Unlocking the Potential of ESG Disclosures in India: A Must-Read Analysis

In an era in which sustainability is not just a choice but a necessity, understanding the Environmental, Social and Governance (ESG) landscape is crucial for stakeholders throughout the business data ecosystem. Our latest white paper, ‘Unearthing Insights from India’s ESG Disclosures,’ dives deep into digital Business Responsibility and Sustainability Reporting (BRSR) data for the financial year 2022-23, as mandated by the Securities and Exchange Board of India (SEBI) for the country’s top 1,000 listed companies.

In a collaborative effort by At Quest Sustainable Solutions and XBRL International staff, we leverage XBRL data to explore a few key metrics and demonstrate how digital reporting revolutionises data analysis in deriving actionable insights. The analysis was based on over 1,000 BRSR reports submitted to the NSE in XBRL format. Each contains about 1600 data points directly supplied and verified by companies, making the reports a valuable data source for many stakeholders.

The paper explores six areas of insight of potential interest to different stakeholder groups. In this post, we will take a quick look at three of these, considering material risks, environmental intensity measures, and social aspects at the workplace. You can find more details and further insights discussed in the full white paper.

Material risks and opportunities

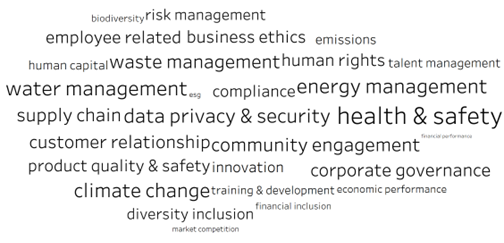

To visualise the critical material risks and opportunities identified by Indian companies, we used word clouds generated from text clustering of narrative disclosures to group similar topics. The analysis reveals “health & safety,” “climate change,” “data privacy & security, and “energy management” as the most frequently mentioned topics overall, as reflected in Figure 1. It is also easy to break this data down, for example, by industry sector, as we show in the full paper.

The analysis uncovers prevailing priority areas for risk management and sustainability efforts and offers sector-specific insights. Such insights are valuable for corporates, investors, and rating agencies, offering an overview of industry perspectives and a means for benchmarking and alignment with peers.

Environmental intensity measures

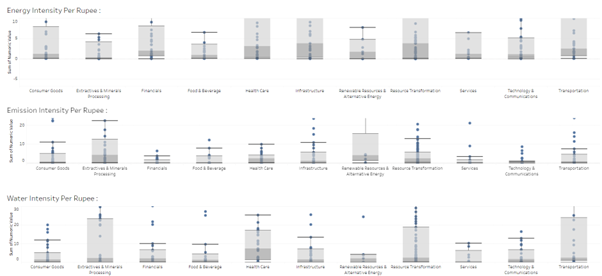

Environmental intensity measures are a critical component of BRSR reporting. This analysis focused on the intensity measures for emissions, energy, and water per rupee of revenue. The graphs in Figure 2 show varying intensity levels across sectors.

Some of these results are as expected: missions intensity tends to be lower in service industries such as Financials, Services, and Technology & Communications, aligning with their operational nature. However, there is more for stakeholders to explore. For example, the Services, Extractives, and Food & Beverages sectors demonstrate lower energy intensity, potentially indicating either lower energy consumption or significantly higher revenues relative to energy use. Meanwhile, perhaps surprisingly, the Health Care sector shows higher water intensity than any other.

This analysis is invaluable for policymakers, industry bodies, investors, and rating agencies, providing a foundation for shaping green-transition policies, setting sustainability agendas, and facilitating industry benchmarking.

Workplace Gender Diversity

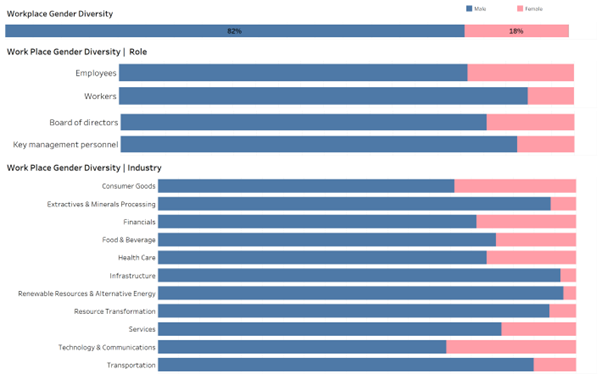

In our third analysis we focus on workplace gender diversity, an increasingly pivotal aspect of corporate social responsibility and sustainability. BRSR disclosures provide a unique dataset for examining gender diversity across over 1,000 companies. This wealth of data, derived from mandatory disclosures, offers a clear and reliable picture of gender representation in the Indian corporate sector. The overall representation of women in the workplace stands at 18%. However, this figure varies significantly across different industries and roles, as illustrated in Figure 3.

Sectors that rely heavily on manual labour, such as Infrastructure, show lower female representation, while service-oriented sectors, like Technology & Communications, exhibit higher levels of gender diversity in their workforce. These disparities in gender diversity not only highlight the challenges faced in achieving gender balance across various sectors but also underscore the opportunities for improvement and growth.

By leveraging the comprehensive and reliable data from BRSR disclosures, stakeholders can better understand the dynamics of workplace gender diversity and its implications for organisational growth and employee performance.

Data quality and improvements

While digitisation represents a leap forward in the utility of BRSR reporting, the paper also identifies key challenges. As companies navigate the initial cycles of XBRL reporting, a number of data-quality issues have surfaced, largely relating to incorrect scales, inconsistent units, and incomplete reporting. Such challenges are common worldwide in the early stages of implementation and underscore the necessary learning curve in adopting new digital reporting standards.

XBRL plays a crucial role in pinpointing and rectifying these data quality gaps. By facilitating the identification of outliers and inconsistencies, digital reporting allows for more accurate and efficient data analysis and quality improvement over time. Achieving this high data quality is crucial to the reliability of ESG reporting and in supporting stakeholders to make informed decisions.

Conclusions

The paper clearly demonstrates the transformative power of XBRL in ESG reporting. The use of XBRL significantly streamlines the analysis process, offering a stark contrast to traditional PDF reports, which require laborious and error-prone manual data transformation. The availability of consistent, machine-readable data enables stakeholders to draw comparisons and derive meaningful insights more effectively. By leveraging machine-readable data, stakeholders are able to easily uncover patterns, trends, and relationships within the data. The digital shift marks a crucial step forward in the ESG domain, meeting increasing stakeholder demands for transparency and accountability.

Whether you’re an investor, policymaker, regulator, corporate, or part of an industry body, this paper elucidates how BRSR disclosures can inform decision-making, improve ESG outcomes, and drive sustainable growth. It’s an essential read for anyone looking to deepen their understanding of India’s ESG reporting landscape – so don’t miss out on these critical insights; dive into the full white paper now.

Links

- Read the white paper here.

- Use the dashboard to explore the analytics.