognised from costs to obtain or fulfil contracts with customers", with an accounting meaning that fully encompasses the meaning of both extension concepts and is therefore considered to be the most appropriate concept on the wider end of the wider-narrower relationship for anchoring. At the time this document was available for publication, the IFRS taxonomy did not have separate concepts for the current and non-current portions of these assets.

Appropriate Anchoring Relationship

Since the base taxonomy concept represents an aggregation of the two extension concepts, the following represents the appropriate wider-narrower relationship for the fact pattern outlined in this example:

Figure 6: Appropriate Anchoring Relationship | Example 2.1

Figure 6: Appropriate Anchoring Relationship | Example 2.12.2 Case 2 – Equity

An extension concept was used to tag the amount for "Reserves and retained earnings" in the following excerpt from the equity section of a statement of financial position. This entity does not have any non-controlling interests.

|

20xy €m |

Concepts used to tag certain line items: |

|

|

Share capital |

3,950 |

|

|

Share premium |

372,131 |

|

|

Reserves and retained earnings |

(220,105) |

extension_Reserves And Retained Earnings |

|

Total shareholders' equity |

155,976 |

ifrs-full_Equity |

Inappropriate Anchoring Relationship

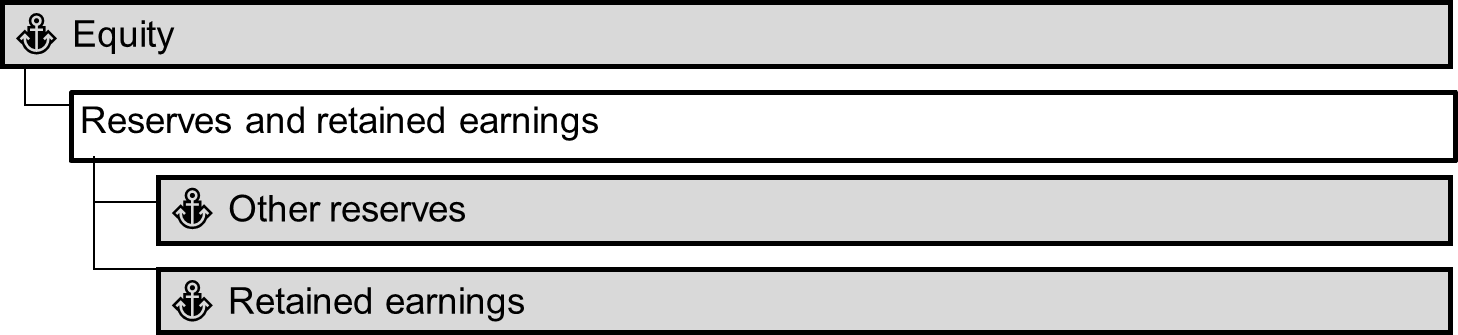

The following inappropriate wider-narrower relationship was provided for this extension:

Figure 7: Inappropriate Anchoring Relationship | Example 2.2

Figure 7: Inappropriate Anchoring Relationship | Example 2.2Only the concept chosen on the wider end of this relationship is considered inappropriate. The concepts included on the narrower end of this relationship are appropriate because there is no equity concept aggregating both reserves and retained earnings included in the base taxonomy at the time this document was available for publication, but there are separate taxonomy concepts for each item.

Anchoring Considerations

While "Equity" is considered to be wider than the extension concept, it does not have the closest wider accounting meaning in the base taxonomy. Therefore, it is not considered the appropriate wider anchor. "Equity" represents an aggregation of "Equity attributable to owners of parent" and "Non-controlling interests". Since this entity does not have any non-controlling interests, the concept with the closest wider accounting meaning would be "Equity attributable to owners of parent".

While "Equity" is used to tag the value for total shareholders' equity and included as a calculation parent for the three concepts presented in the equity section of this statement of financial position, this example illustrates how presentation and calculation relationships could differ from the concepts intended to be used in anchoring relationships.

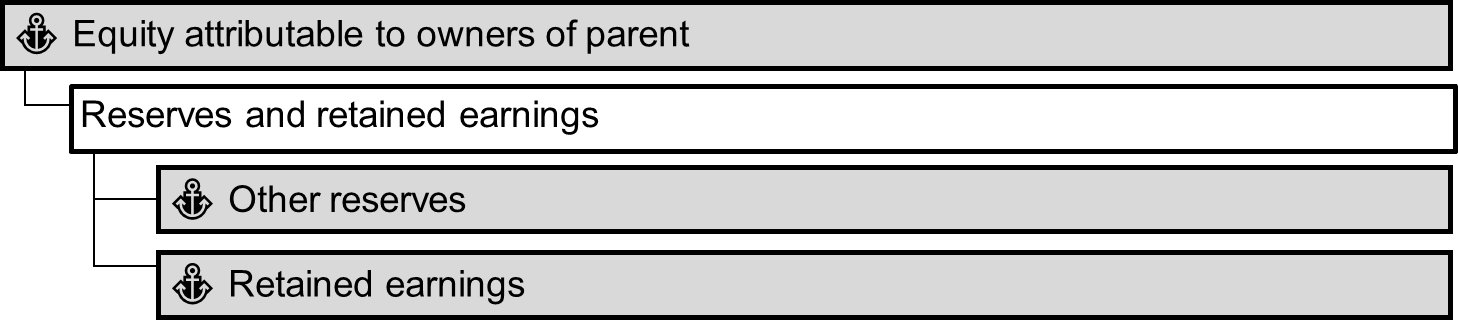

Appropriate Anchoring Relationship

The appropriate wider-narrower relationships for the fact pattern outlined in this example is as follows:

Figure 8: Appropriate Anchoring Relationship | Example 2.2

Figure 8: Appropriate Anchoring Relationship | Example 2.23 Example 3 – Appropriate use of "other" concept

Here is an example illustrating an appropriate use of an "other" concept as a wider anchor when the documentation label of the concept in the base taxonomy does not indicate it is for items that are not separately disclosed.

Background

An extension concept was used to tag the amounts for "Other cash receipts from sales of equity instruments of other entities classified as investing activities" and "Other cash receipts from sales of debt instruments of other entities classified as investing activities" in the following excerpt from a statement of cash flows.

|

20xy €m |

Concepts used to tag extensions: |

||

|

Other cash payments to acquire equity instruments of other entities classified as investing activities |

(2,873,934) |

||

|

Cash advances and loans made to related parties |

(771,812) |

||

|

Other cash receipts from sales of equity instruments of other entities classified as investing activities |

24,841,726 |

extension_Other cash receipts from sales of equity instruments of other entities, classified as investing activities |

|

|

Other cash receipts from sales of debt instruments of other entities classified as investing activities |

300,000 |

extension_Other cash receipts from sales of debt instruments of other entities, classified as investing activities |

|

|

Cash flows from (used) in investing activities |

21,495,980 |

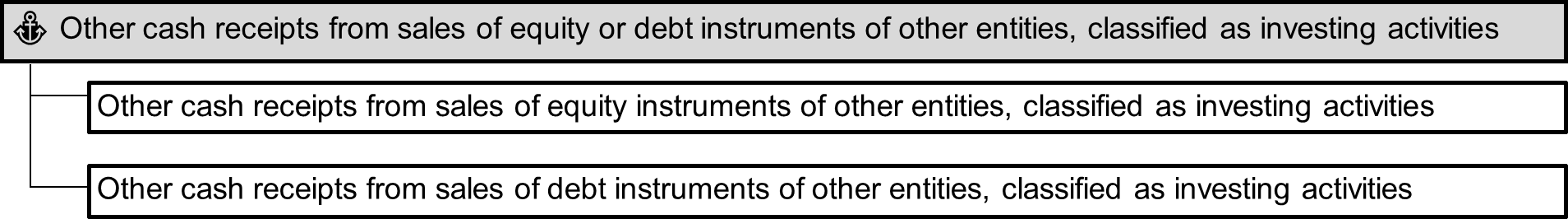

Appropriate Anchoring Relationship

The following appropriate wider-narrower relationship was provided for this extension:

Figure 9: Appropriate Anchoring Relationship | Example 3

Figure 9: Appropriate Anchoring Relationship | Example 3Anchoring both extension concepts to this "other" base taxonomy concept is appropriate because this base taxonomy concept represents an aggregation of these two extension concepts. Therefore, the base taxonomy concept is considered to be wider in accounting meaning than the two extension concepts, which are included on the narrower end of the wider-narrower relationship.

4 Example 4 – Anchoring a 'net' concept

An extension concept was used to tag the amount for "Net interest paid" in the following excerpt for a statement of cash flows.

|

|

20xy €m |

Concept used to tag extension: |

|

|

Cash flows from operations before tax and financing costs |

5,920 |

||

|

Changes in operating working capital requirement and current provisions |

2,330 |

||

|

Income taxes paid |

(1,056) |

||

|

Net interest paid |

(590) |

extension_Net interest paid |

|

|

Dividends received from companies accounted for under the equity method |

71 |

||

|

Net cash flows from operating activities |

6,675 |

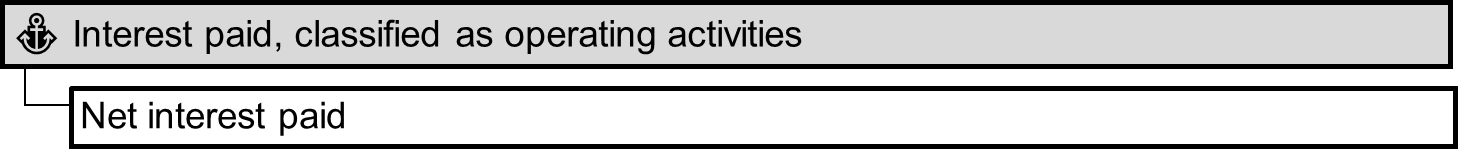

Inappropriate Anchoring Relationship

The following anchoring relationship is not appropriate for this extension concept:

Figure 10: Inappropriate Anchoring Relationship | Example 4

Figure 10: Inappropriate Anchoring Relationship | Example 4The extension concept has a 'net' meaning, as it includes both interest paid and interest received. The base taxonomy concept, "Interest paid, classified as operating activities", has a 'gross' meaning. Therefore, it is not wide enough to be used as the wider anchor for this extension concept, even if the amount disclosed is a net payment and not a net receipt of interest.

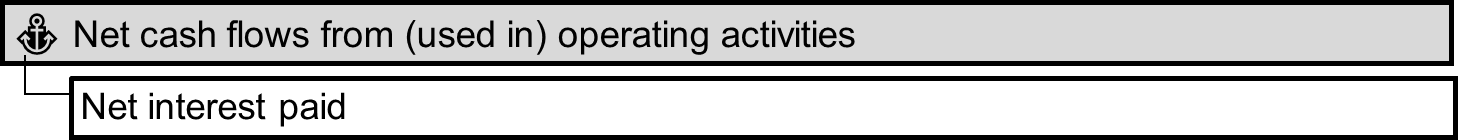

Anchoring considerations

When considering what the closest wider element in the base taxonomy is, the 'net' meaning of the concept for the entity-specific disclosure should be taken into consideration. At the time this document was available for publication, the IFRS taxonomy did not have a 'net' element for interest paid, net of interest received. Therefore, the closest wider base taxonomy concept is "Net cash flows from (used in) operating activities".

Appropriate Anchoring Relationship

The appropriate wider-narrower relationship for the fact pattern outlined in this example is as follows:

Figure 11: Appropriate Anchoring Relationship | Example 4

Figure 11: Appropriate Anchoring Relationship | Example 45 Example 5 – Inappropriate narrower anchoring

Here is an example illustrating an inappropriate decision for narrower anchoring due to not considering information in the notes to the financial statements. The narrower anchoring requirement in this example is such that where the extension concept consists of two or more base taxonomy concepts, the issuer shall anchor that extension concept to each of those base taxonomy concepts.

Background

An extension concept was properly used to tag the amount for "Goodwill and acquired intangibles" in the following excerpt from an unclassified statement of financial position.

|

20xy €m |

Concepts used to tag certain line items: |

|

|

Cash and cash equivalents |

205 |

|

|

Fee and other receivables |

328 |

|

|

Pension assets |

38 |

|

|

Leasehold property |

171 |

|

|

Goodwill and acquired intangibles |

680 |

extension_Goodwill and acquired intangibles |

|

Other intangibles |

81 |

ifrs-full_Other intangible assets |

|

Deferred tax assets |

215 |

|

|

Total assets |

1,718 |

Inappropriate Anchoring Relationship

It was appropriately determined that the extension concept required a wider anchor, "Intangible assets and goodwill". But it was inappropriately determined that the extension concept required no narrower anchoring relationship. The inappropriate reasoning was that, although the base taxonomy includes the concept, (i.e., "Goodwill") for one component of the extension, there is no concept in the base taxonomy for the other component "acquired intangibles". As such, it was determined that the disclosure for the extension did not consist of two or more base taxonomy concepts, and no narrower anchoring was required.

Figure 12: Inappropriate Anchoring Relationship | Example 5

Figure 12: Inappropriate Anchoring Relationship | Example 5Additional Information about Extension from Notes to the Financial Statements

The corresponding note disclosure for "Goodwill and acquired intangibles" indicated that the amount consists of four items, as shown in the following excerpt from the note.

|

Goodwill and acquired intangibles |

|||||

|

Goodwill |

Brand |

Investment agreements |

Distribution channels |

Total |

|

|

Net book value, beginning of year |

521 |

168 |

90 |

25 |

804 |

|

Amortisation |

(41) |

(26) |

(8) |

(75) |

|

|

Impairment |

(49) |

(49) |

|||

|

Net book value, end of year |

472 |

127 |

64 |

17 |

680 |

The note shows that acquired intangibles consists of three components. The base taxonomy does not include a concept for two of the components (i.e., "Investment agreements" and "Distribution channels"), but the base taxonomy does include a concept for "Brand names".

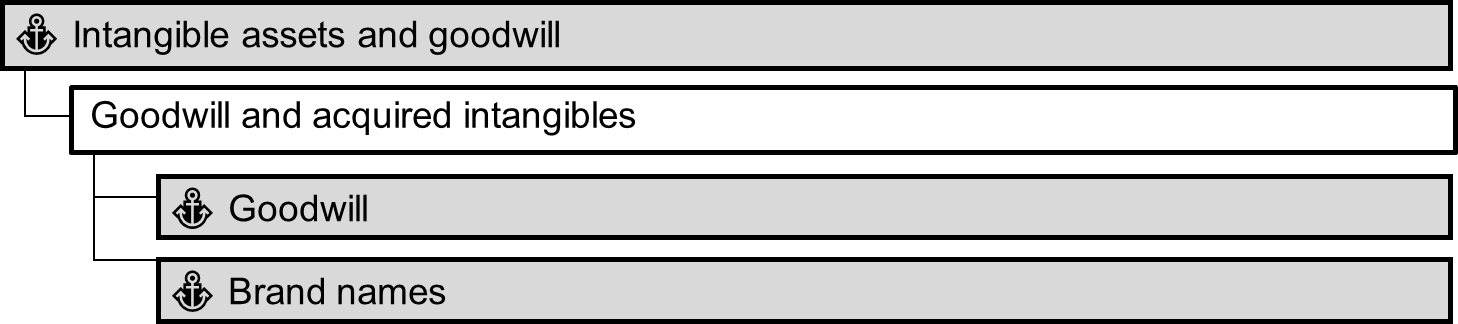

Anchoring Considerations

The extension concept "Goodwill and acquired intangibles" does consist of two or more base taxonomy concepts (i.e., "Goodwill" and "Brand names"), so a narrower anchoring relationship should be created with those two base taxonomy concepts on the narrower end of the wider-narrower relationship for the extension concept.

Appropriate Anchoring Relationship

For purposes of meeting the anchoring requirement in this example, the following represents the appropriate wider-narrower relationships:

Figure 13: Appropriate Anchoring Relationship | Example 5

Figure 13: Appropriate Anchoring Relationship | Example 56 Example 6 – Inappropriate anchoring of entity specific domain member

The anchoring requirement in the Regulatory Technical Standard applies to entity specific elements, not just concepts. The anchoring mechanism is a bit different and often is applied automatically by ESEF preparation software, but the user needs to remain mindful of the rules around anchoring relating to the accounting meaning and/or scope of the disclosure.

Background

In the example below, the preparer has disclosed not only "Net income (loss) per ordinary share" but also "Net income (loss) per savings share".

|

20xy |

20xx |

|

|

Net income (loss) per ordinary share |

0.99393 |

10.52109 |

|

Net income (loss) per savings share |

1.01456 |

10.54372 |

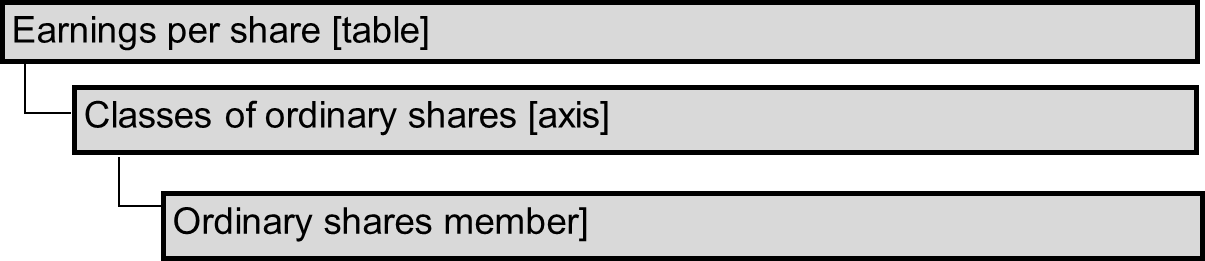

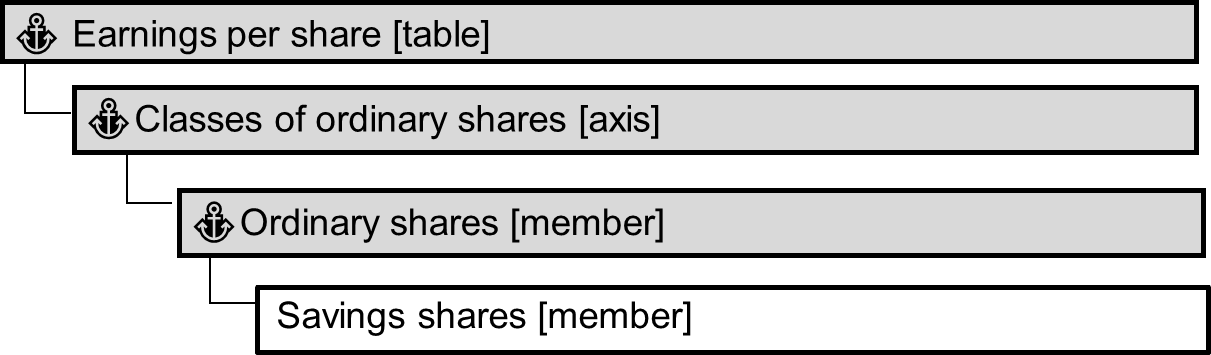

If the second line was not reported, the first line item would be reported using the concept 'Total basic earnings (loss) per share' with the following dimensional structure, as is available in the base taxonomy.

Figure 14: Dimensional structure in the base taxonomy | Example 6

Figure 14: Dimensional structure in the base taxonomy | Example 6Given the second item disclosed, the data modelling of this table should be revisited. Consider the following anchoring for an entity specific member "Savings shares [member]" created by the preparer for the second line item in the table.

Inappropriate anchoring 1

Figure 15: Inappropriate Anchoring Relationship | Example 6

Figure 15: Inappropriate Anchoring Relationship | Example 6Inappropriate anchoring 2

Figure 16: Inappropriate Anchoring Relationship | Example 6

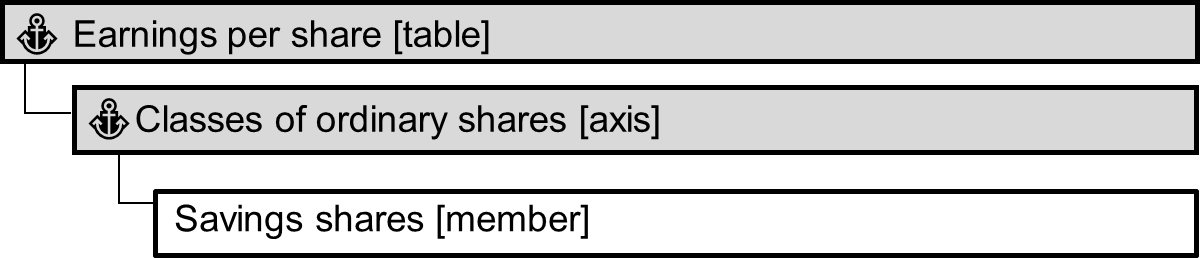

Figure 16: Inappropriate Anchoring Relationship | Example 6Both examples above are inappropriate because savings shares do not meet the accounting meaning of ordinary shares. Note that this is not an issue with the table, "Earnings per share [table]", as that does not refer specifically to ordinary shares.

Anchoring considerations

Looking at the characteristics of savings shares as disclosed in this annual report, we can confirm that they are classified as equity (and not debt) and that they do not meet the definition of ordinary shares as per IAS 33 as they get preferential dividends (i.e., they are not subordinate to all other equity instruments). The preparer here has decided that this does not meet the characteristics of preference shares either and has chosen to create an entity specific member, "Savings shares [member]", rather than use the "Preference shares [member]", which is available in the base taxonomy. Please note the focus of this document is anchoring and not tagging decisions.

Manual intervention in the dimensional structure will be needed by the user to set up the appropriate anchoring as preparation software will not be able to take accounting meaning into account.

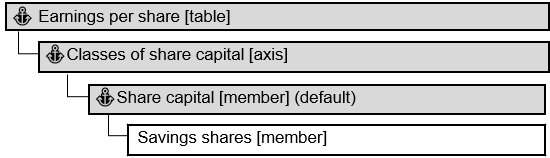

Appropriate Anchoring Relationship

In this example, an entity specific axis can be avoided, as the "Classes of share capital [axis]" can be used instead under the "Earning per share [table]" as follows:

Figure 17: Appropriate Anchoring Relationship | Example 6

Figure 17: Appropriate Anchoring Relationship | Example 6This document was produced by the Entity Specific Disclosure Task Force.

Published on 2022-05-25.